- This is a list of the gross national debt of 178 countries, showing the variation in debt levels from Venezuela at 304% of GDP to Macau at 0% of GDP.

- National debt refers to the amount of total government debt a country has. This is also referred to as ‘public sector debt’.

- It is compiled using data from the IMF.

- Note: National debt is different to ‘External debt‘ – External debt includes all the debt a country (both private and public sector) owes to foreigners.

- Updated 1 September 2021.

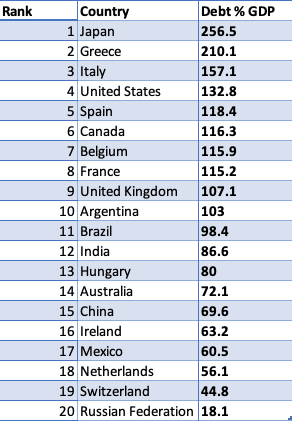

Debt of selected economies

List of National Debt by Country

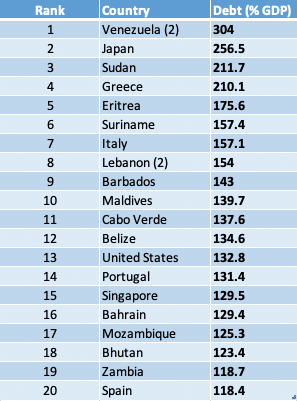

Levels of general gross government debt. Debt levels as % of GDP for 2021 (² unless stated)

| Rank | Country | Debt levels as % of GDP for 2021 |

| 1 | Venezuela ² | 304 |

| 2 | Japan | 256.5 |

| 3 | Sudan | 211.7 |

| 4 | Greece | 210.1 |

| 5 | Eritrea | 175.6 |

| 6 | Suriname | 157.4 |

| 7 | Italy | 157.1 |

| 8 | Lebanon ² | 154 |

| 9 | Barbados | 143 |

| 10 | Maldives | 139.7 |

| 11 | Cabo Verde | 137.6 |

| 12 | Belize | 134.6 |

| 13 | United States | 132.8 |

| 14 | Portugal | 131.4 |

| 15 | Singapore | 129.5 |

| 16 | Bahrain | 129.4 |

| 17 | Mozambique | 125.3 |

| 18 | Bhutan | 123.4 |

| 19 | Zambia | 118.7 |

| 20 | Spain | 118.4 |

| 21 | Canada | 116.3 |

| 22 | Belgium | 115.9 |

| 23 | France | 115.2 |

| 24 | Cyprus | 113 |

| 25 | Angola | 110.7 |

| 26 | United Kingdom | 107.1 |

| 27 | Sri Lanka | 105.4 |

| 28 | Argentina (2) | 103 |

| 29 | Brazil | 98.4 |

| 30 | Jamaica | 96.5 |

| 31 | Dominica | 96.4 |

| 32 | Montenegro | 94.6 |

| 33 | Egypt | 92.9 |

| 34 | Jordan | 91.2 |

| 35 | Tunisia | 91.2 |

| 36 | Congo, Republic of | 90.5 |

| 37 | Bahamas, The | 88.6 |

| 38 | El Salvador | 88.2 |

| 39 | Mauritius | 87.7 |

| 40 | Pakistan | 87.7 |

| 41 | Austria | 87.2 |

| 42 | India | 86.6 |

| 43 | Croatia | 86.3 |

| 44 | Fiji | 83.6 |

| 45 | Iceland | 82.5 |

| 46 | Ghana | 81.5 |

| 47 | South Africa | 80.8 |

| 48 | Slovenia | 80.5 |

| 49 | Hungary | 80 |

| 50 | Israel | 78.3 |

| 51 | Guinea-Bissau | 78.1 |

| 52 | Mongolia | 77.9 |

| 53 | Morocco | 77.1 |

| 54 | Malawi | 76.8 |

| 55 | Burundi | 75.6 |

| 56 | Albania | 75.4 |

| 57 | Grenada | 74.5 |

| 58 | Gambia, The | 73.9 |

| 59 | Kyrgyz Republic | 73.4 |

| 60 | Yemen | 73 |

| 61 | Costa Rica | 72.5 |

| 62 | São Tomé and Príncipe | 72.4 |

| 63 | Australia | 72.1 |

| 64 | Kenya | 71.5 |

| 65 | Namibia | 71.4 |

| 66 | Oman | 71.3 |

| 67 | Gabon | 71.1 |

| 68 | Germany | 70.3 |

| 69 | Armenia | 69.9 |

| 70 | Iraq | 69.7 |

| 71 | China, People’s Republic of | 69.6 |

| 72 | Bolivia | 69 |

| 73 | Finland | 68.8 |

| 74 | Lao P.D.R. | 68.3 |

| 75 | Uruguay | 68 |

| 76 | Malaysia | 67 |

| 77 | Senegal | 66.8 |

| 78 | Dominican Republic | 66.6 |

| 79 | Rwanda | 66 |

| 80 | Ecuador | 65.1 |

| 81 | Puerto Rico | 64.8 |

| 82 | Colombia | 64.2 |

| 83 | Slovak Republic | 64 |

| 84 | Emerging market and developing economies | 64 |

| 85 | Georgia | 63.9 |

| 86 | Algeria | 63.3 |

| 87 | Ireland | 63.2 |

| 88 | Trinidad and Tobago | 62.1 |

| 89 | Panama | 61.4 |

| 90 | Mexico | 60.5 |

| 91 | Togo | 60 |

| 92 | Qatar | 59.8 |

| 93 | Serbia | 59 |

| 94 | Ukraine | 58.1 |

| 95 | Malta | 57.9 |

| 96 | Poland | 57.4 |

| 97 | Liberia | 57 |

| 98 | Mauritania | 56.3 |

| 99 | Netherlands | 56.1 |

| 100 | Ethiopia | 56 |

| 101 | Thailand | 55.9 |

| 102 | Honduras | 53.9 |

| 103 | North Macedonia | 53.8 |

| 104 | Korea, Republic of | 53.2 |

| 105 | Romania | 52.6 |

| 106 | Philippines | 51.9 |

| 107 | Zimbabwe | 51.4 |

| 108 | Lesotho | 49.8 |

| 109 | Tajikistan | 49.8 |

| 110 | Nepal | 49.6 |

| 111 | Papua New Guinea | 49.6 |

| 112 | Lithuania | 49.5 |

| 113 | Myanmar | 49.1 |

| 114 | Samoa | 49 |

| 115 | Uganda | 48.8 |

| 116 | Vietnam | 48 |

| 117 | West Bank and Gaza | 47.9 |

| 118 | Benin | 47.7 |

| 119 | Nicaragua | 47.6 |

| 120 | Latvia | 47.2 |

| 121 | South Sudan, Republic of | 47 |

| 122 | Madagascar | 46.9 |

| 123 | Burkina Faso | 46.8 |

| 124 | New Zealand | 46.4 |

| 125 | Côte d’Ivoire | 46.3 |

| 126 | Mali | 46.1 |

| 127 | Belarus | 45.7 |

| 128 | Switzerland | 44.8 |

| 129 | Niger | 44.5 |

| 130 | Equatorial Guinea | 44.1 |

| 131 | Czech Republic | 44 |

| 132 | Tonga | 43.7 |

| 133 | Cameroon | 42.5 |

| 134 | Guinea | 42.3 |

| 135 | Uzbekistan | 42.3 |

| 136 | Central African Republic | 42.2 |

| 137 | Chad | 41.7 |

| 138 | Denmark | 41.6 |

| 139 | Norway | 41.6 |

| 140 | Guyana | 41.4 |

| 141 | Indonesia | 41.4 |

| 142 | Sweden | 40.4 |

| 143 | Bangladesh | 40.2 |

| 144 | Djibouti | 40.2 |

| 145 | Moldova | 39.5 |

| 146 | Bosnia and Herzegovina | 38.6 |

| 147 | Tanzania | 37.9 |

| 148 | Turkey | 37.1 |

| 149 | United Arab Emirates | 37.1 |

| 150 | Iran | 36.6 |

| 151 | Paraguay | 35.7 |

| 152 | Peru | 35.4 |

| 153 | Chile | 33.6 |

| 154 | Cambodia | 33.4 |

| 155 | Guatemala | 33.1 |

| 156 | Taiwan Province of China | 32.5 |

| 157 | Nigeria | 31.9 |

| 158 | Saudi Arabia | 31 |

| 159 | Azerbaijan | 30.9 |

| 160 | Kazakhstan | 27 |

| 161 | Luxembourg | 26.8 |

| 162 | Haiti | 26 |

| 163 | Turkmenistan | 26 |

| 164 | Bulgaria | 25.5 |

| 165 | Botswana | 25.3 |

| 166 | Estonia | 25.1 |

| 167 | Marshall Islands | 23.3 |

| 168 | Kiribati | 21.4 |

| 169 | Russian Federation | 18.1 |

| 170 | Micronesia, Fed. States of | 15.3 |

| 171 | Timor-Leste | 15 |

| 172 | Kuwait | 13.7 |

| 173 | Congo, Dem. Rep. of the | 12.4 |

| 174 | Tuvalu | 11.8 |

| 175 | Afghanistan | 8.8 |

| 176 | Brunei Darussalam | 2.3 |

| 177 | Hong Kong SAR | 0.9 |

| 178 | Macao SAR | 0 |

All debt levels apply to 2021, except ² No figures for 2021. Debt given for 2020

Source: IMF DataSet, accessed 1 September 2021

Highest levels of Government debt in the world

The country with the highest debt to GDP ratio in 2020 was Venezuela (304%) – a reflection of a collapsing economy and failure to collect tax revenues.

The second biggest debt burden is Japan with 256% – though this is very different situation with economic stability and prosperity. The Japanese government is able to borrow from private individuals in Japan. Conflict in Sudan and Eritrea have played a large role in their high debt levels.

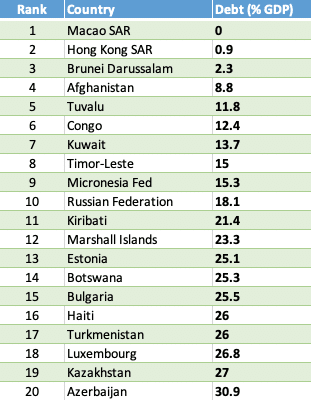

Lowest levels of government debt in the world

The country with the lowest levels of debt is Macau – an autonomous region on the south coast of China. Macau is the most densely populated region in the world, with one of highest levels of GDP per capita. Nearly 80% of the government’s revenue comes from a thriving gambling industry. Oil producing countries, like Brunei, Kuwait and Kazakhstan have low levels of debt because governments have successfully collected tax revenue from oil.

Some very poor countries like Afghanistan, Congo and Haiti have perhaps surprisingly low levels of debt. One reason is that the country does not have functioning bond markets. There is so much uncertainty that governments do not have the opportunity to borrow.

Problems of national debt

High levels of national debt can cause these potential problems

- Requirement of higher taxes and/or lower spending

- Higher debt interest payments

- Pressure to print money – causing inflation.

- Debt financed by overseas borrowing can lead to external pressure

- Crowding out of the private sector

See: more problems of government borrowing

How much can a government borrow?

- Japan’s national debt is 265% of GDP and has been high for a couple of decades. This reflects the ability of Japan to borrow from domestic citizens. Despite prolonged periods of high debt, interest rates are still low because markets feel the government is still solvent.

- A developing economy like Argentina has a track record of default on debt, therefore markets are less willing to lend money to the government. Therefore when debt levels in Argentina increase it has a greater effect on pushing up interest rates.

Factors that depend on how much a government can borrow include

- Default rates of government

- Inflationary pressures. High inflation will make investors less willing to buy government bonds because they will devalue due to inflation

- Can the government print its own money? If the government can print money it can avoid liquidity issues, though there is potential danger of inflation.

- What are the prospects for economic growth? Higher economic growth makes it easier to reduce debt to GDP ratios over time.

- How much can a government borrow?

Difference between debt and deficit

Government debt is the total amount of outstanding liabilities. The deficit is the annual amount by which spending exceeds income. The debt is the accumulation of past deficits.

For example in 2020, the US deficit was $3.13 trillion. The US total debt is $29 trillion.

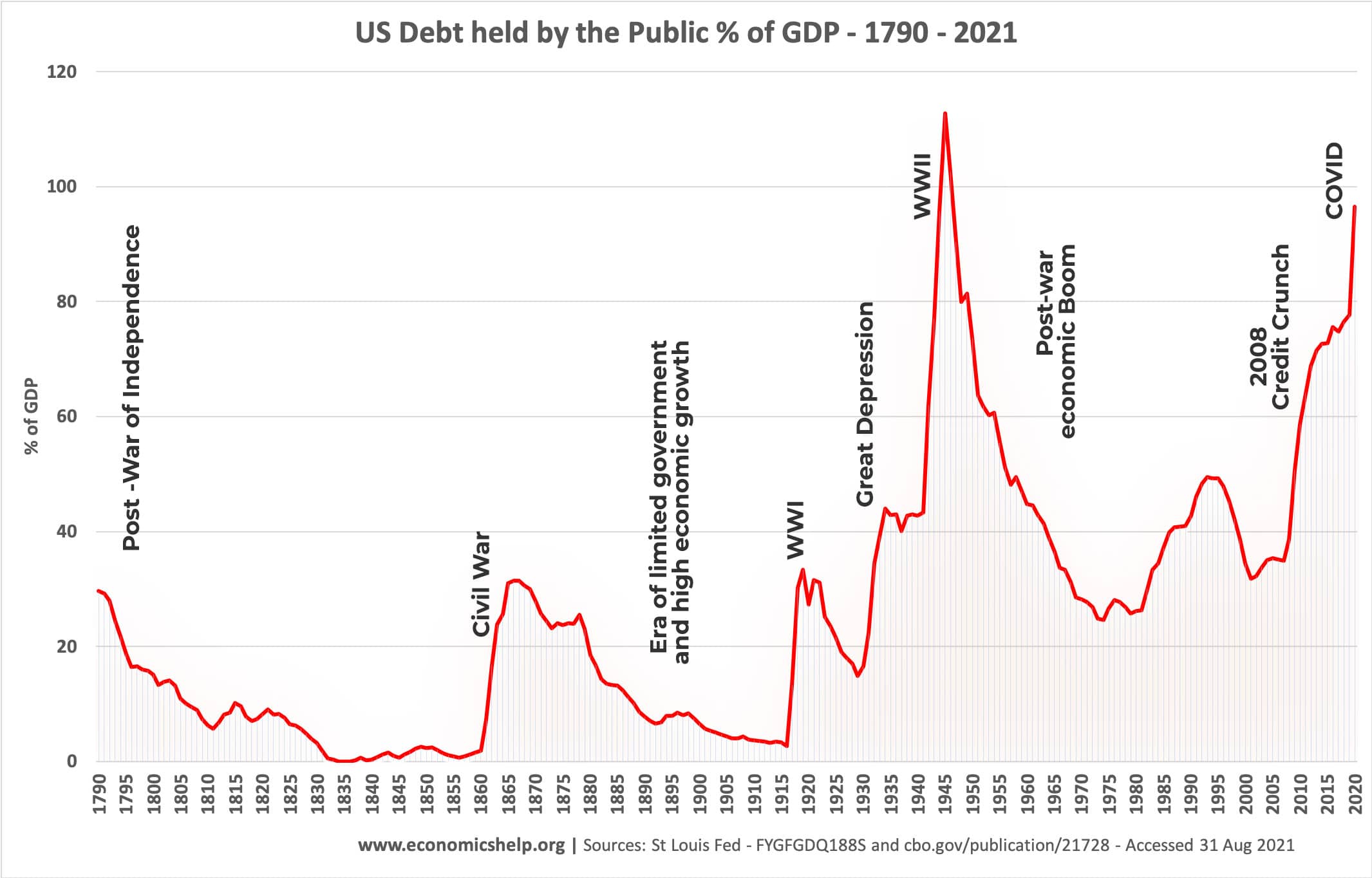

Causes of national debt

This graph for US national debt shows how national crisis leads to a rise in government borrowing. This isn’t necessarily a bad thing. Government debt enabled the US government to finance the short-term costs of the two world wars. It also enabled the government to respond to the crisis of the 2008 financial crash and the 2020 Covid crisis. Causes of national debt can include

- Recession – tax revenues fall when the economy shrinks. Also the government spend more on unemployment benefits

- Investment – Governments might borrow to build new roads, schools and hospitals.

- Finance war –

- Demographic changes and welfare spending. An ageing population tends to place more strain on government finances with older people requiring more health care spending, pensions and also they pay less income tax.

- Political decisions. Some governments may support higher spending on welfare programmes, whearas other governments may target a balanced budget.

Related

Further Reading

- Why is Japan able to borrow so much at low interest rates?

- Euro Debt crisis explained

- National Debt, printing money and inflation

Readers Question

I don’t understand how a high domestic savings rate makes a high public sector debt sustainable. Surely 195% GDP public debt is a massive burden on the Japanese government via interest payments? UK public debt is about 45% GDP whilst we have a relatively low savings rate, how are these facts related? How are domestic savings linked to public debt?

Could someone please help me answer these questions.

Who runs the IMF and World bank?

Which country’s are not in debt to them?

Im having trouble understanding where the money to pay back debt will come from, as every county I can think of owes them money.

Basically, Who has got it all????

Marcus,

Japan’s debt is sustainable because the interest rates for yen denominated debt is practically 0%. If you have a savings account with the Japan post office (the biggest bank in the world by pure deposits), then your interest rate is 0.0001% p.a. The Bank of Japan keeps its interest rates low and so it is really a borrower’s market now.

Here is another extreme example. Assuming you get a fixed rate mortgage over a 35-year period, can you guess what the interest rate on it is? About 2.8%…

Moderator, do any countries have a national surplus

(as opposed to national debt)?

American citizens, our national debt is more or less almost 100 percent of GDP now, but was only 60 percent give or take 10 years ago, with a very recent sharp upward spike. fiddle with the values on this page (very good) to see

its now almost $40,000 per citizen now not including the crushing state debts such as California. Argentina and

Brazil had currency crises at lower GDP levels, time to wake up and tell your friends, or we will wake up some day and find out China and other countries are not buying our T-bills anymore. (China is at 18% debt to GDP- and they are bailing out our spending, shame on us!) When the rest of the world and China turn off the spigot maybe your nest egg will be worth 25 cents on the dollar or less and you will be saying “what happened?” I know this sounds crazy but what is crazy is $40,000 National debt per person when many are not making a living such as retired, children etc. It is a train wreck that we can avoid but cannot continue as the interest mounts. No entity can spend more than they make.

Lets not be another Argentina, read about their pain They were down to bartering goods, currency was worthless. Lets tell our elected officials we need higher taxes and lower spending! Because voters, nasty as that sounds, the Chinese will not piss away loans that we are reaching the point of not being able to repay, and remember look at the figures, they know more about finance than us…and we could default. Too bad, the dollar could have stayed the world currency but it won’t, we do not have the political will.

The Chinese Yuan will quietly become the international trading currency. Sad, we really had a good country here, and we are blowing it.

What is the most interesting question is who is the whole world in debt to and why should we be in debt to anyone considering that without its people a country produces nothing (except raw materials for those countries which are lucky enough to have them). For the answer see the documentary: “Ring of Power – Empire of the city” I think the website is helpfreetheearth.com but you can watch it on youtube.

It is interesting how the Japanese, as high as their exports are with their technology markets, have such a high debt. Why would their debts be so high if their savings are high at the same time? Perhaps if Japanese citizens concentrate more on repaying their personal debt, they would be in much better standings.

Surely there are methods for people to manage their debt by budgeting their finances. I know websites similar to heaps.co.nz (heaps!) are specifically set up to get people out of their debt (whether student, mortgage, etc.)

wellthe world bank play an important roll in a modern economy but still the functions of is not that much in facor of india. they have to change thair bluddy stratrrgy………

Yeah, that list made a relief… So we in Bulgaria have a very small national debt. That’s good, that’s good… And don’t think you can make our debt higher! I read about a plan two American politicians have made in 1990 about “the economical destroying of Bulgaria”. It consisted of the idea of making people borrow more money that they cannot pay back – in other words, making a huge national debt. If you read the information from some sites (ah, yes, they’re all in Bulgarian), you’ll find out that we, the people in the Balkans, especially Bulgaria, have some kind of special character foreigners describe as “foolishness” or “primitiveness” that, unbelievable as it may be, has saved our identity during the centuries. Saved us from big empires’attacks in the past and, fortunately, from full Americanization now. I can’t predict if the Chinese Yuan will become an international currency or if the Far East will economically conquer the West, but I know one thing. Our peninsula has always been a crossroad between Europe and Asia and neither the USA nor the Asian Tigers can succeed in conquering us. I am 15 years old, a boy living in Sofia, the capital of Bulgaria, and that’s from me.

What is the interest paid by these countries on their national debt….because I feel the net outgoings due to annual interest payments will give a better picture of the situation.

wow, most interesting. I had no idea Japan was s high.

interesting stats but i fear it is not the full story and some countries who look worse off could in fact be out of trouble quicker due to exports and prudent economics.

Ladies and gentlemen. This is crazy. How can the whole world be in debt. Who are they in debt to? What if a country just decides to not pay their debtors. What if the U.S. Says I’m not paying. Come take it if you want it. We have a military and a local populace with guns, so have fun with that. Are we in debt to bankers or to china and who is china in debt to?

I think you may have the wrong idea about ‘debt’. When a bank lends you money, it does it using deposits that people make. The government of individual contries maybe borrowing from bank deposits or it may be selling bonds. bonds are “I’ll pay this sum at a given date”. The “sum” I’ll pay you is the value of the bond now and plus yield (or interest). Banks offer term deposits to those with axcess funds in order to lend that money to others. The term deposit matures at a certain time and it is paid in full plus agreed interest. The bank has a debt with me when accepts my term deposit and uses my funds to do something with it. Banks re-lend it, governments use to pay for service and other projects in the hope that when the bonds are due they will have sufficient funds to pay. The problem arrives when the Government can’t pay because it hasn’t collected enough taxes, and it goes bankrupt. This will have a ripple effect and, depending on how big is the bankrupt. A small country going under (Iceland went down years ago) will have little effect, if a large one goes under (eg the USA) then we are in big, very big trouble with the World economy stalling and dark days ahead ….

everyone is in debt because everything we are living is created by debt. Debt is humanity big joke and we are living in a hole of shit because of this illusion.!!!