Recession risks for UK in 2023 worsen

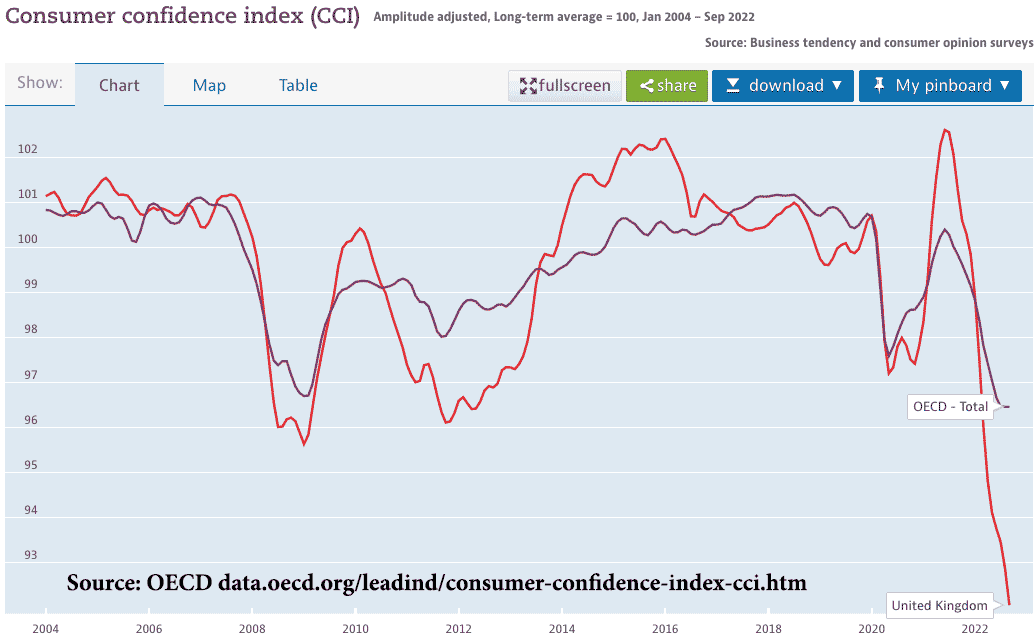

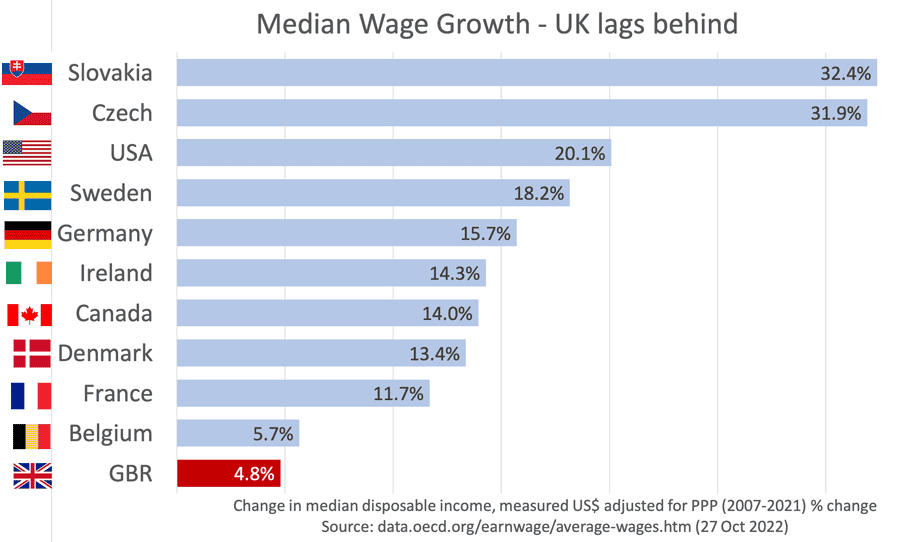

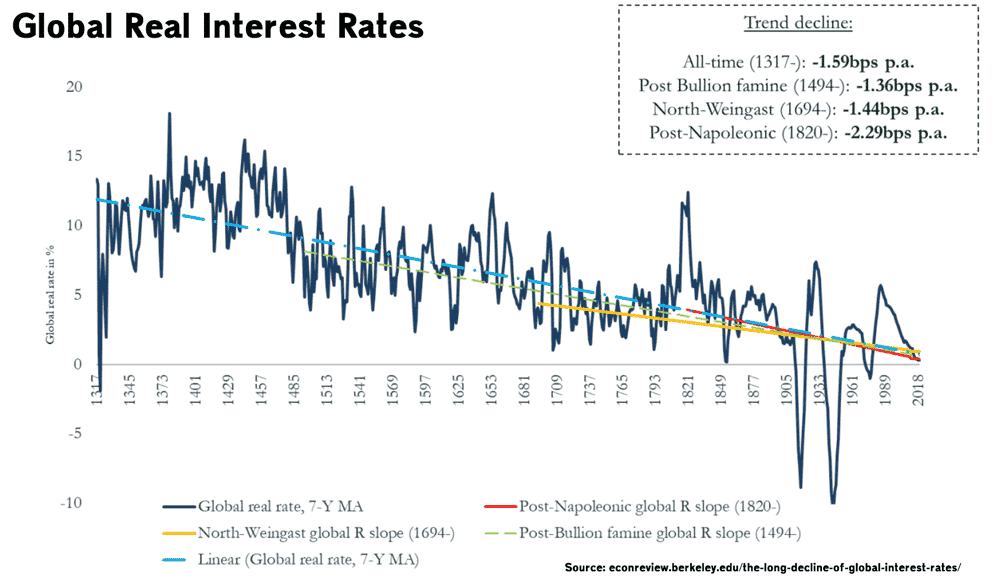

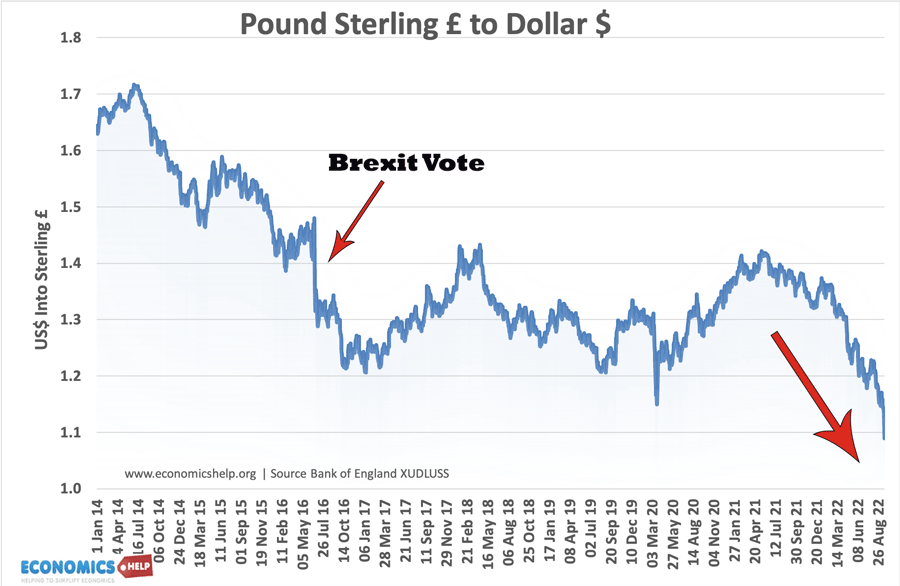

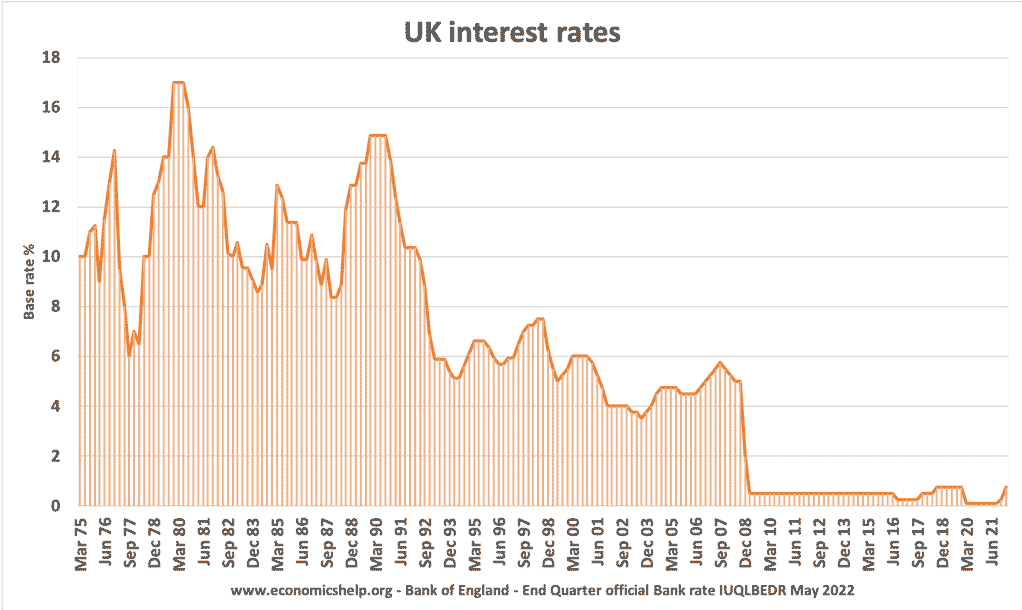

Earlier this summer the Bank of England warned that the UK was heading into the deepest recession in a generation. Yesterday the Bank of England warned the UK was in the longest recession in a generation – a double gloomy prognosis to go with their record-breaking rise in interest rates by 75 basis points from …