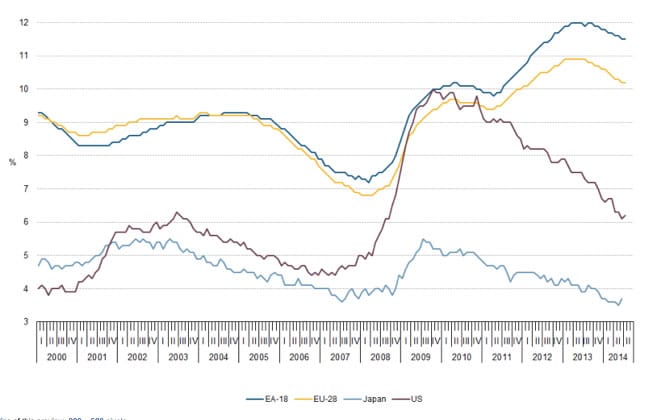

- Unemployment rate in the Eurozone area: 11.5% (July 2014)

- EU-28 Unemployment is slightly lower at 10.2% (July 2014)

- Total unemployment in the EU-28 is 24.850 million (July 2014)

- The Eurozone (EA-18) jobless total is now 18.409 million. (link) The highest since records began.

- Youth unemployment rates in the EU 27 is 21.8% (July 2014)

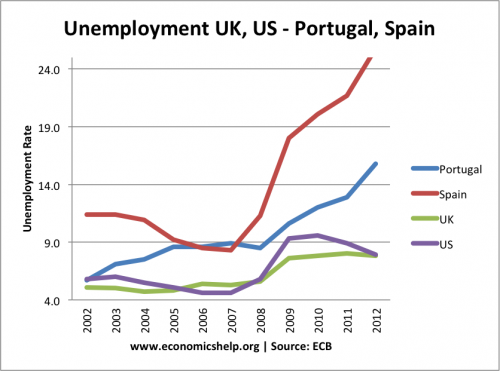

- The lowest unemployment rates are in Austria (4.9 %) and Germany (4.9 %). The highest rates are in Greece (27.2 % in January 2014) and Spain (24.5 %).

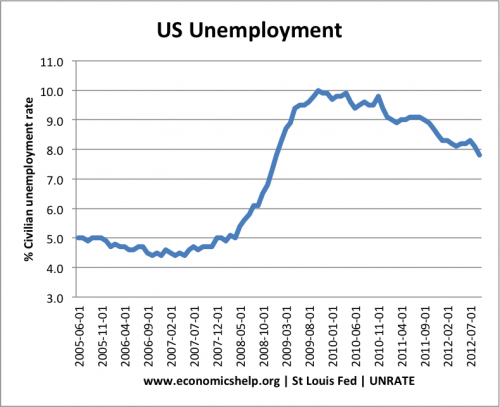

- By comparison, unemployment in Japan is 3.6%, and in US 6.8%. UK unemployment is 6.5%

- Eurostat unemployment figures

Source: ECB

Causes of European unemployment crisis

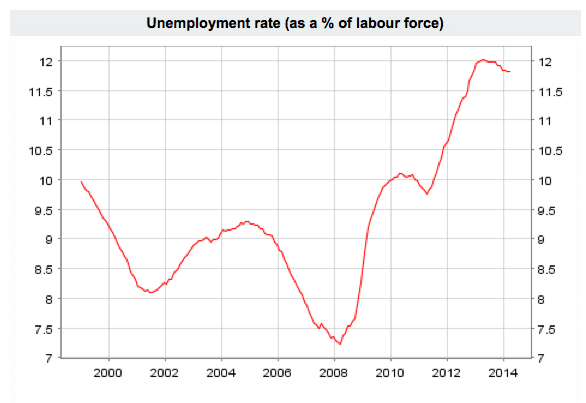

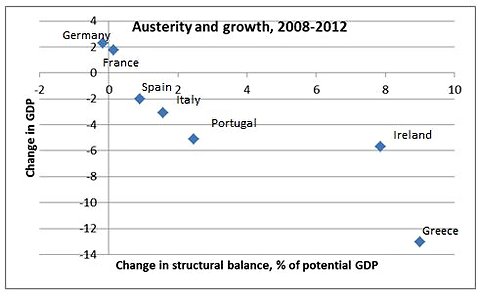

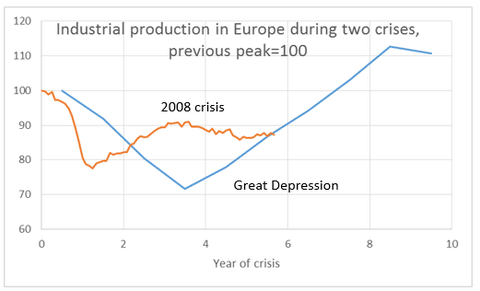

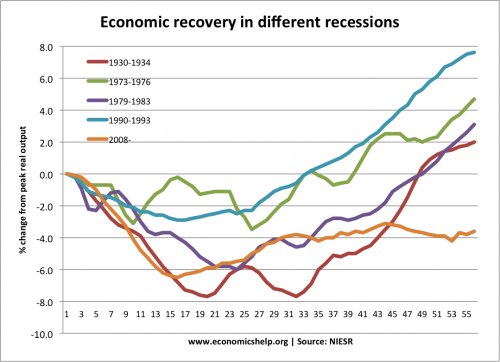

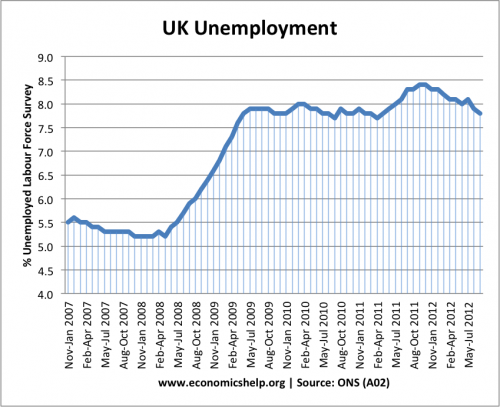

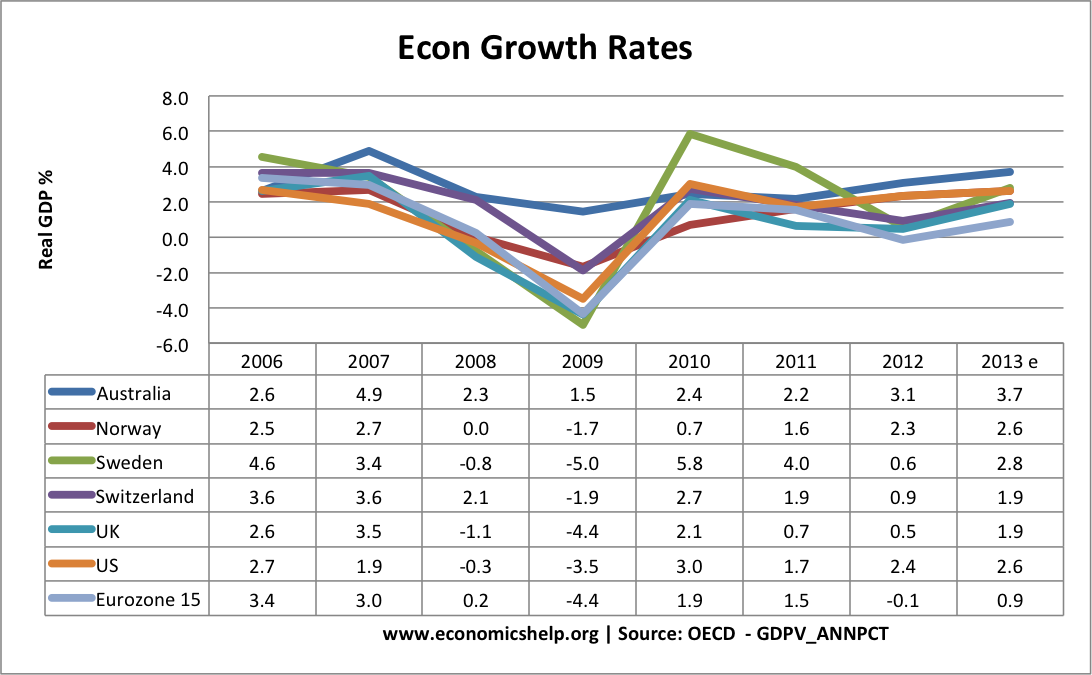

After falling to 7.5% in 2008, the prolonged recession of 2008-13, has caused a sharp rise in unemployment. The continent seems to be stuck in a deflationary spiral and is facing a prolonged double-dip recession. Hardest hit debtor countries, such as Spain, Greece, Portugal and Italy are facing stringent budget cuts – which are depressing demand.

But, in the Eurozone, there is little relief available to boost demand. Countries are unable to devalue. Monetary policy set by the ECB has been unflinching in targeting low inflation and offering little monetary easing – despite the prolonged recession. Also, depressed demand throughout the region is making it difficult to grow through increasing exports. Even northern Europe, which has had large current account surpluses are engaging in modest austerity. The result is that demand has remained depressed across Europe.

Despite its potentially damaging social and economic impact, throughout the 2008-13 European crisis, unemployment has had a relatively low profile – European policymakers have always given the impression they are more concerned about appeasing bond markets and low inflation than tackling the more pressing problem of unemployment. There has been a reluctance to tackle the fundamental deficiency of aggregate demand which is leading to lower growth and falling employment. Efforts to reduce unemployment have centred on talk of more flexible labour markets. This may be part of the solution for structural unemployment, but increasing labour market flexibility alone cannot deal with the cyclical unemployment.