I only take a passing interest in American politics. I’m just grateful not to live in Ohio, where voters have been subject to hours and hours of political ad campaigns. According to a newsnight presenter, if the 150,000 ads were all lined up, they would last for four consecutive days. (although I’m sure that would constitute cruel and unusual punishment. I think I’d talk after the first six hours). I’ve never seen an American political ad, but I doubt they explain the nuances of balance sheet recessions, liquidity traps and the optimal way to reduce debt to GDP ratios without con straining economic recovery.

But, despite economics being somewhat in the background, the re-election of Obama could be seen as a political confirmation that:

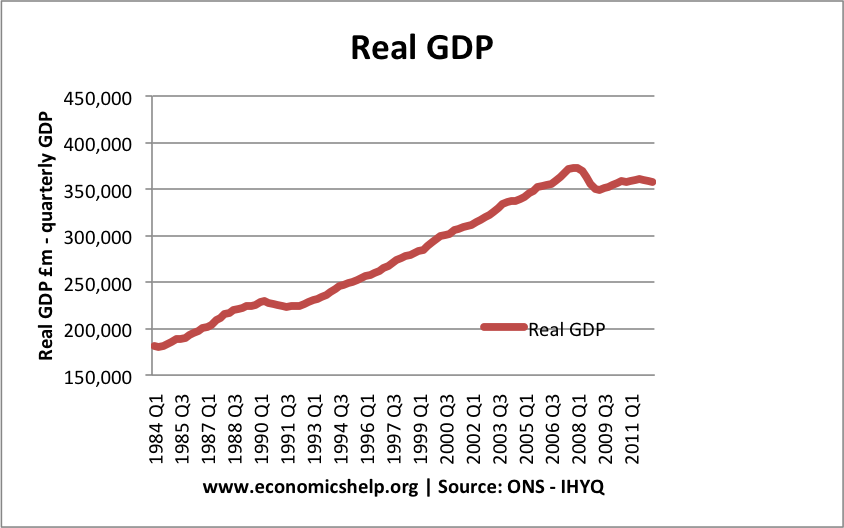

The recession was the result of the financial excesses in the lead up to 2008 – and not really the present administration.

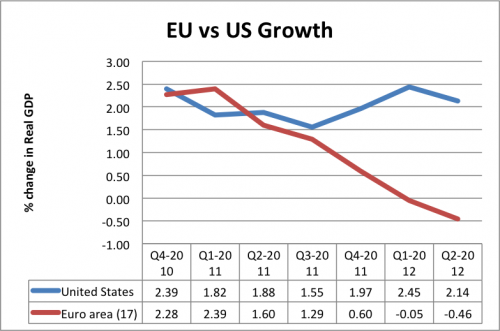

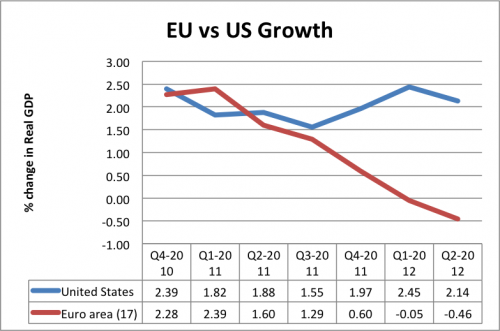

Overcoming this unique balance sheet recession was always going to be difficult and long process. The US has performed moderately – but much better than many of its fellow countries. To some extent Obama deserves credit for allowing a recovery – even if it could have been stronger.

In a country which loves the laissez faire ideal like no others, it’s interesting to still see solid support for the idea that government intervention can actually make markets work more efficiently. Obama supported the rescue of the automobile industry with government money. Romney opposed the use of federal funds. The bailout was a success, so it’s only fair Obama did well in the ‘rust belt’ north. Even the hurricane Sandy is a reminder that for real crisis, government rescue funds can play an invaluable role. Recent years have been a reminder that the highest ideal of government is not just to reduce taxes on the rich.

Read more