How do business know – Shall we put up our price?

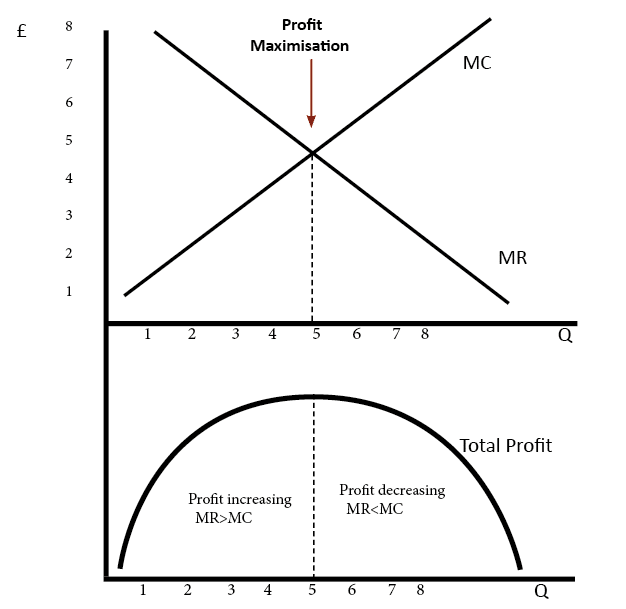

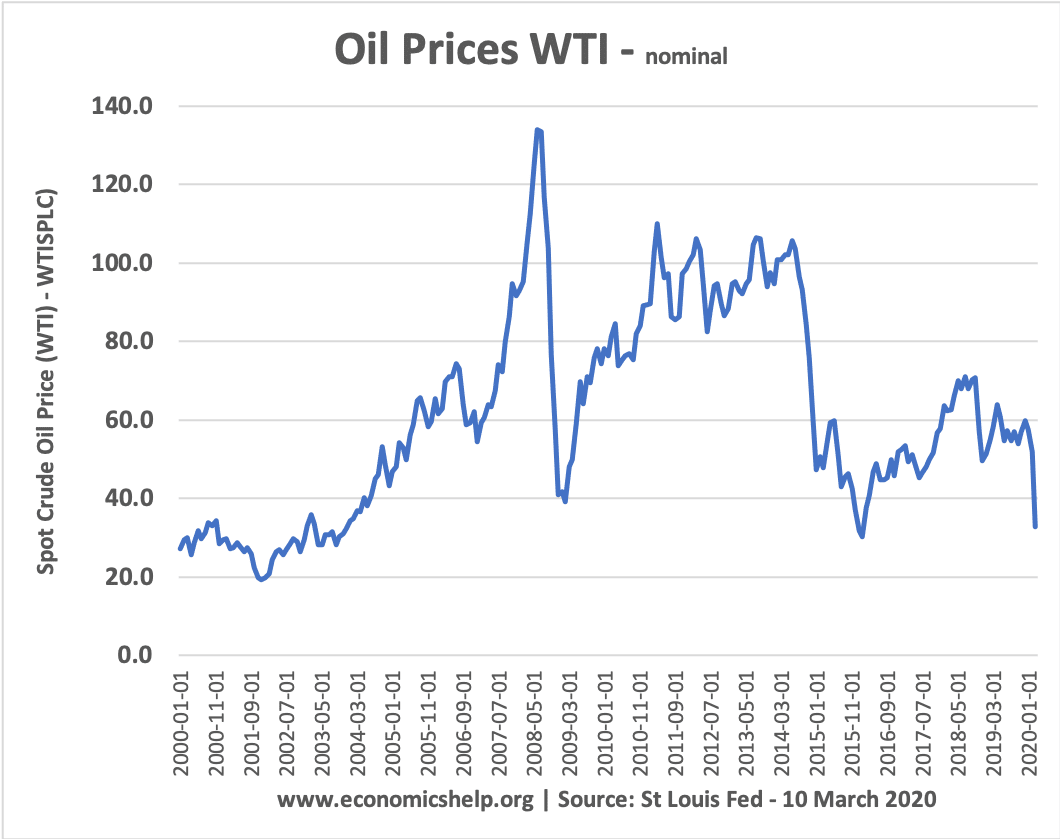

There are a few different reasons firms may put up prices, but in each case, a business will weigh up the pros and cons. Potential reasons for increasing prices An increase in costs of production. A general increase in the price level (inflation) Competitors are increasing the price. Firms believe demand has become more price …