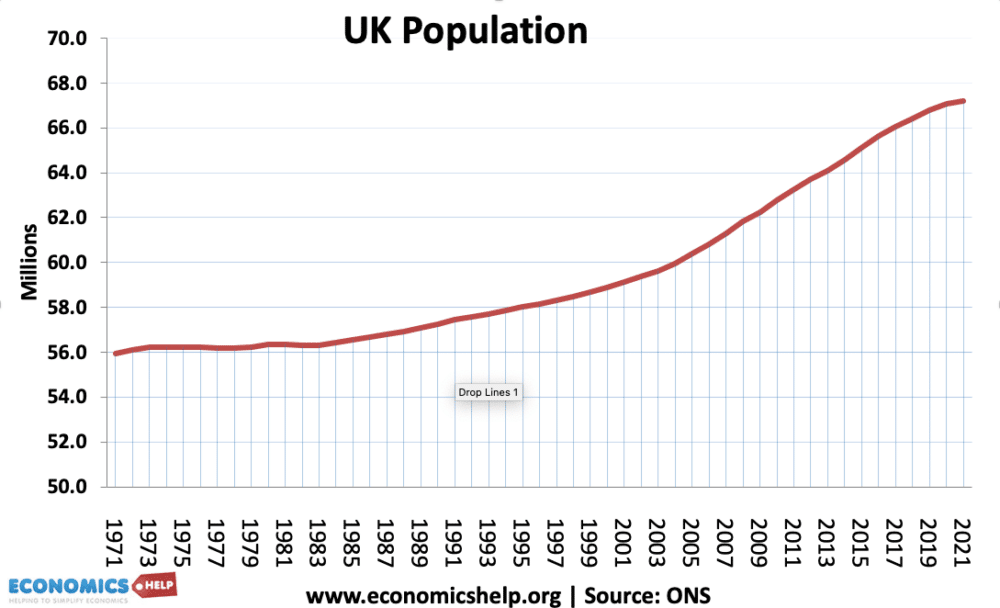

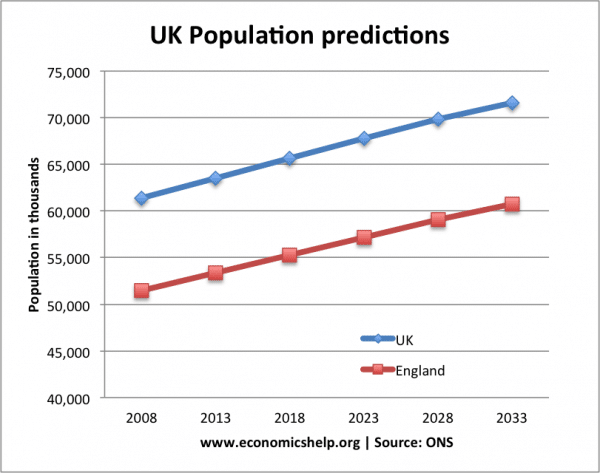

The UK population is projected to increase by 9.7 million over the next 25 years from an estimated 64.6 million in mid-2014 to 74.3 million in mid-2039. (ONS). Approx. 50% of the population increase is expected due to net migration.

This is a look at the economic and social impact of a rise in the population.

The UK is bucking the trend of many Western economies, such as Italy, France and Japan – who are seeing low birth rates, an ageing population and declining populations.

UK population projections at BBC

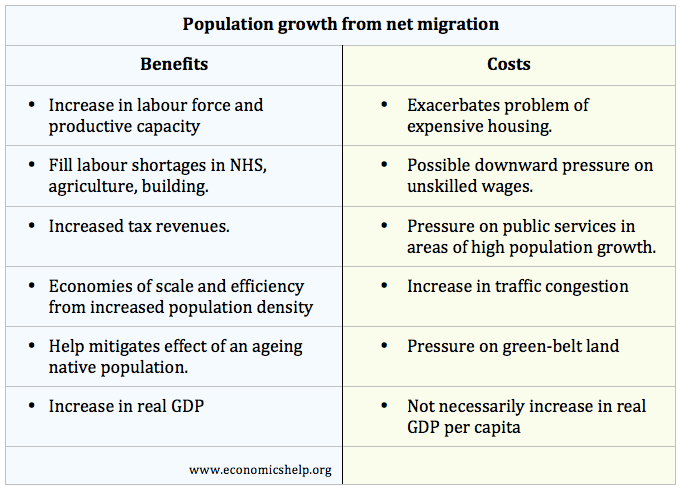

The growth of the UK population raises many issues, some positive and some negative. From an economic perspective, the population growth is generally good news. The growing population will increase the productive capacity of the economy, and help the UK avoid a demographic time bomb through improving tax revenues. However, a growing population will exacerbate existing problems, such as the long-standing housing crisis and a shortage of supply. It will also put pressure on existing infrastructure and the transport network. To deal with the rising population and congestion, we are likely to see increased building on greenbelt land and a change in the UK’s landscape.

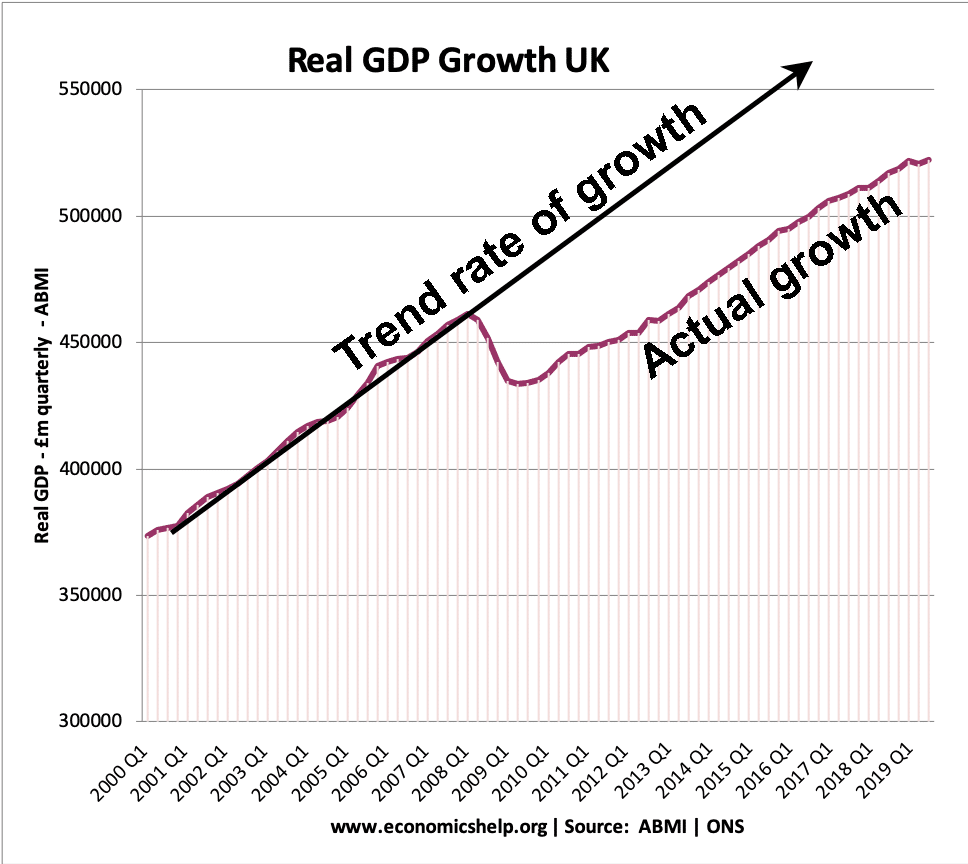

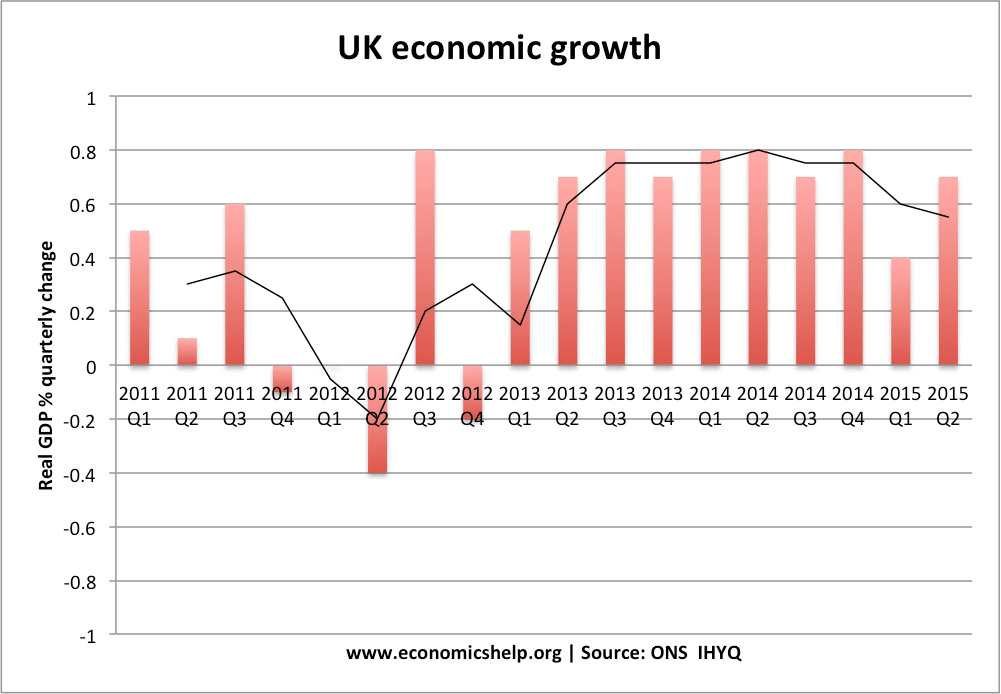

On the one hand, population growth will help the UK economy become one of the largest in the EU, but as a consequence, we will have to deal with increased congestion and increased demand on local infrastructure.

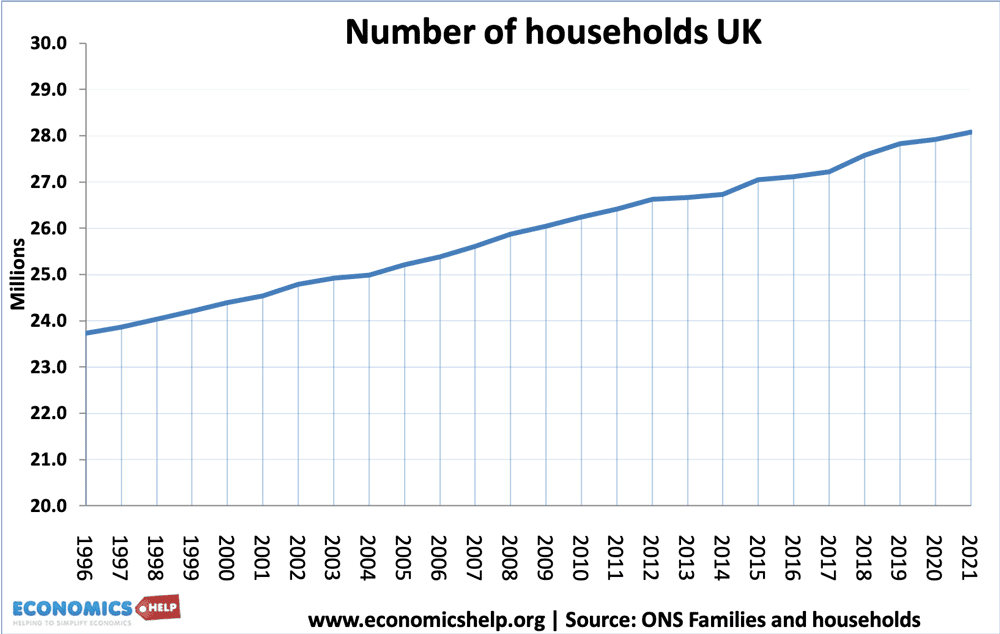

Number of households

The number of households has been rising faster than population. 16% growth since 1996.

Housing

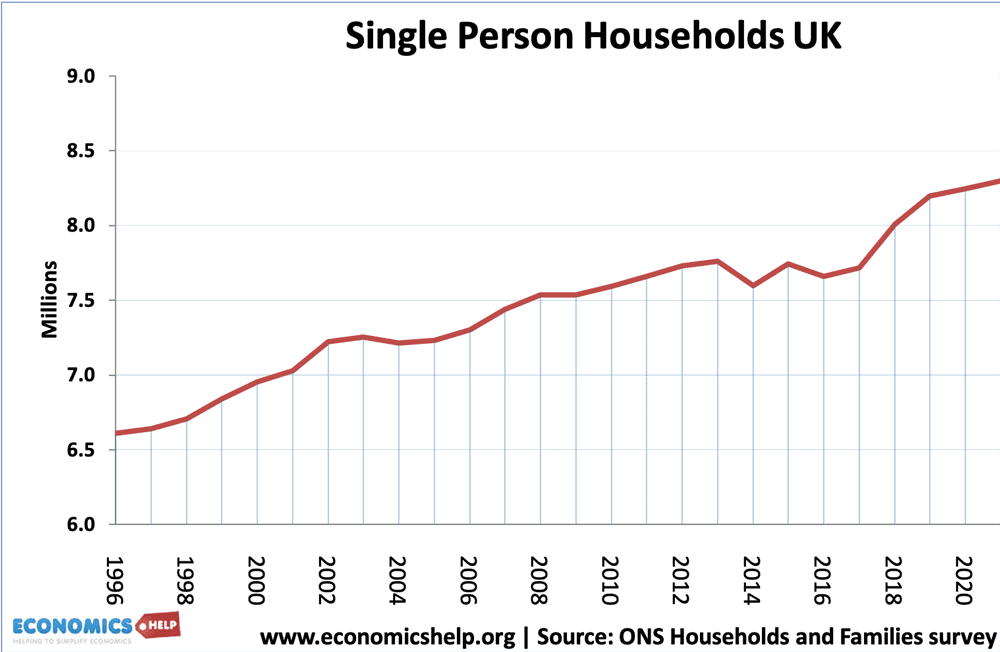

The UK is already struggling to meet existing demand for housing. A rising population will put even more pressure on housing; also, the rise in the number of households is greater than the rise in the population due to the growth of single occupancy households.

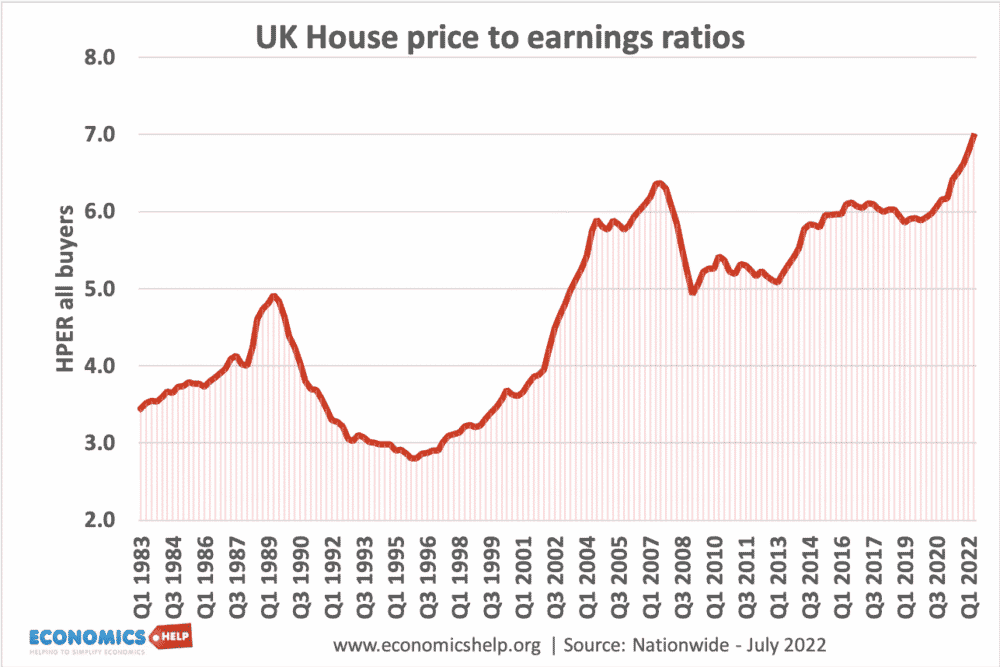

As mentioned in ‘housing crisis’, the UK already has a persistent shortage of housing. Demand is rising faster than our willingness to build. This shortfall is causing an increase in long-term house prices, reducing affordability. If the UK population continues to grow to 71 million plus it will, ceteris paribus put upward pressure on house prices. It will require a dramatic change in housing policy and could require large-scale new towns to catch up with the shortage.

House price to earnings for first time buyers likely to keep rising.

If the supply of housing fails to meet the growth in the number of households, it will increase the cost of living. House prices will rise and the cost of renting will also continue to rise. This is likely to exacerbate the growth in wealth inequality we have seen in the past few years.

Arguably we could deal with the housing shortage if the political will is there. In the 1950s, we built 400,000 new homes a year. But, given the current resistance to even moderate new home building programmes, 300-400,000 new homes a year will be very difficult.

Limiting the impact of an ageing population

Many countries with declining populations are seeing a rise in the percentage of people over retirement age. This puts pressure on government spending (health and pensions) and leads to lower tax revenues (See: impact of an ageing population). The UK population is rising due to net migration and higher birth rates. This means the UK has a higher % of people of working age, who are net contributors to the exchequer (paying income tax, not receiving pensions)

Therefore the growth in the population improves the long-term UK budgetary position, reducing the need for spending cuts and/or tax increases.

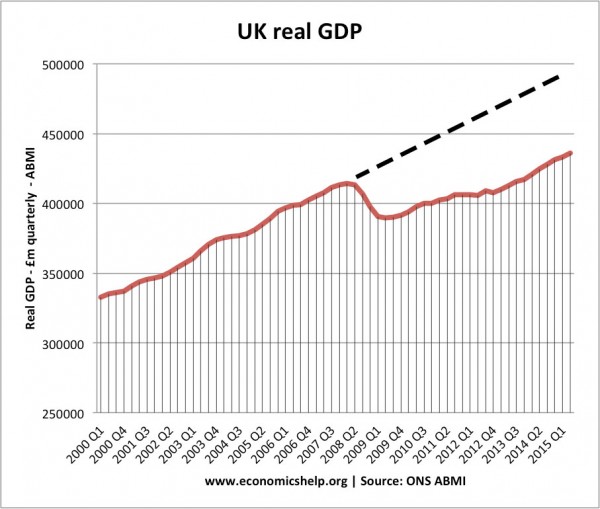

The growth in the working age population also increases the size of the UK labour force, enabling higher productive capacity. This will help increase UK real GDP compared to other countries. (note, GDP per capita – GDP per head may not be affected by a growing population.)

However, by mid-2039, more than 1 in 12 of the population is projected to be aged 80 or over. (ONS)

Increased efficiency of greater population density

Increased population density is more efficient from both an environmental and economic perspective. The highest carbon per capita consumption comes from rural/low population density areas. There are economies of scale in providing transport and infrastructure which helps reduce the per capita impact on both government spending and the environment.

(Report: increased efficiency of higher urban density) (Study: efficiency of public services from higher density)