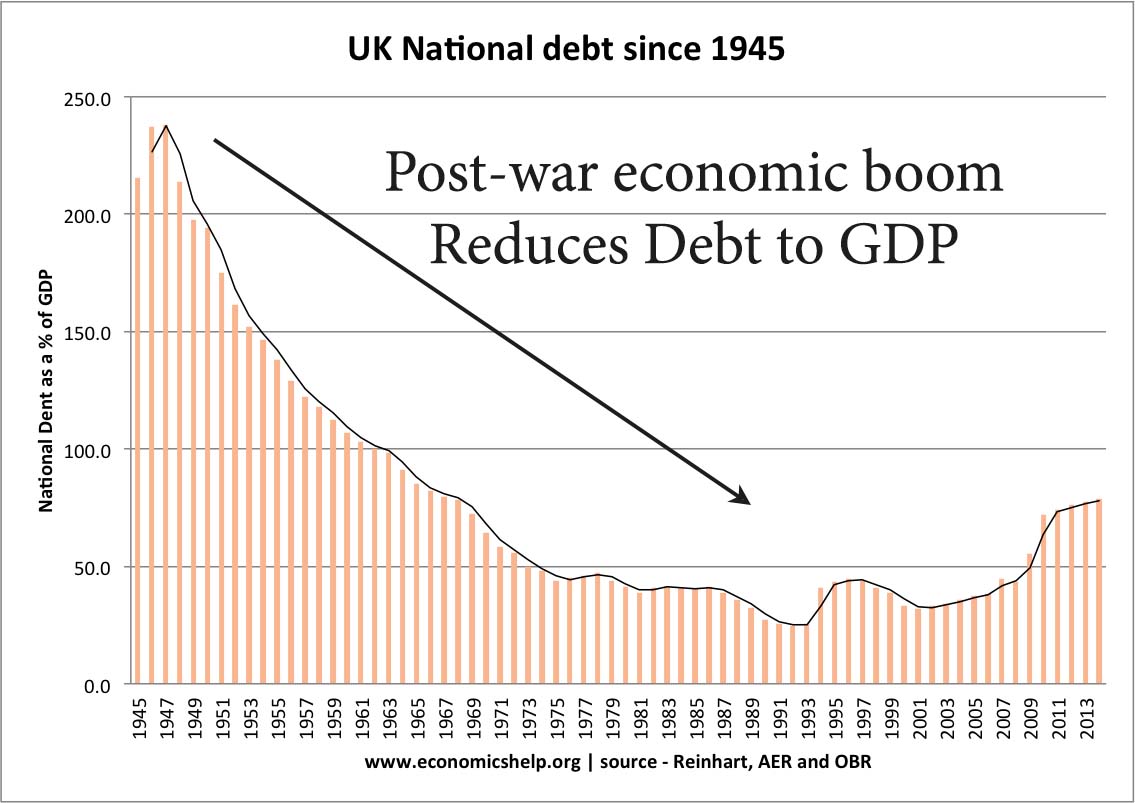

Readers Question: What caused the massive decrease in the debt to GDP ratio for the UK following World War II?

It is a good question to ask. In the past few years, many European policymakers have felt that rising debt levels needed panic levels of austerity/spending cuts. But, that didn’t happen in the UK in the post-war period.

Summary

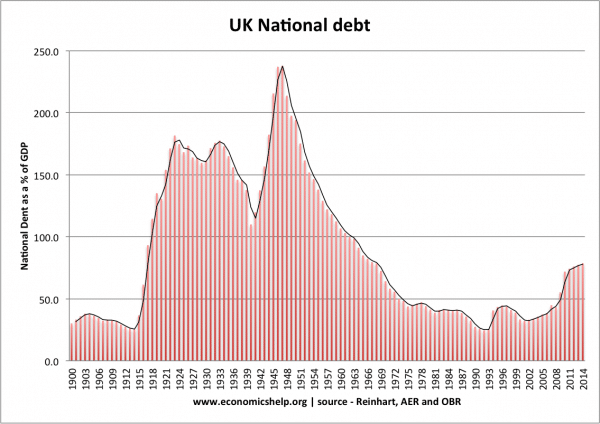

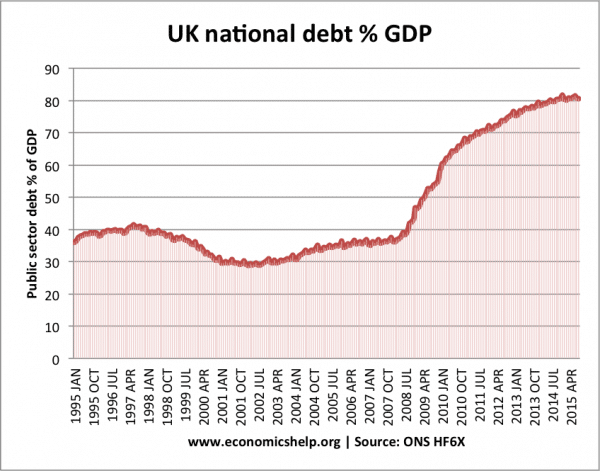

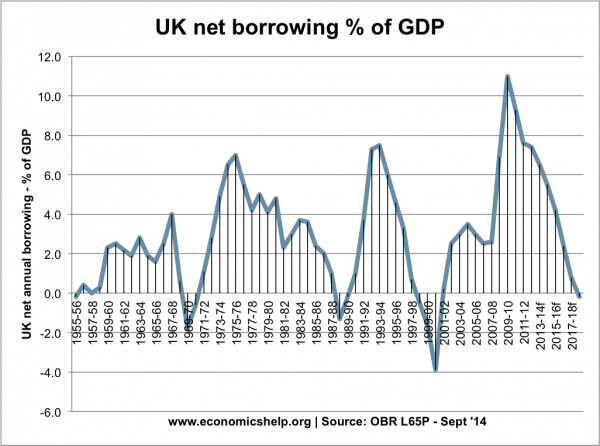

UK national debt peaked in the late 1940s at over 230% of GDP. From the early 1950s to early 1990s, we see a consistent decrease in the debt to GDP ratio. Using the above measure of national debt, UK debt as a % of GDP reached a low of 32% in 1993. (1) At the start of the global credit crunch in 2007, public sector debt was 38% of GDP.

ONS Datasets | Long run fiscal indicators PSA5A at ONS

In the past eight years, debt has increased to 80% of GDP but is beginning to stabilise.

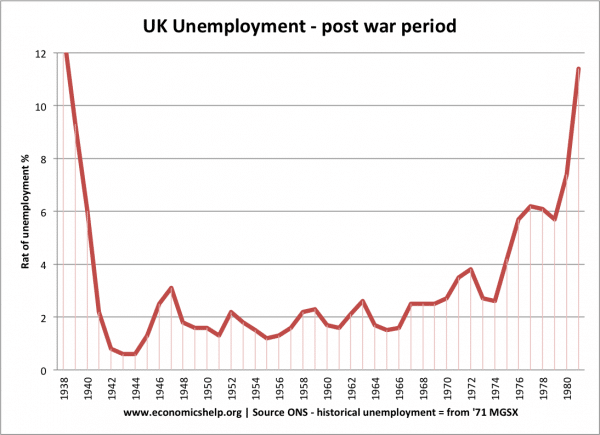

The main reason UK debt to GDP fell in the post-war period was the sustained period of economic growth and near full employment until the late 1970s. This growth saw rising real incomes which in turn led to higher tax revenues and falling debt to GDP ratios.

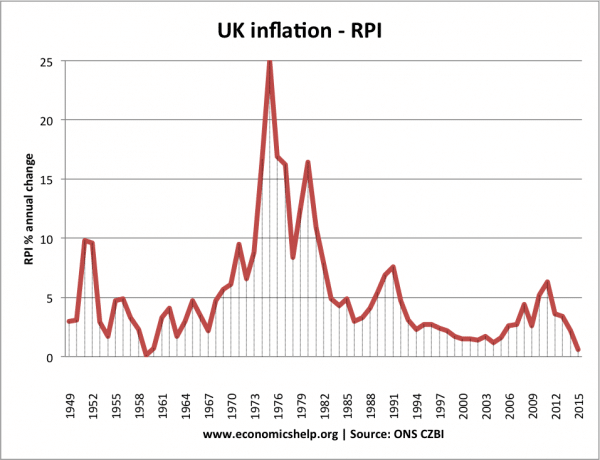

There was also a positive inflation rate, which helped erode the real value of debt.

Higher government spending in post-war period

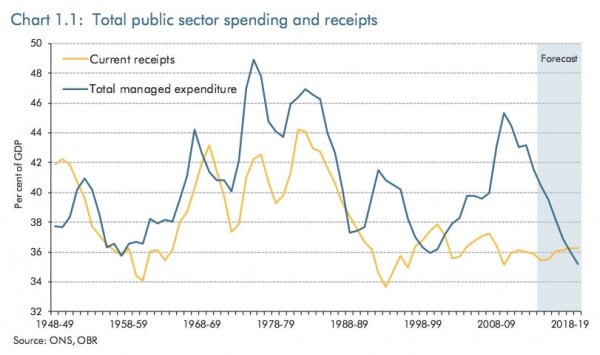

Firstly, debt to GDP was definitely not reduced through cutting government expenditure.

Note – Debt to GDP fell, despite higher real government spending on the newly formed welfare state and national health service. In fact, government spending as a % of GDP rose from around 35% of GDP in the early 1950s to the high 40%s in the 1970s.

Source: OBR, Dec 2014

Why did UK debt to GDP fall?

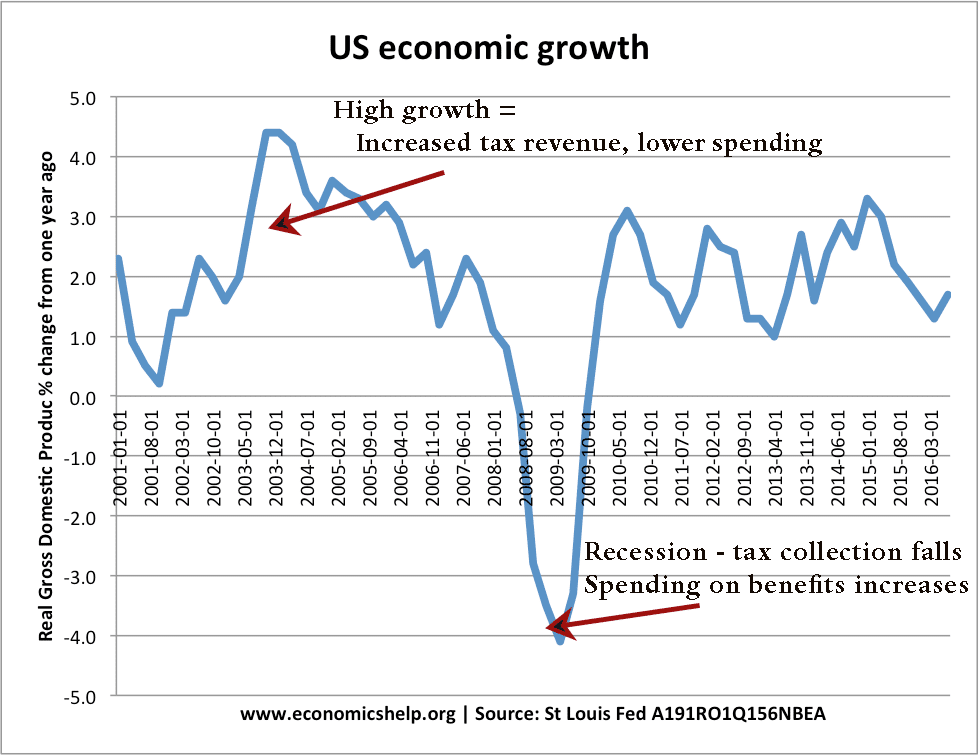

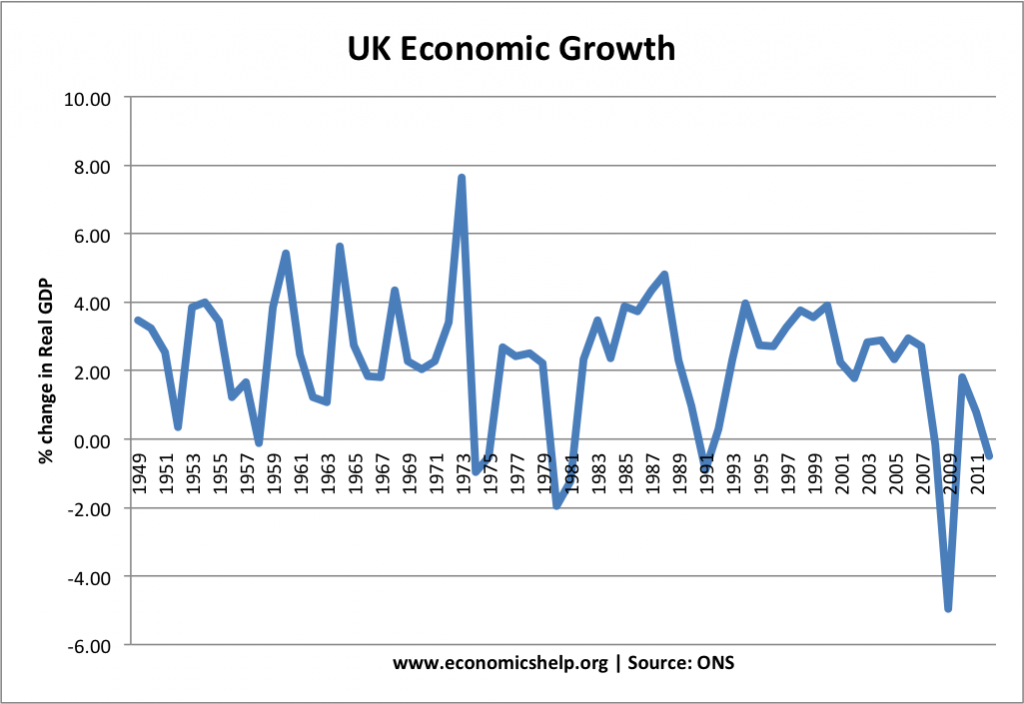

- Economic growth was averaging 2.5% +. Total real debt increased in this period, but GDP increased at a faster rate. Therefore, the debt to GDP ratio fell.

- Positive inflation.

- Patience. After the early 1950s, debt to GDP fell over the next four decades. It took a long time to reduce debt to GDP.

- Relatively low budget deficits (though the UK very rarely had a budget surplus)

Postwar economic boom

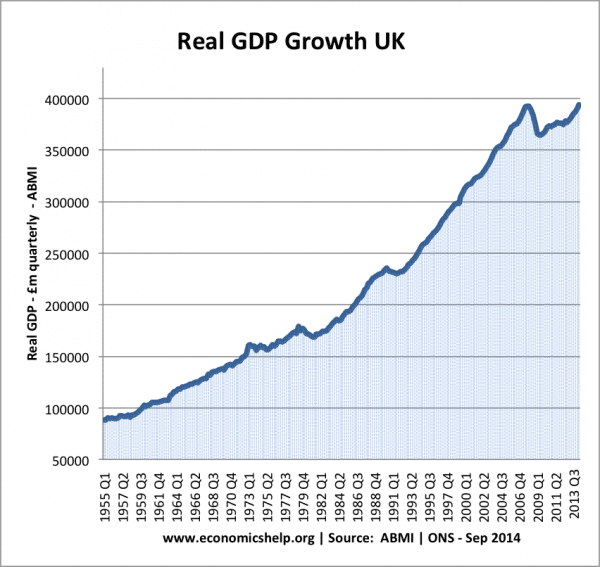

This graph shows UK real GDP. In 1955 it was less than £100,000 m (quarterly). By the early 1970s, real GDP had doubled in a relatively short period of time.

This graph also explains the sharp rise in debt as a % of GDP 2007-2013 – real GDP stagnated and stopped growing.

UK post-war inflation

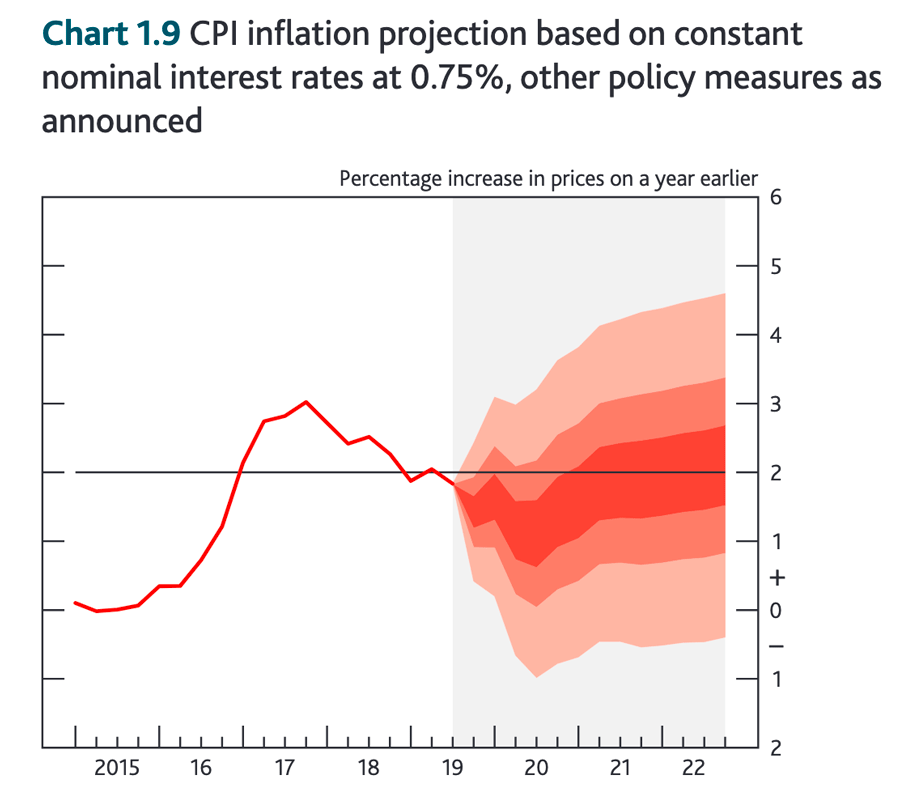

Inflation helps reduce the real value of debt. This occurred in the 1970s. Though interest rates did rise in the 70s to give some compensation to bondholders.

UK post-war budget deficit

Unemployment

What caused economic growth in the post-war period?

- Global economic boom

The UK economy benefited from the period of rapid global economic growth, especially in Western Europe. In fact, in this period, UK growth lagged behind many of our Western European neighbours. But, overall the UK enjoyed a period of rapid growth in trade and economic growth. The global economic boom was helped by

- Recovery of Japan and Germany

- Low global inflation

- Increased free trade, with reduction of tariff barriers

- Relative political and economic stability

- Technological improvements, such as computers, better petrol engines. Some of these technological improvements were quite low-tech like containerisation,

2. Immigration

UK growth was so rapid, the economy experienced labour shortages. This led to the mass immigration of the 1950s and 60s to help deal with the labour market shortages. This helped increase the working population and increase real GDP. GDP per capita rose at a slower pace than actual real GDP.

3. Improved education

In the post-war period, there was a growth in university education, and secondary education became more comprehensive.

4. Effective demand management

One of the cornerstones of William Beveridge’s Welfare proposals was the assumption that a comprehensive welfare state required considerable efforts to achieve near full employment. The UK experienced boom and bust cycles, but the downturns were relatively minor, and there were no real recessions of any significance until 1973.

In the post-war period, the government controlled monetary policy and fiscal policy and had a willingness to cut interest rates during economic slowdowns. The benign global economic conditions helped give a low trade-off between inflation and unemployment.

UK growth could have been higher

Many commentators state that although the UK did enjoy a post-war economic boom, it was actually a missed opportunity and our relative competitiveness declined. The UK had many failings such as

- Uncompetitive industry

- Poor industrial relations

- Lack of vocational training

- A degree of complacency – not felt in countries, such as Japan and Germany.