A frequently asked question is – Who does the UK borrow from? Who owns the UK’s government debt?

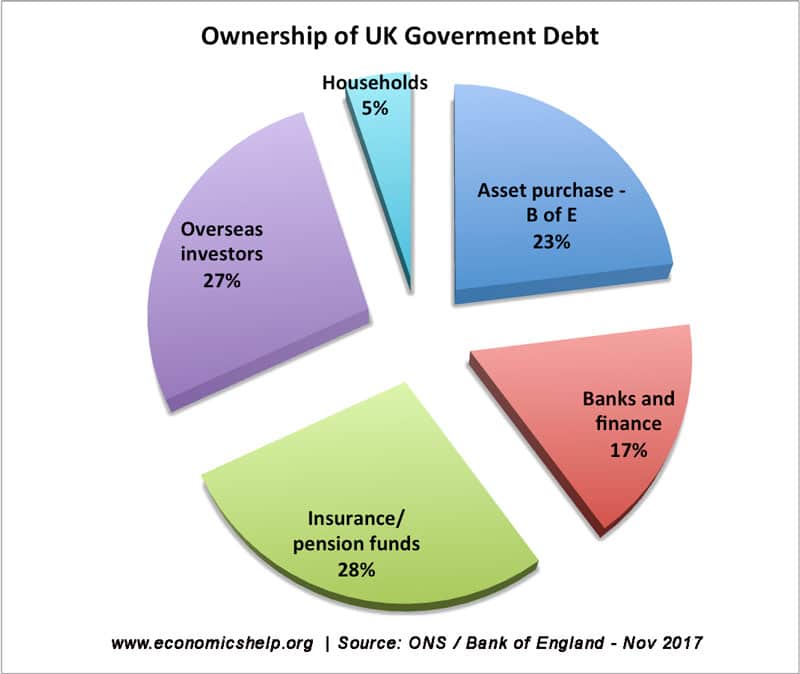

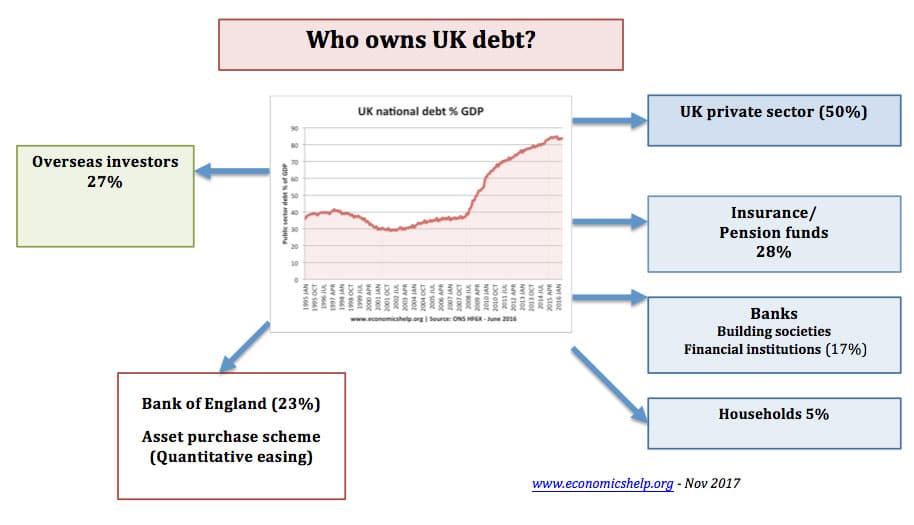

UK government debt is primarily held by:

- Private financial institutions – banks, pension funds, investment trusts and also private households.

- 27% is held by overseas investors (e.g. American investment trusts/Japanese banks)

- 23% is held by Bank of England – as part of Quantitative easing/asset purchase programme.

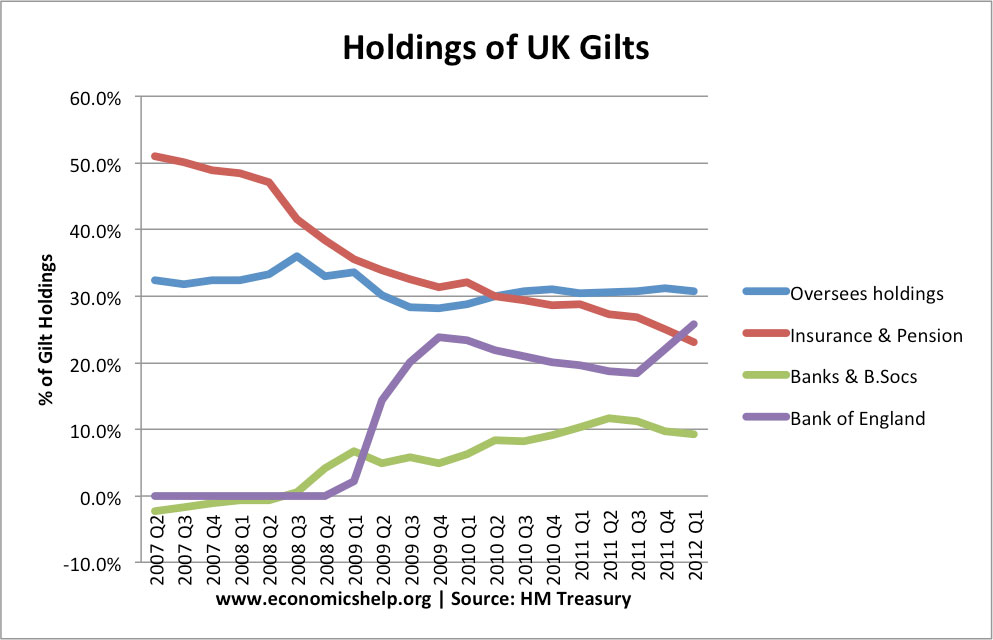

These are bought by private sector institutions such as pension funds, investment trusts and banks. The majority of these private sector buyers are domestic financial institutions. Most UK government debt is owned by the UK private sector. From 2009-12, the Bank of England has pursued a policy of Quantitative easing which involves buying gilts from the private sector. Therefore, there has been a growth in the % of UK gilts held by the Bank of England.

Notes about government debt

- The government needs to borrow because it spends more than it receives in tax revenue.

- To finance this shortfall the government sell bonds, gilts, and treasury bills.

- In the UK government debt is managed by the DMO Debt Management Office

- Government debt is the accumulation of past borrowing. The government’s budget deficit adds to its total debt. It borrows by selling ‘gilts’ and bonds. In return purchasers of bonds get paid an interest from government.

- Government debt is different from the external debt of a country (the total owed by private and government sector to foreign debtors)

- It is also different to the balance of trade (concerned with the level of UK imports and exports)

Why do people lend buy gilts? (effectively lending government money)

- Government bonds are seen as a safe investment. The UK has not defaulted on debt in the past. It is a safer investment than shares – which can go down in value.

- Rate of interest. Buyers of bonds get an interest on the bond. Some bonds are ‘index-linked’ which means the rate of interest varies with inflation. If investors are nervous about inflation reducing the value of gilts, they can buy these index-linked bonds

- In a recession, demand for government bonds tends to be higher because of banks, companies are more nervous about lending and investing. Government bonds are a safe investment for turbulent times.

- Pension funds need to invest contributions for future payouts. Government bonds provide a secure part of the portfolio.

- Companies like Apple may have a large surplus of profit and high levels of savings. Bonds are a way to invest this money.

- Households can buy bonds as a way to save and get a guaranteed bond yield (often higher than bank rates.

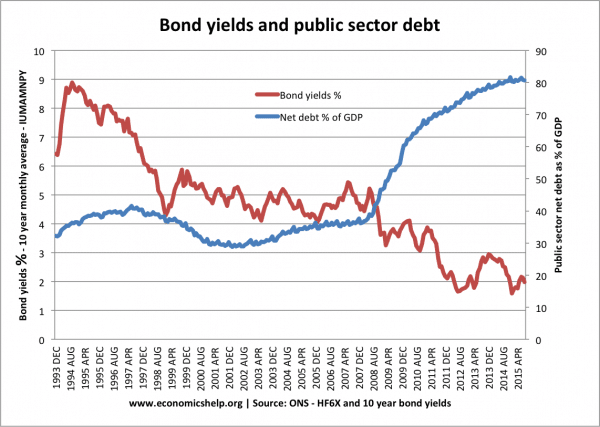

This shows people were willing to buy government bonds – despite lower bond yields.

Trends in ownership of UK debt

Since 2009, the Bank of England has purchased gilts. During this period, the % of gilts held by UK insurance and pension funds has fallen.

On 2nd November 2017, The Bank of England has bought £495bn worth of UK gilts.

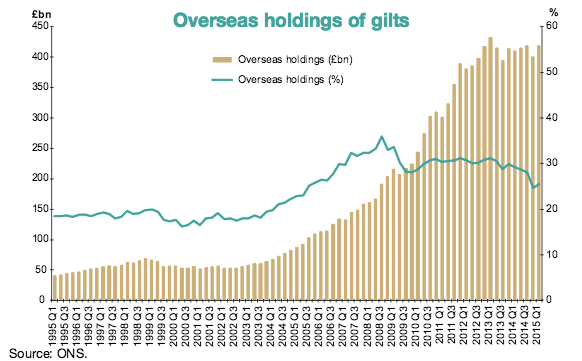

Overseas holdings have stayed fairly constant around 30%. Helped by the Euro-crisis making UK debt more attractive than countries in the Eurozone.

UK Public sector net debt was1,785.3 billion at the end of September 2017, equivalent to 87.2% of GDP

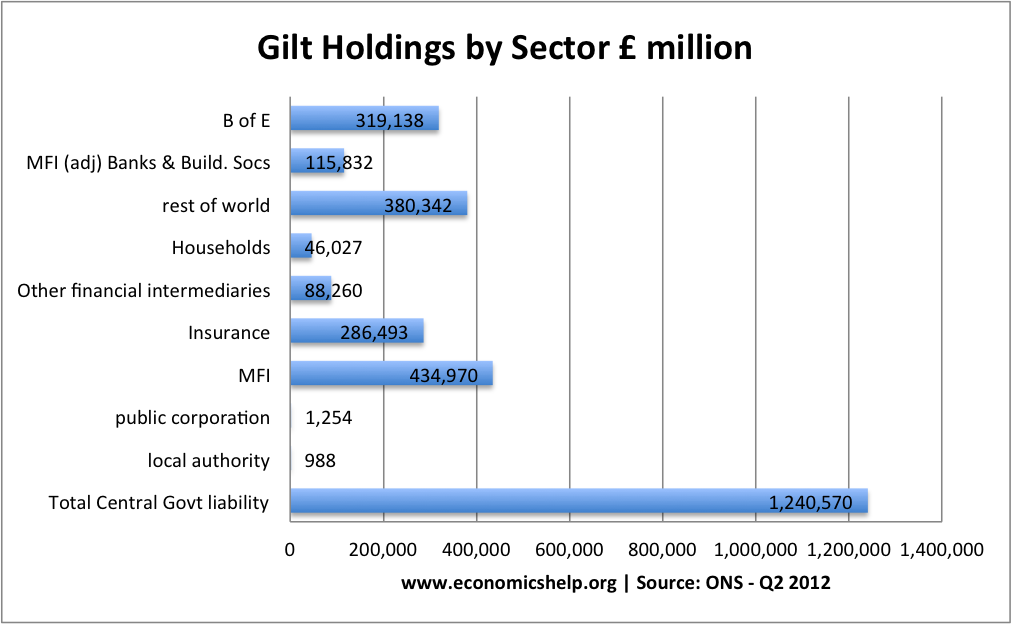

Holdings of gilts by sector

Other small fractions include public corporations and local authorities.

Graph Showing UK Debt Held By Overseas Investors

Who owns US National Debt?

As of March 4, 2009, the total U.S. federal debt was $10,942,165,294,650.89 (just under $11 trillion) You can find latest figure here at US Treasury Direct

The biggest foreign holders of US debt are:

- China – $727 bn

- Japan – $629 bn

- UK – $157 bn

- Brazil – $129bn

- Russia – $116bn

Total foreign debt holdings = $3,000bn or about 28% of total national debt.

Note: in 2001, foreign debt holdings were $1,051 bn or 17% of total holding

Source: debt statistics at US treasury

Related

External links

- PSF Finance stats at HM Treasury

- More data source: UK DMO

You perform an invaluable service digging out these facts and figures. Thanks.

you didn’t answer the main question – which countries own UK national debt? Like in the breakdown you provided for US national debt

Thanks

Still unsure who does own the debt.

It’s not us 👍🏻😂😂🥳✈️👌🏼

Please let me know the figures owed to chinese interests

Same point as Yuri. I’m interested in the breakdown of UK gilts owned by non-UK interests. It appears that this data isn’t publically available. Why? Any ideas?

Can someone please clarify: –

1) What’s the size of National Debt – is it £2trillion?

2) How much of that has been bought by the Bank of England, through quantitative easing?

3) Does the Bank of England in effect pay interest on the bonds it has bought back (presumably not)?

4) If not, what stops the Bank of England buying back all debt being at serviced at the cost of £55bn per year?

5) What’s the size of national debt if national pension liabilities and public sector pension liabilities are factored in?

Something still puzzles – current net spending is ~£50bnannually. So UK government is spending ~£1bn more than earned each month. Total government debt is (per above) around £1.3tn – so £1,300bn.

If UK finances somehow can be made to generate £1bn surplus per month, that implies it will take over 100 years to repay.

On what basis is UK still a safe haven to invest?

I’d suggest that the last thing those with wealth want is for debts to be paid. Then they’d loose the capacity to extract wealth from economies via rent with excess wealth.

The UK has only finished paying off WW1 debt, which was far higher in GDP terms than today’s debt. 80% was held domestically- so those families have done very well, and are probably glad to have a financial crash leading to new borrowing to open a new fiedl for extraction.

The fact that the UK govt still paid off WW1 debt king nearly 100 years shows why it’s so attractive.