Methods to Control Inflation

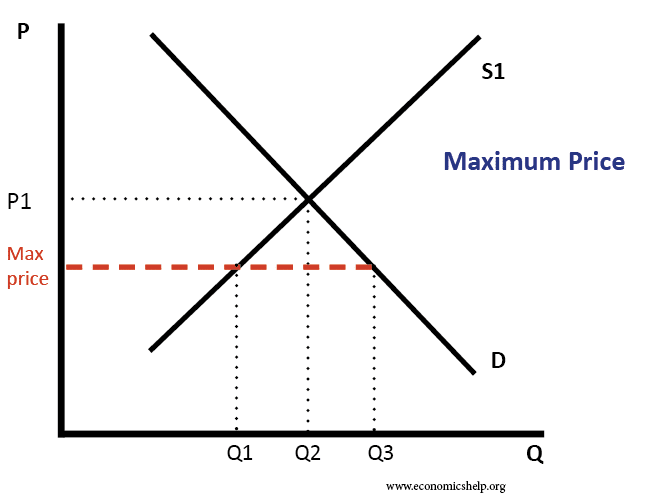

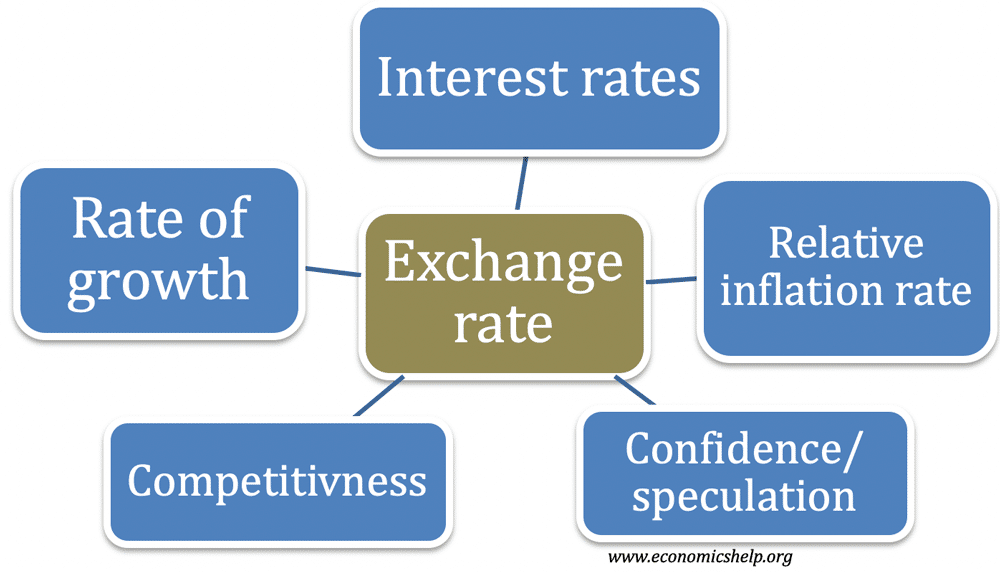

Inflation is generally controlled by the Central Bank and/or the government. The main policy used is monetary policy (changing interest rates). However, in theory, there are a variety of tools to control inflation including: Monetary policy – Higher interest rates reduce demand in the economy, leading to lower economic growth and lower inflation. Control of …