Price discrimination involves charging different prices to different sets of consumers for the same good. Firms can charge different prices depending on several criteria:

- Quantity bought (e.g. lower unit price when higher quantity is bought)

- Time of use (higher price at peak times)

- Age profile (e.g. discounts for OAPs)

- When unit is bought (e.g. discounts for buying early)

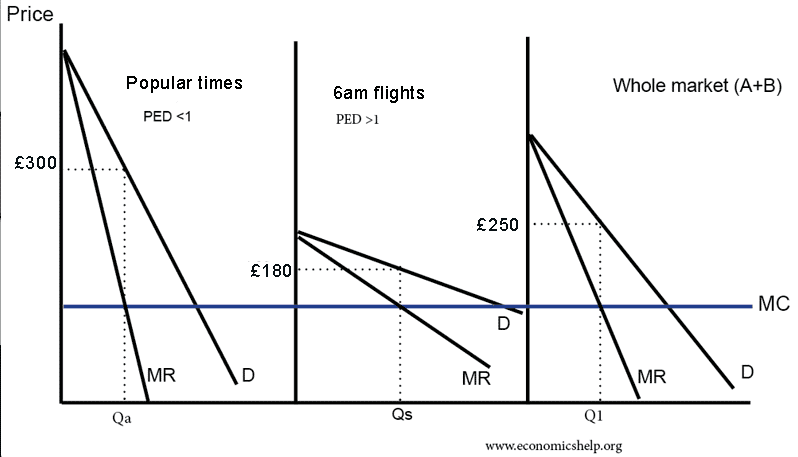

The main principle behind price discrimination is that a firm is trying to make use of different price elasticities of demand. If some people have a very inelastic demand, it means they are willing to pay a higher price. If the firm can set higher prices for these consumers it can increase its revenue and profits. Other consumers will be more sensitive to prices (elastic demand) and so will respond to special offers and price discounts. The firm can benefit if it can separate these consumers and therefore reduce their consumer surplus. See theory of price discrimination here

In the real world, price discrimination might involve charging a different price for a slightly different good.

In this example, of price discrimination, students are given a cheaper price

How does an Airline practise price discrimination?

1. Time of buying a ticket.

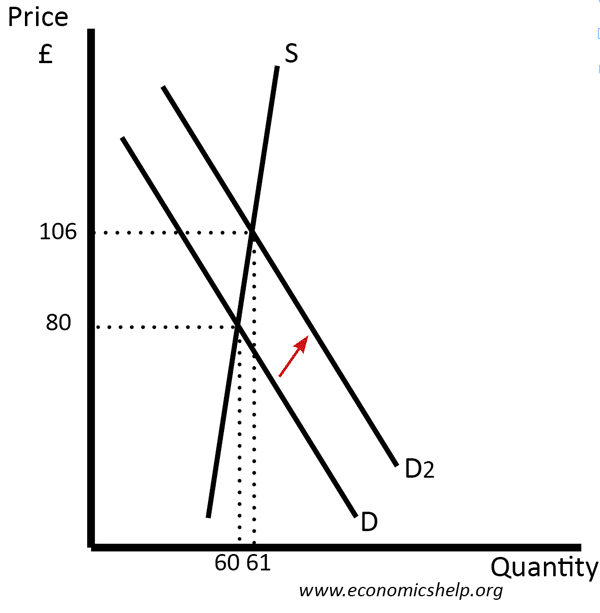

There is no hard and fast rule, but if you buy a ticket several months in advance it tends to be cheaper. If demand for the particular flight is high, then the airline starts putting up the price of that flight. It means that the remaining tickets will only be bought by people willing to pay a higher price (inelastic demand). If a particular flight is not selling very well, the airline will do the opposite and reduce the price. This lower price attracts more people who are sensitive to prices and ensures that the flight will fill up.

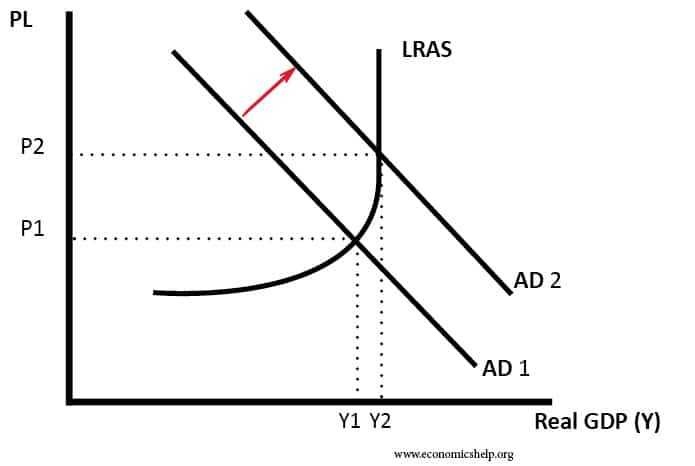

Ideally, the airline would like to fill up the plane with passengers paying the most they are willing to pay. There is no point in selling very cheap tickets and having the flight sold out many weeks in advance.

Why does the price of an airline ticket change from hour to hour?

You may have had experience of looking for an airline ticket and seeing a flight for £200. The next day, you return to buy a ticket, but see it has gone up to £220. This is very annoying but is due to price discrimination. The airline will reserve a certain number of economy tickets at a low price (to attract early customers more sensitive to price. But, if the tickets for flight are selling well, it can afford to charge higher prices for the remaining few tickets. The airline is trying to capture as much consumer surplus as possible)

2. Unsocial hours cheaper

Because some flight times are less popular, these flights will tend to be cheaper. For example, if you take a weekend break. Most people would prefer to come back late on Sunday. These late Sunday flights tend to be more expensive than early morning Sunday flights.

3. Paying extra for seats with more leg room.

In economy class, Virgin offered a seat with 3 inches of extra legroom for £30. At 185cm, I jumped at the offer. To me, it is a good £30 investment. It was quite popular with nearly 40% of seats in economy class now being taken up with extra legroom seats. It is not quite price discrimination because it’s a slightly different product, but the airline is able to charge higher prices to those consumers with slightly more inelastic demand. In addition to the 3 inches of extra legroom, you could go to the other extreme and pay £15,000 for a first-class airfare.

Interestingly, you can only buy these extra legroom seats shortly before the flight. I wonder if this is to discourage people from avoiding business and just buying a cheap upgrade to economy class?