Readers Question: How is it possible for countries with massive debt to have a strong currency, e.g Japan and the US?

Sometimes countries can have large debts that are sustainable. In the case of Japan and the US, the general consensus is that there is a very low risk of default.

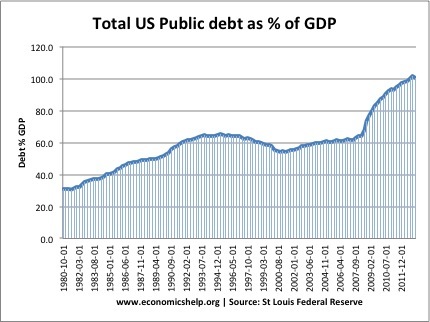

US debt is very large, but debt interest payments are manageable. The US has had much higher debt to GDP ratios in the past (US Debt history). Also, markets expect the US economy to grow in the future (already first signs of economic recovery in US). This will help reduce debt to GDP ratio in the future.

Therefore, buying US securities is still seen as a fairly safe investment. It is unlikely the US will face inflation or debt default, so investors are currently willing to hold dollar assets.

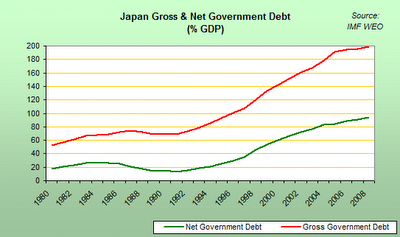

Japan has an even higher level of public sector debt (over 220% of GDP) But, Japanese bond yields are very low. This is helped by a large pool of domestic savings. There is a high willingness to buy debt. See: Japan debt

In recent months, there has been an increase in demand for Japanese bonds from foreign investors. Foreign investors have been buying short-term Japanese Treasury Bills. A significant reason for this is that investors prefer the idea of holding Japanese bonds to Eurozone debt.