Readers Question: You have partially explained the answer to my question in your reply to my other question, “What will we do when we can’t pay back the money owing to the government bond holders when they reach the end if their term”. While I appreciate the convenient use of the debt to GDP ratio I feel that it tends to sidestep the truth about the remaining debt. This is almost like the government using the reduction in the deficit rather than the reality of remaining, possibly increasing debt.

For some reason, the first thing that comes into my mind is the famous quote from Dr Strangelove – “how I learned to stop worrying and love the bomb (debt)”

I guess we can blame Charles Dickens and Wilkins Micawber from David Copperfield.

“Annual income twenty pounds, annual expenditure nineteen pounds nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds nought and six, result misery.”

No matter how much you talk about government debt, people won’t feel comfortable until we have a zero budget deficit and zero government debt. – (even though, I don’t think any modern economy has ever had such a situation – nor would one be particularly desirable.) Many issues are addressed here: The political appeal of austerity.

What does debt cost?

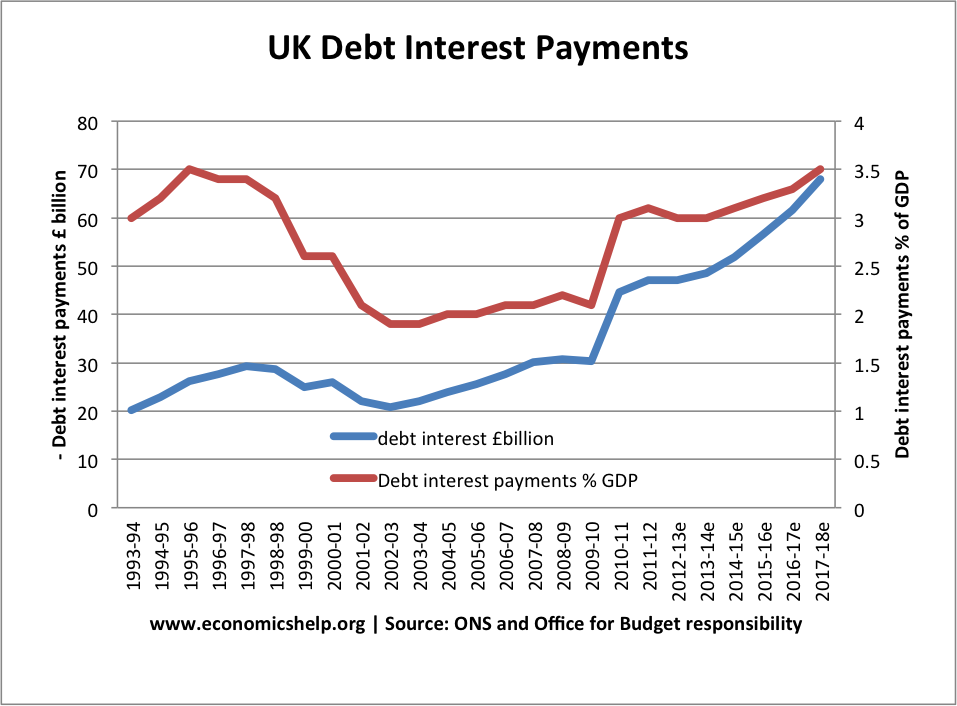

Another way of thinking about government debt is the annual cost of servicing the debt. What percentage of GDP is spent on debt interest payments? What percentage of tax revenues is spent on servicing the debt? You could have an increase in the real value of debt, but a smaller percentage spent on paying interest on the debt. Would you worry about a mortgage – if every year the monthly mortgage payments were becoming a smaller percentage of your disposable income?

The cost of servicing UK debt has risen in the past few years, due to rise in debt. But, by historical standards, it is still quite low and certainly quite manageable. More on Cost of borrowing

Of course, the cost of debt interest payments also depend on interest rates. A rise in interest rates will cause higher borrowing costs. But, with low interest rates predicted, we are unlikely to see a jump in borrowing costs – at least in the medium term.

Another way of thinking about debt is – what exactly is it?

The private sector fund a high percentage of buying government debt through buying government bonds. Suppose we decide to immediate slash the deficit and pay off the government debt. This will require a large increase in tax (or spending cuts) – this would lead to lower savings because the private sector have less disposable income. Reducing the debt in one sense means changing how you finance the government spending – higher tax / less benefits rather than bonds from private sector saving.

Who do we borrow from?

Essentially we are borrowing from ourself. – Who lends to the government?

If were predominantly borrowing from overseas, it may be different.

In the case of quantitative easing, the Central Bank has created money (without causing inflation because of the credit crunch) and bought bonds. You can’t always get away with this; it requires a particular low inflation environment. But, Europe should seriously be considering it.

“how I learned to stop worrying and love the debt”

It may sound as if I think government borrowing is a good thing – or something to be blaze about. This also isn’t the case. A rise in government borrowing can be damaging to a countries long-term economic fortunes. – See: Problems of government borrowing. There are drawbacks to rising government debt – especially if it isn’t being used to help fund public sector investment or offset a fall in private sector spending in a recession. If we see a rise in government borrowing due to demographic changes (ageing population) and higher spending on non-productive programs, it is something to be concerned about.

Related