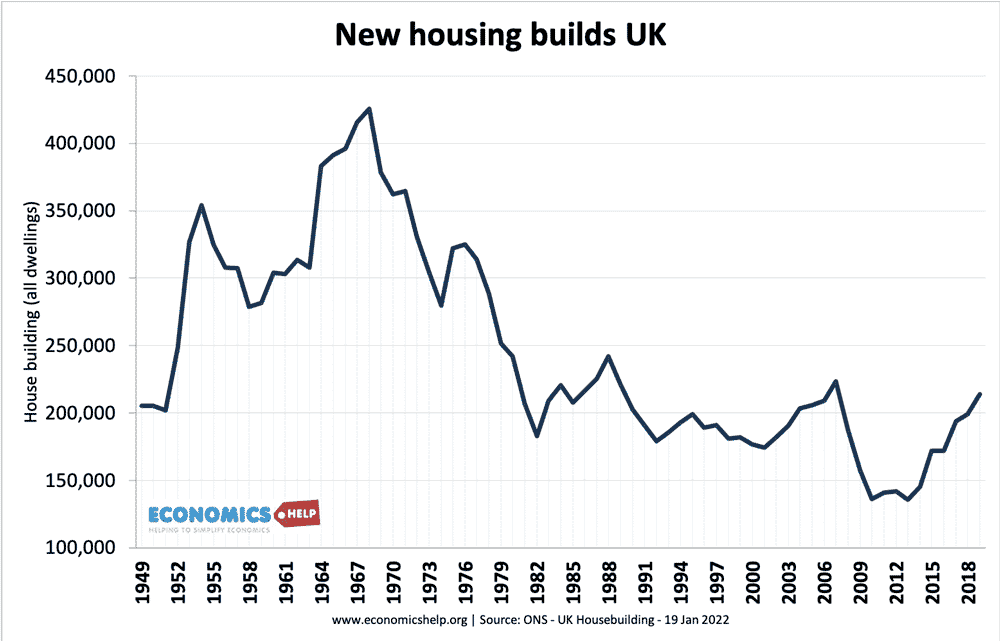

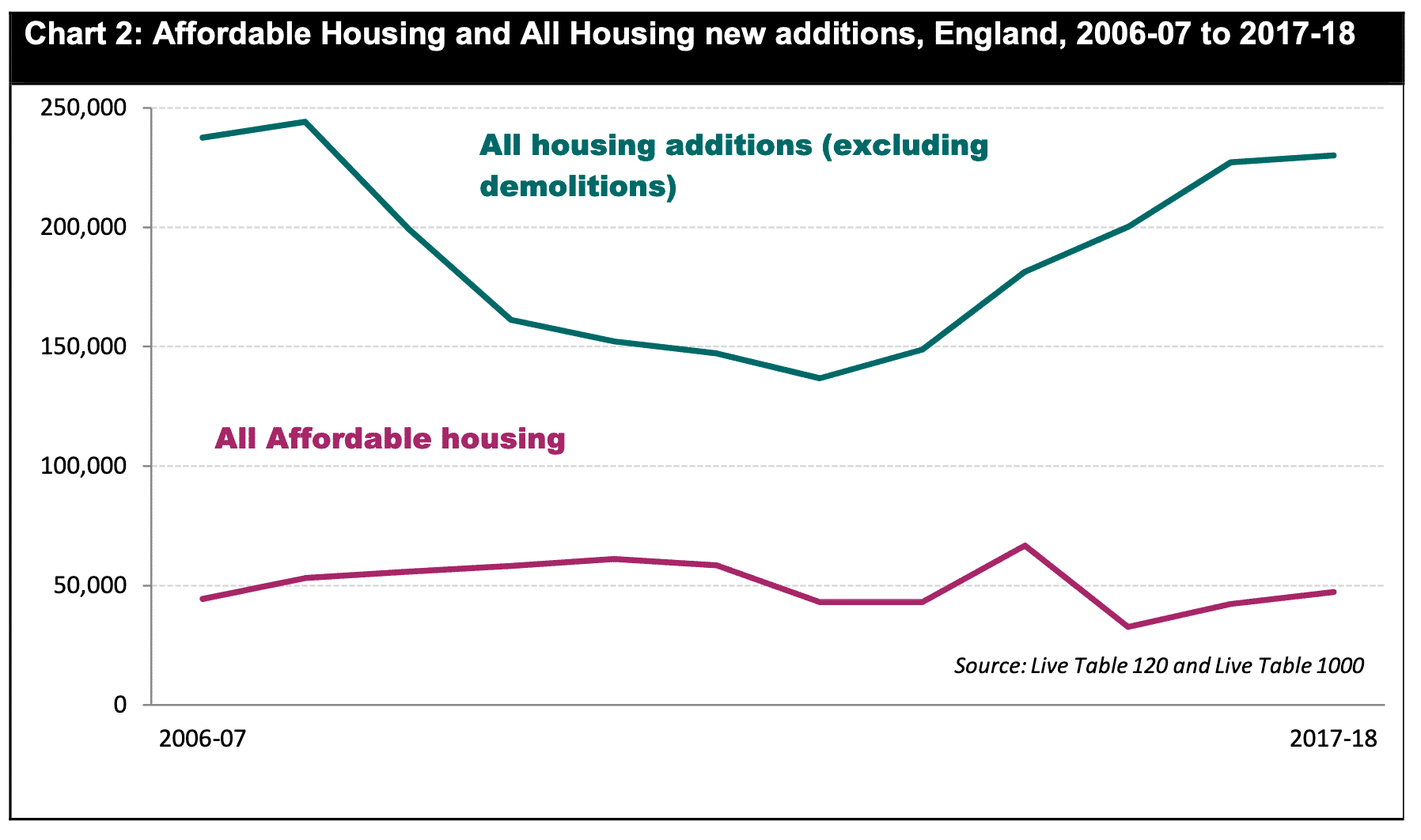

A fundamental problem in the UK housing market is a persistent shortage of housing. The ONS forecast the number of households in the UK will increase by 1.6 million (7.1%) over the next 10 years, from 23.2 million in 2018 to 24.8 million in 2028, and yet the current rate of home construction is struggling to increase above 150,000-200,000 a year.

Source: House building ONS July 2022

In the UK house building fell below 150,000 a year in the years following the financial crisis, but have recovered to levels just above 200,000 – though still below that needed to meet the rising demand.

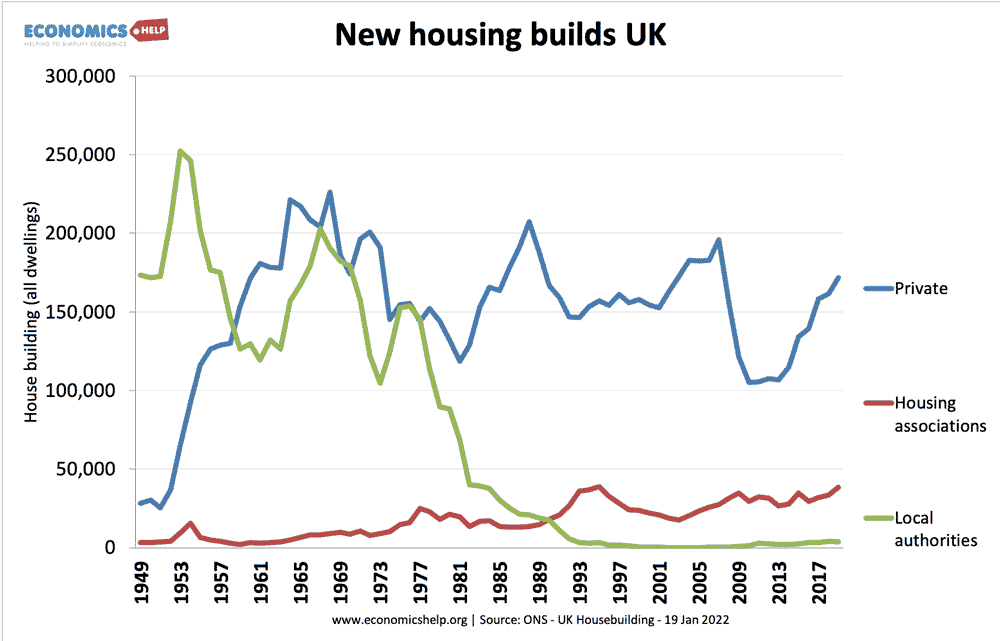

Type of new housing builds

This shows how since the 1980s, housing builds by local authorities has fallen to virtually zero. Housing supply comes primarily from private enterprise.

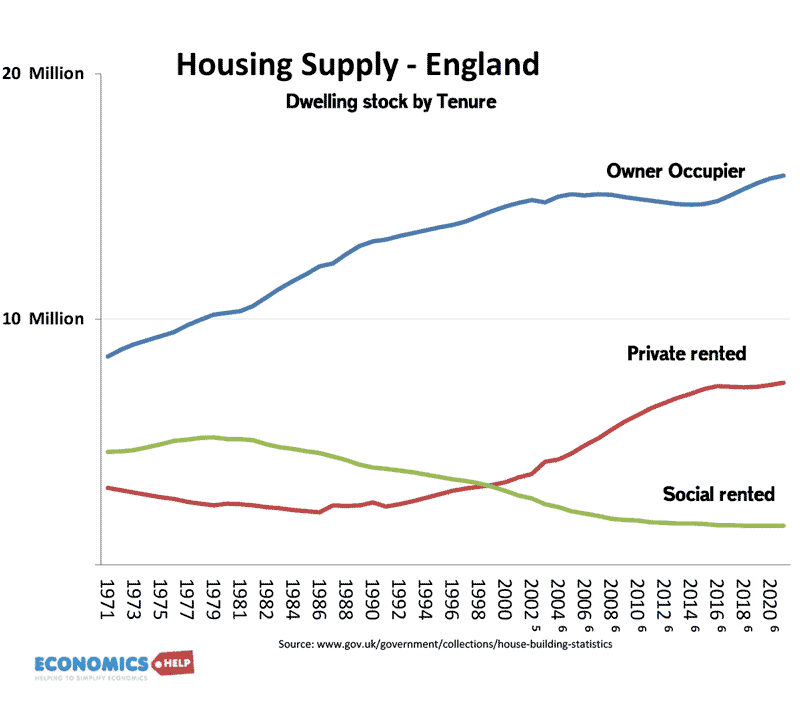

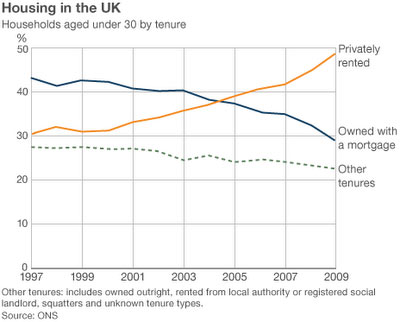

How Private rented accommodation has replaced social renting

Housing shortage

According to Crisis, there is also a backlog of nearly 5 million households with unsuitable accommodation. Unsuitable accommodation can include overcrowding, structural problems, and housing with poor maintenance. This is particularly a problem for people with health conditions which have been worsened by living with dampness and lack of ventilation.

Although successive governments have agreed more housing needs to be built. There is a tension with finding where housing can be built as many local communities already feel a sense of overcrowding and often oppose new home builds.

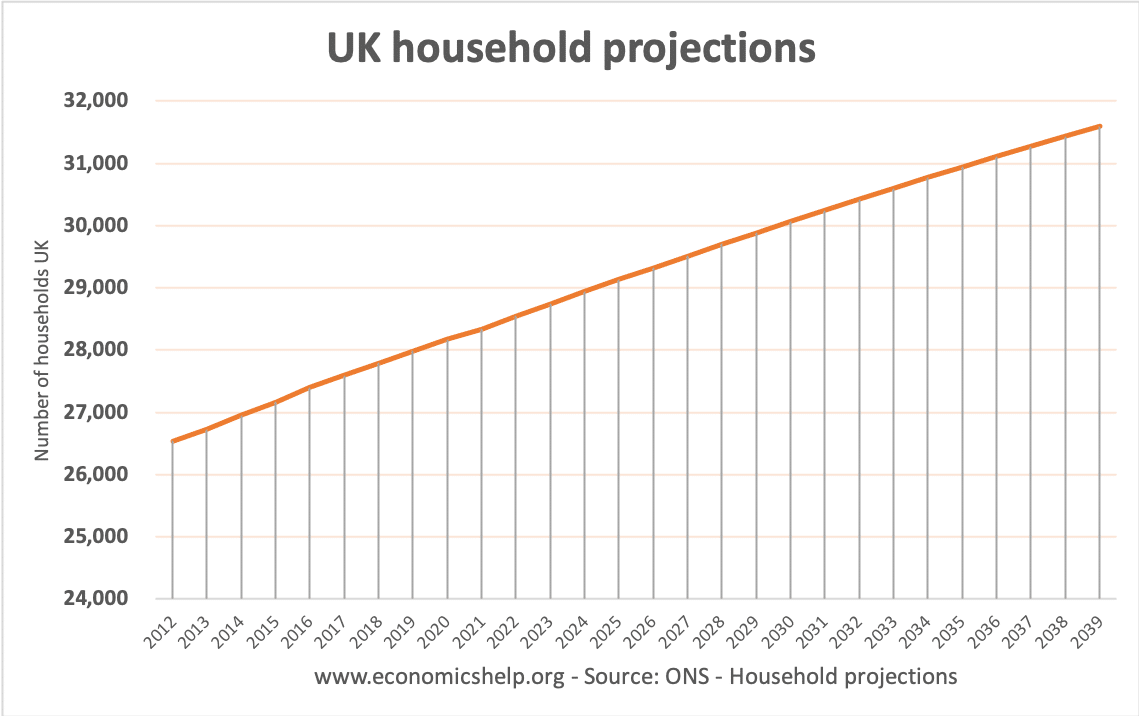

One study commissioned by National Housing Federation (NHF) claimed that England alone would need 340,000 new homes (of which 145,000 affordable) per year to catch up with the backlog. (Parliament)

Household projections

The number of households is predicted to rise by 4.3 million over the next two decades.

In 2022 the Government set a target of increasing the supply of housing by 300,000 a year. (link) However, since the credit crunch of 2008, this target has severely fallen behind as housing construction has slumped.

Policies to deal with expensive house prices in the UK have sometimes focused on demand-side approaches, such as “Help to Buy” which offers credit to groups of young home buyers. But increasing the availability of credit doesn’t directly address the problem of supply

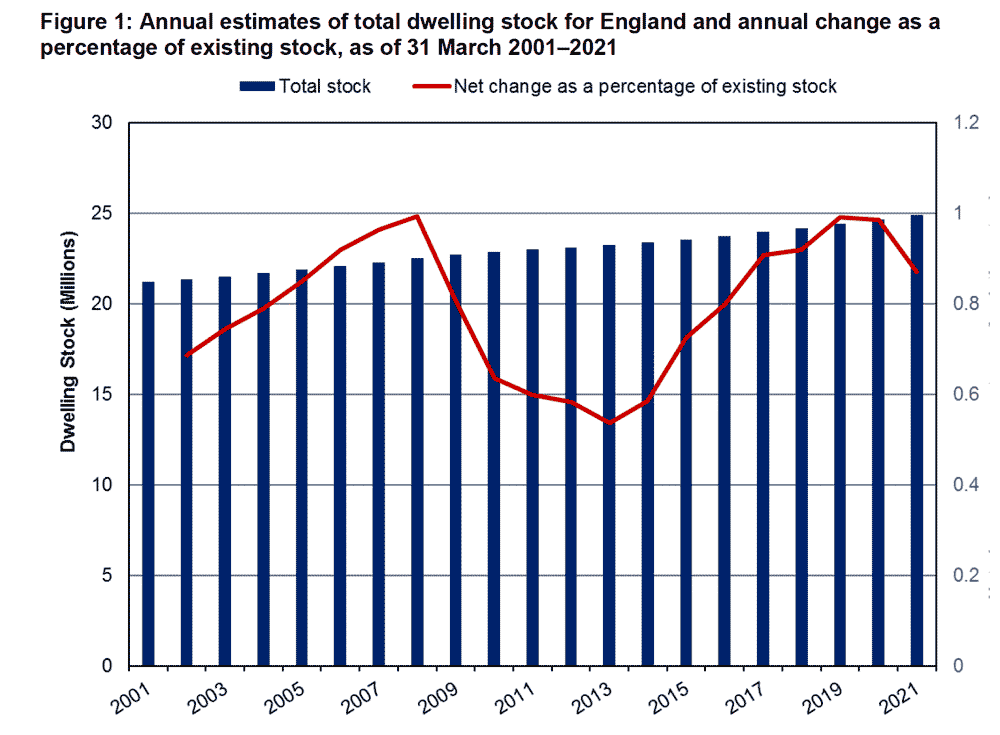

Source: GOV.UK Dwelling stock, May 2022

There is hope that improved mortgage availability will increase private sector construction. But, it doesn’t resolve other issues, such as planning regulations and local opposition to building homes on a large scale.

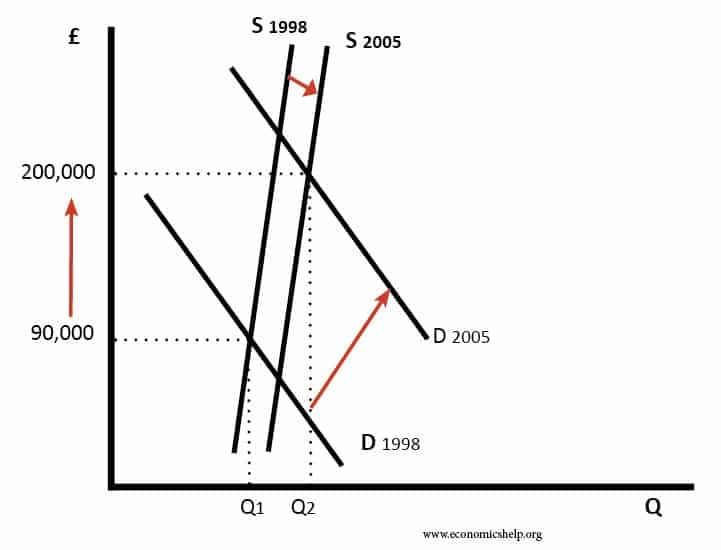

Demand growing faster than supply

Graph showing that demand for housing stock has been growing faster than net additions to the housing stock, pushing up house prices.

source: Understanding supply constraints in UK housing market, Shelter

Implications of Housing Shortages

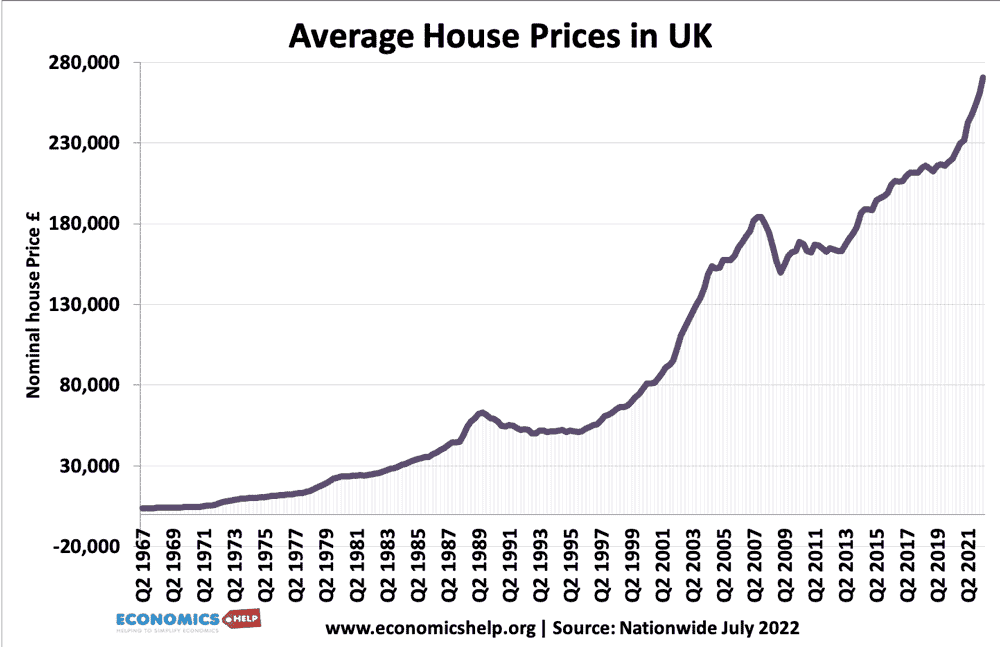

1. House prices will continue to rise in long-term

Despite two housing crashes, real house prices show a remorseless upward trend. The limited supply also tends to make house prices more volatile. Because supply is relatively inelastic a small change in demand can cause a significant change in price. This is a major factor behind the UK housing market’s tendency to boom and bust.

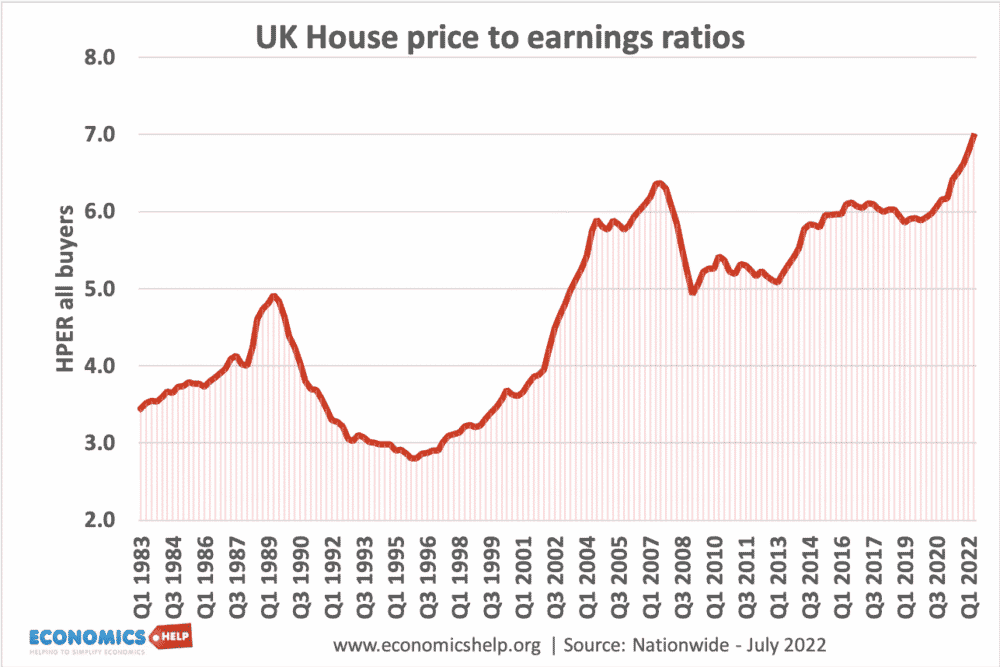

2. Housing will become more expensive as the percentage of income

Source: Nationwide house price data

In the mid 1990s, the UK house price to earnings ratio was under 3.0. At the height of the 2008 housing bubble, it had increased to 6.3. Despite a minor fall due to the financial crisis, the house price to ratio earnings have risen to a record level of 7.0 in 2022.

If the long-term trend of the rising population is combined with limited supply, this is likely to squeeze prices higher. See more at UK housing affordability.

2. Switch to the private rented sector will continue. If house prices continue to rise, more people will be looking for private rented accommodation.

Type of Property

3. Growth in wealth inequality. Rising house prices benefit homeowners (typically older people). However, it reduces living standards of those without a home. The UK will increasingly become divided between those who own a home and those who don’t.

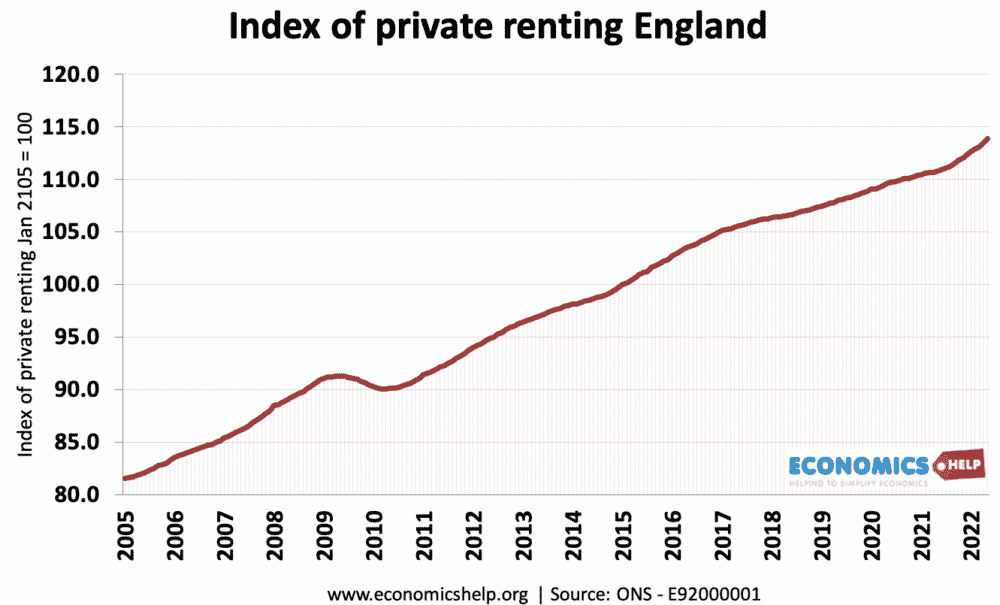

4. Upward pressure on rental prices. The shortage of housing will put upward pressure on the price of rented accommodation. Housing costs will take a bigger share of people’s incomes affecting their discretionary income.

The ONS now publish stats by a nation within UK – England, Scotland, Wales.

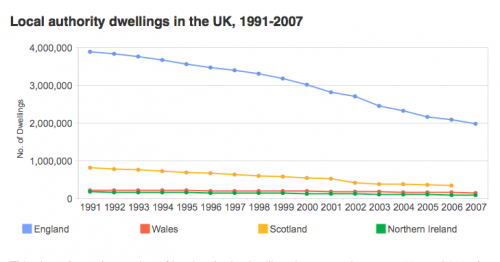

Local authority housing

Local authority housing stock has plummeted due to the popular right-to-buy scheme and transfer of housing stock to housing associations.

source: JRF Housing & Neighbourhood studies

Further reading

Thank you for this – as a new local authority cllr I am trying to ascertain what flexibility there is in the so called ‘standard method’ by which local authorities are required to determine their land supply for housing.

Here in Herefordshire we are trying to tackle the problem of providing affordable housing to retain or incentivise a younger demographic.