Crisis in UK Private Rented Sector – Why Prices likely to rise

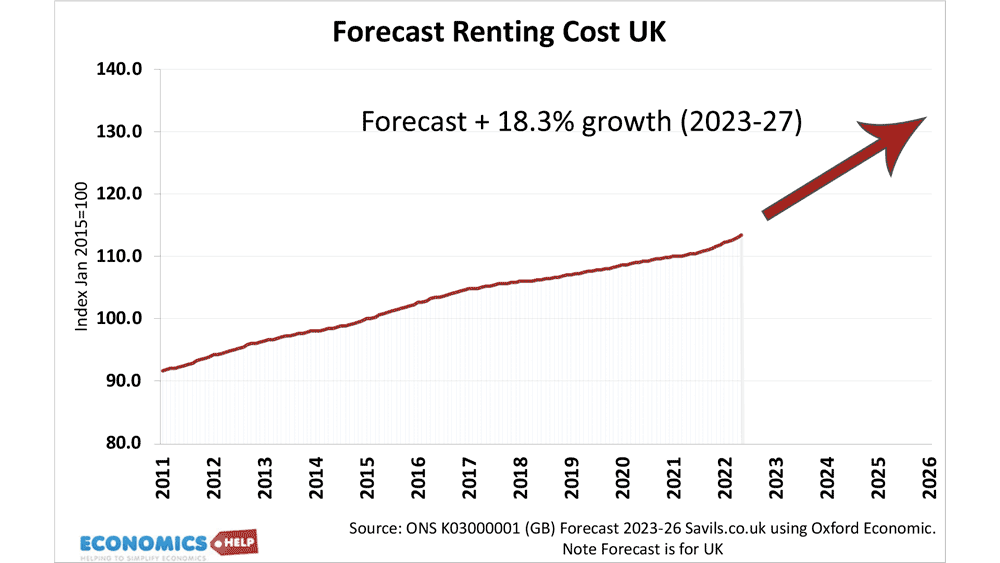

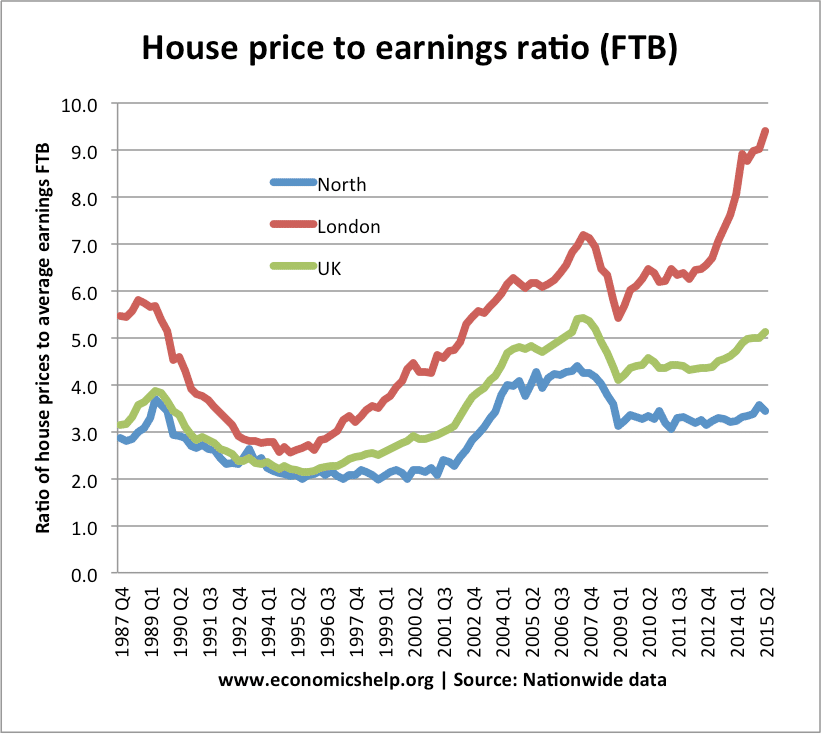

In recent years, the UK private rental market has seen a surge in demand, and the average price of renting rising 40%. Yet it is the least favoured form of housing tenure, with many renters paying an increasingly unaffordable share of income on rent. The crisis costs the government £27 billion in housing benefits, leads …