How can government pay for emergency crisis spending?

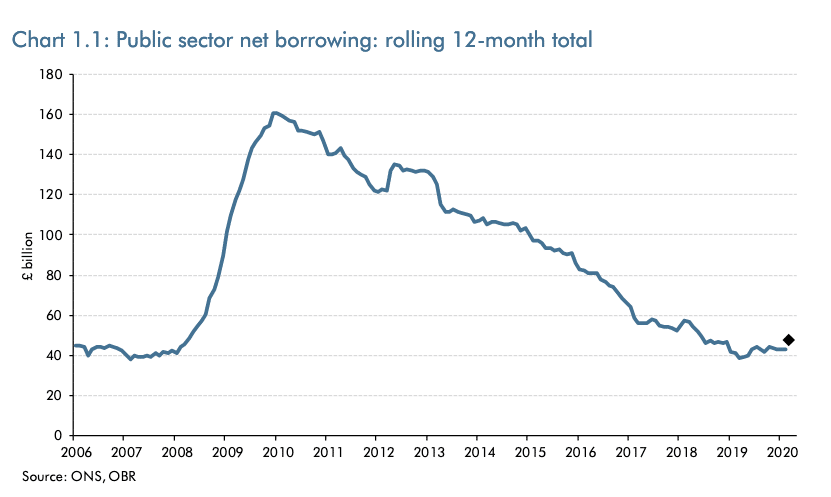

The next 12 months are going to see unprecedented demands on the government budget. It is likely GDP will fall 10-20% – if not more. On its own, this would lead to a surge in government borrowing Fall in income tax receipts as people earn less Fall in VAT and excise duties as people spend …