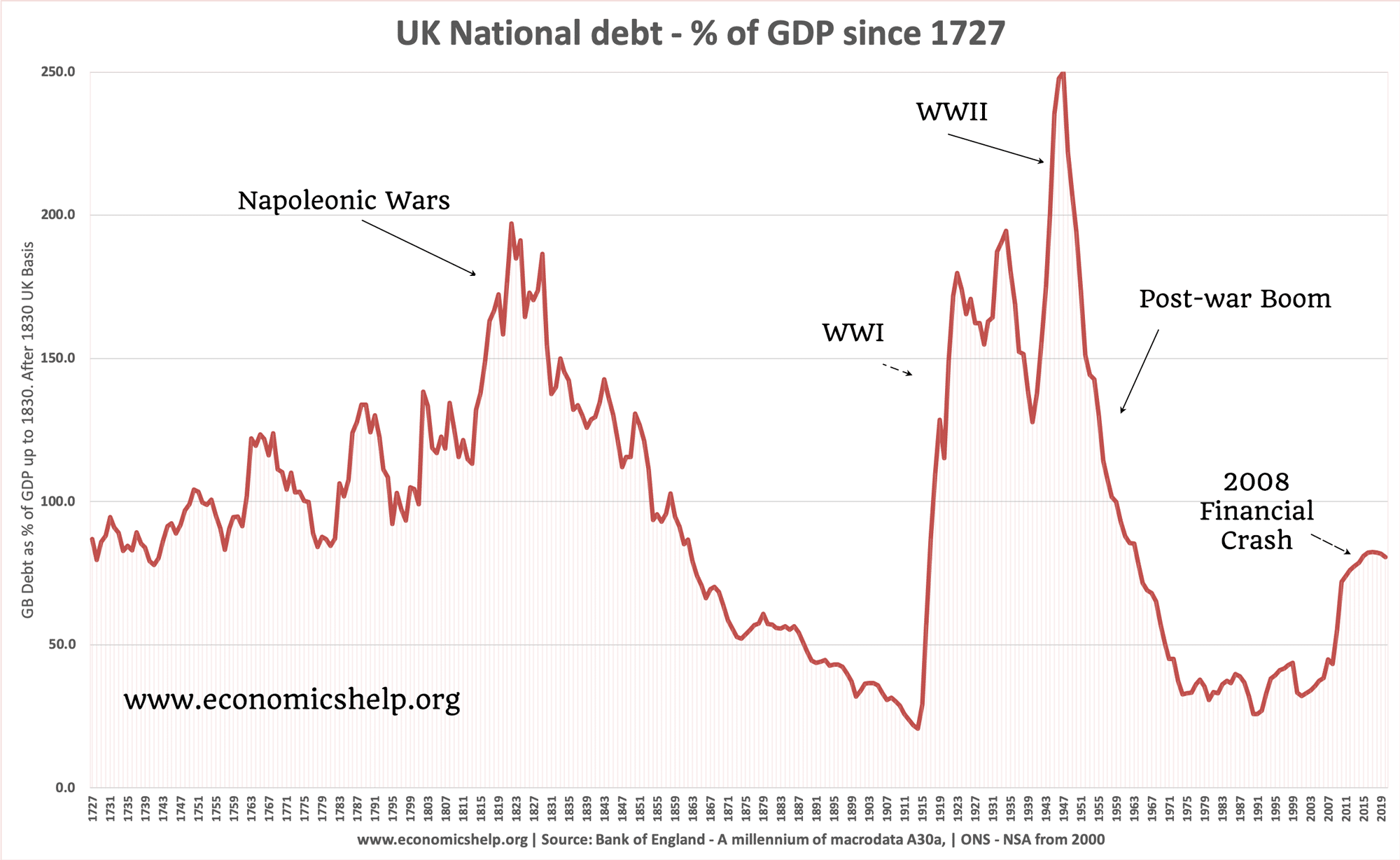

How important is the budget deficit?

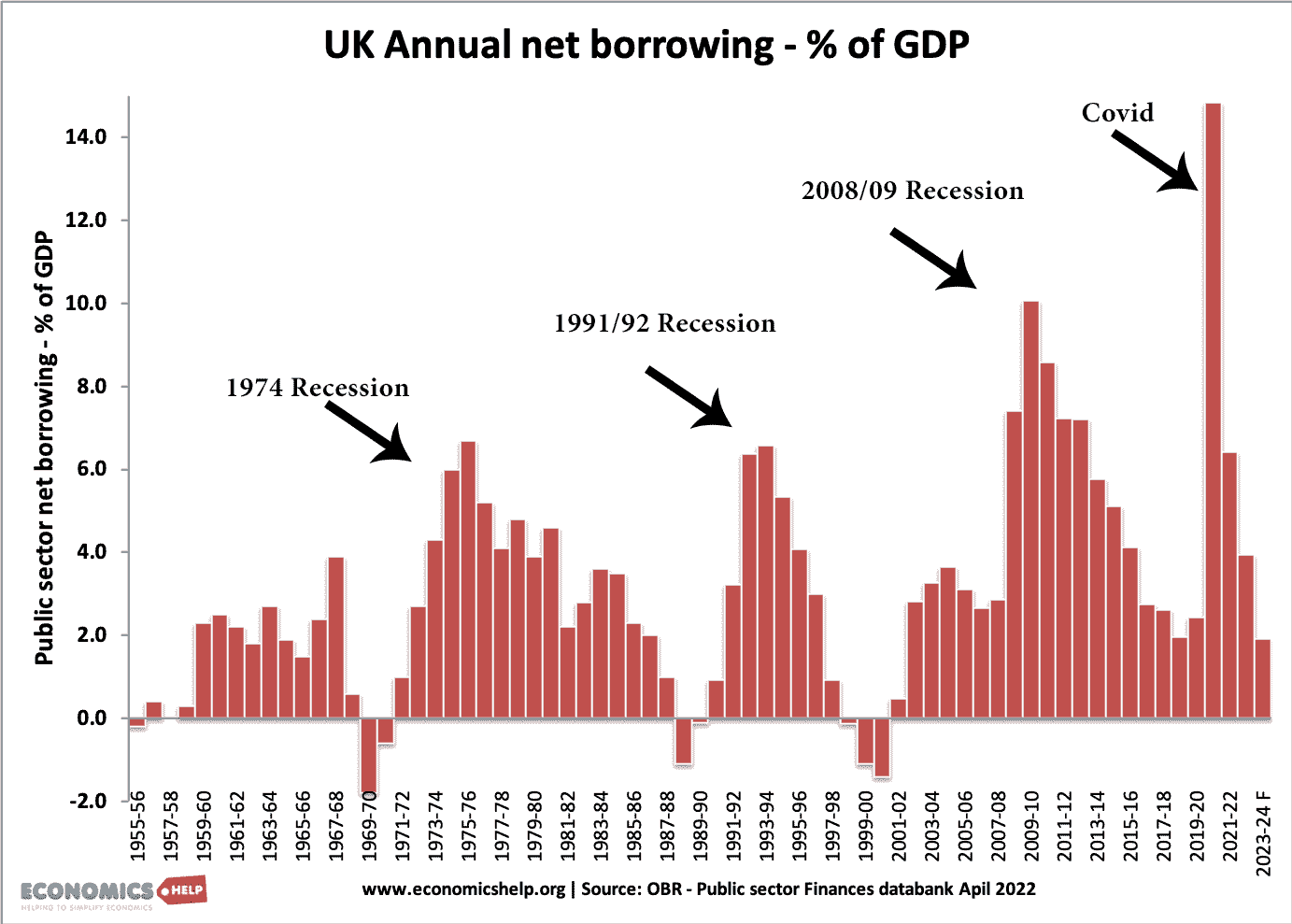

Readers Question: How important is the budget deficit? The budget deficit is the annual amount the government borrow. The government usually financed the budget deficit by selling bonds to the private sector To libertarian and free-market economists, budget deficits are liable to cause significant economic problems – crowding out of the private sector, higher interest …