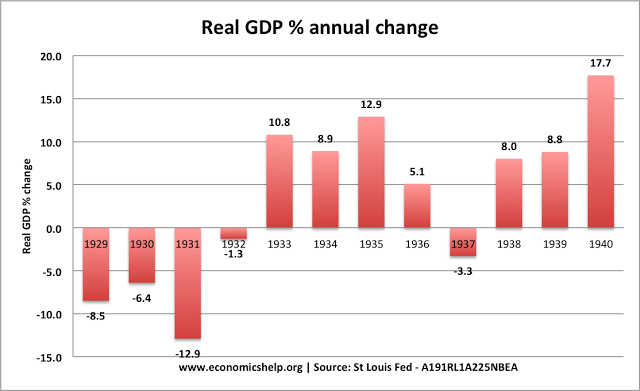

Definition of a Recession

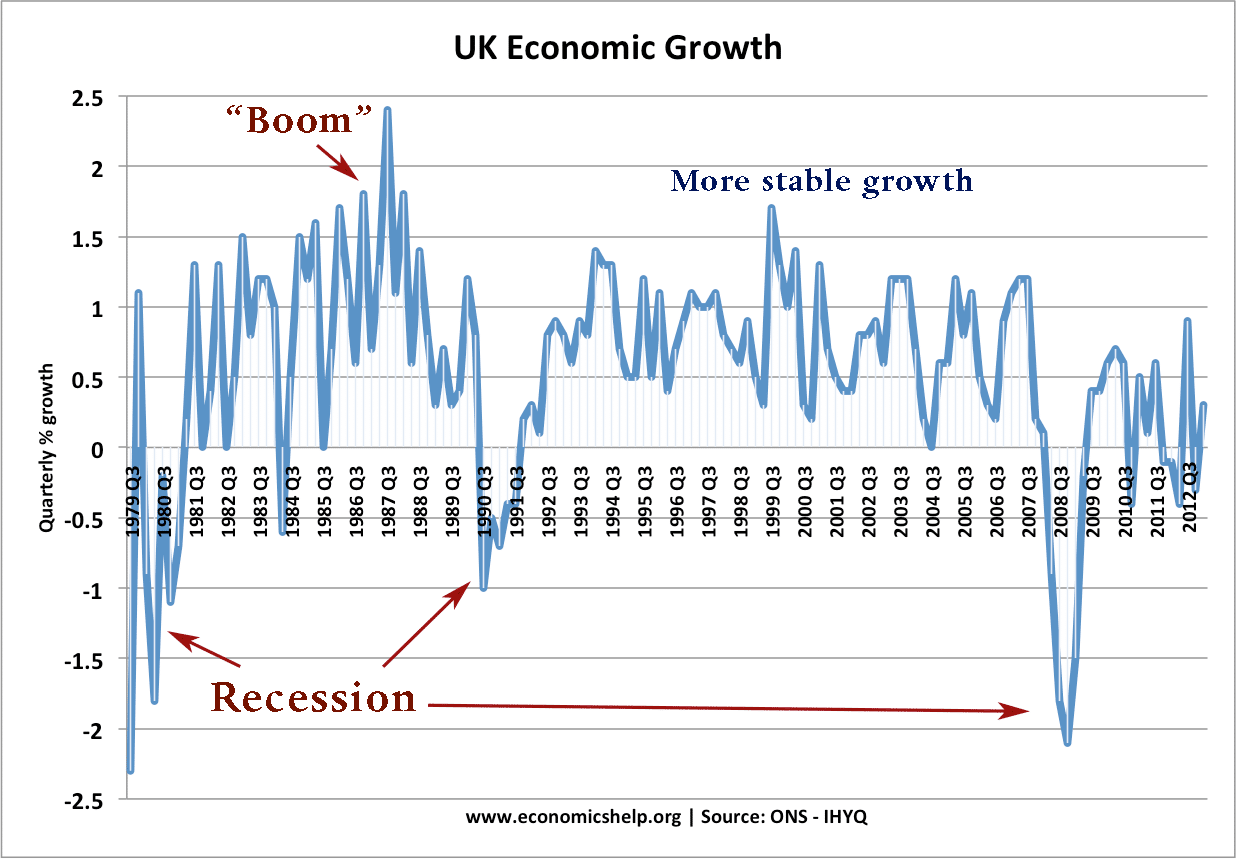

A recession is a period with a significant decline in economic activity characterised by falling GDP, rising unemployment and a decline in real incomes. A quick and simple definition of a recession (used in the UK and EU) is – negative economic growth for two consecutive quarters. The US uses a more comprehensive definition of …