Housing benefit in the UK

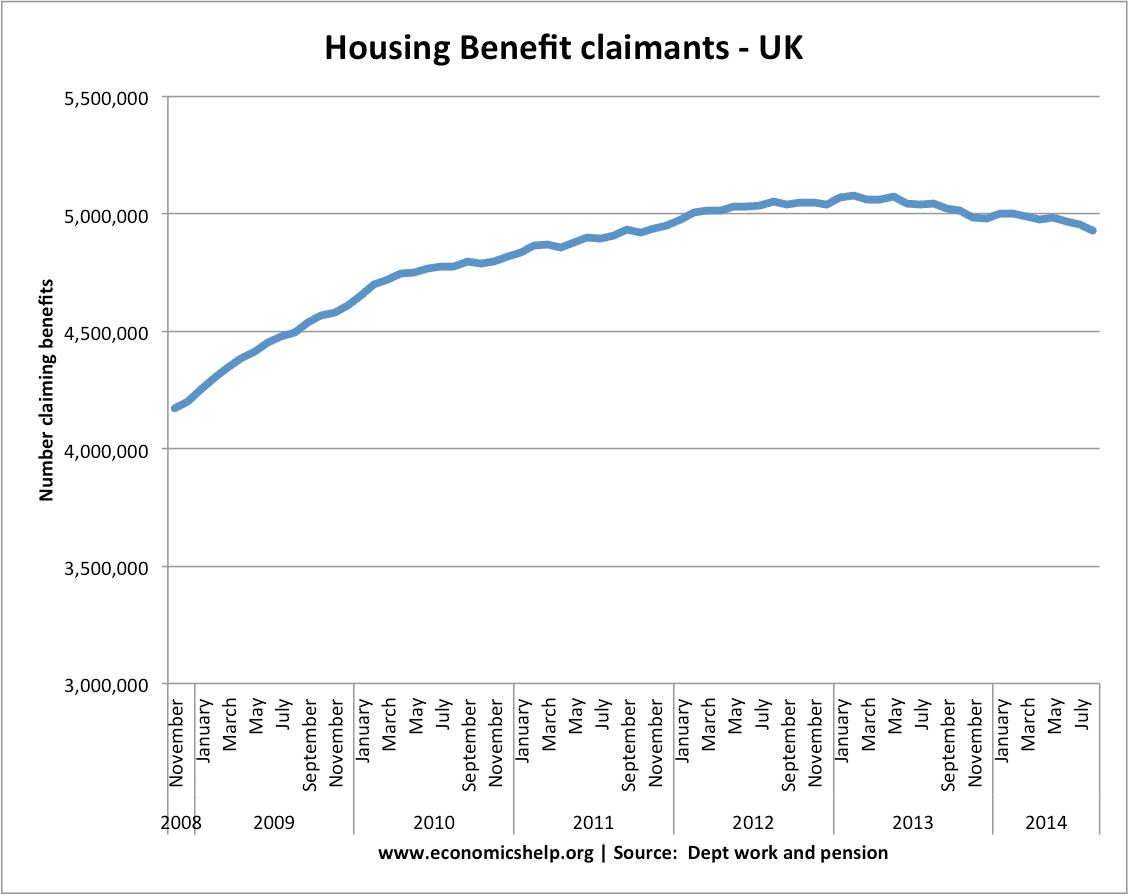

Readers Question: There are around 22 million households in the UK, 2/3 of whom own their house. So the rental market would be around 7 million of whom one million receive benefit, some portion living in social housing, some in private rented housing. Does that seem reasonable? Can you point me towards actual numbers? In …