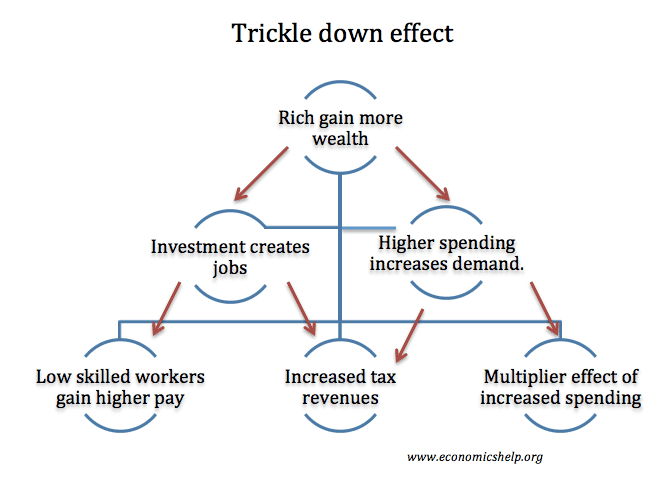

Trickle down economics

Trickle down economics is a term used to describe the belief that if high-income earners gain an increase in salary, then everyone in the economy will benefit as their increased income and wealth filter through to all sections in society. How the trickle-down effect may work in theory If the richest gain an increase in …