The UK national debt is the total amount of money the British government owes to the private sector and other purchasers of UK gilts (e.g. Bank of England).

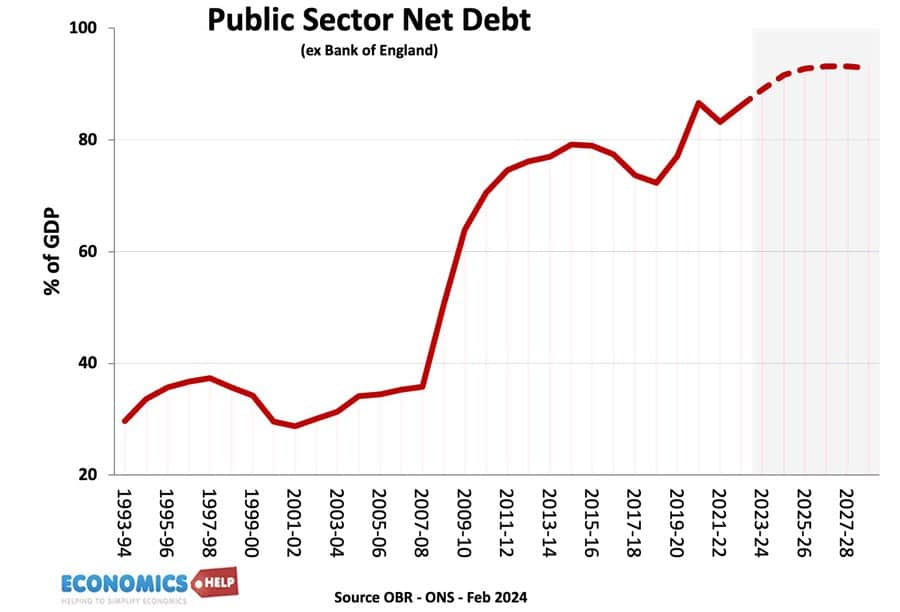

- UK public sector net debt (ex public sector banks) was £2,685.6 billion or 98.1% of GDP (20 Dec 2024).

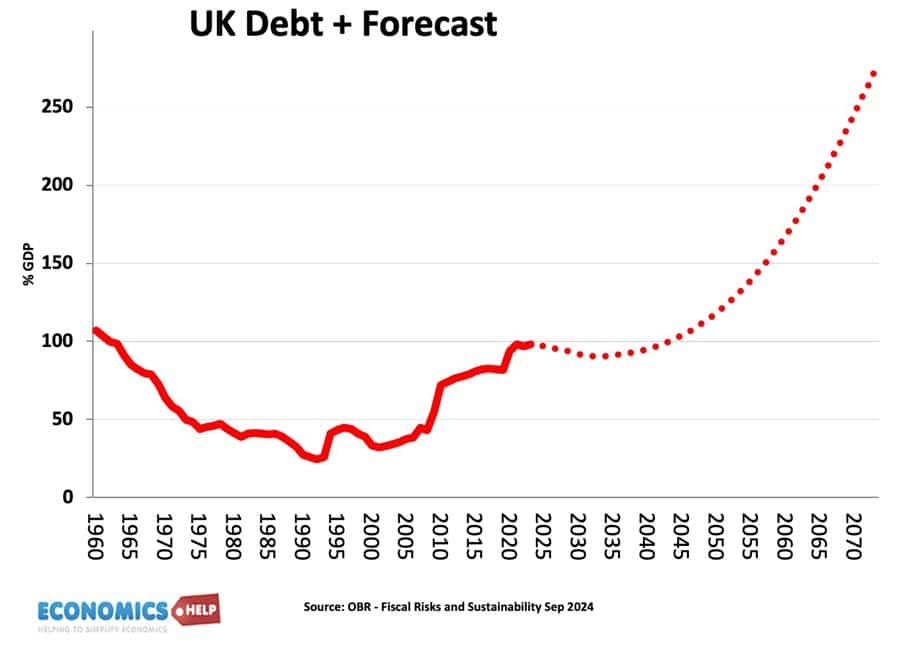

- The OBR have forecast substantial rises in UK debt over the coming decade because of demographic factors, putting strain on UK spending.

- Source: [1. ONS public sector finances,- HF6X] (page updated 20 Jan 2024)

Source: ONS debt as % of GDP – HF6X | PUSF – public sector finances at ONS

Reasons for National debt

- Enables the government to spend more during periods of national crisis, e.g wars, pandemics, and recessions.

- In a recession, the government will automatically receive lower tax revenues (less VAT and income tax) and will have to spend more on benefits (e.g. more unemployment benefits) This causes a cyclical rise in debt.

- Extra government borrowing during a recession can help provide fiscal stimulus to promote economic recovery. By borrowing and then spending more, the government is injecting demand into the economy and this can help to reduce unemployment. This is known as fiscal policy and was advocated by J.M. Keynes.

- Strong market demand for government debt. Private investors buy gilts because they are seen as risk-free investments and there is also an annual dividend from the bond yield. Since 2009, there has been strong demand despite very low-interest rates, meaning the government can borrow very cheaply.

- Finance investment. The government could borrow to finance public investment projects that can lead to higher growth in the future.

- Political convenience. There is usually political pressure to cut taxes and increase government spending. Allowing debt to rise can be a way for the government to avoid difficult choices.

Forecast for the National debt?

Source: Fiscal risks and sustainability – OBR – Economic and Fiscal Outlook Oct 2024

The OBR have forecast that, on our given trajectory, UK public sector debt could reach 350% of GDP within 50 years. The pessimistic outlook for national debt is made because

- An ageing population and demographic changes will put increased pressure on government spending, notably health care and pension spending.

- A smaller working population will limit UK’s productive capacity.

- Stress on finances from geopolitical events, such as frostier relations with China, Russia and the Middle East.

- Higher energy prices

- Costs of climate change.

- Declining tax revenues from petrol in a decarbonising economy.

- Low productivity growth of UK since the financial crash of 2009

- Recent boost to debt from the financial crisis and one-off cost of Coronovirus pandemic, which cut tax revenues and required government support for lockdown measures.

UK debt in context

Predicting debt for the next 50 years is difficult since we don’t know what kind of productivity improvements may come, e.g. continued gains in renewable energy may reduce the burden of higher oil and gas prices. Equally, the costs of environmental change could be worse.

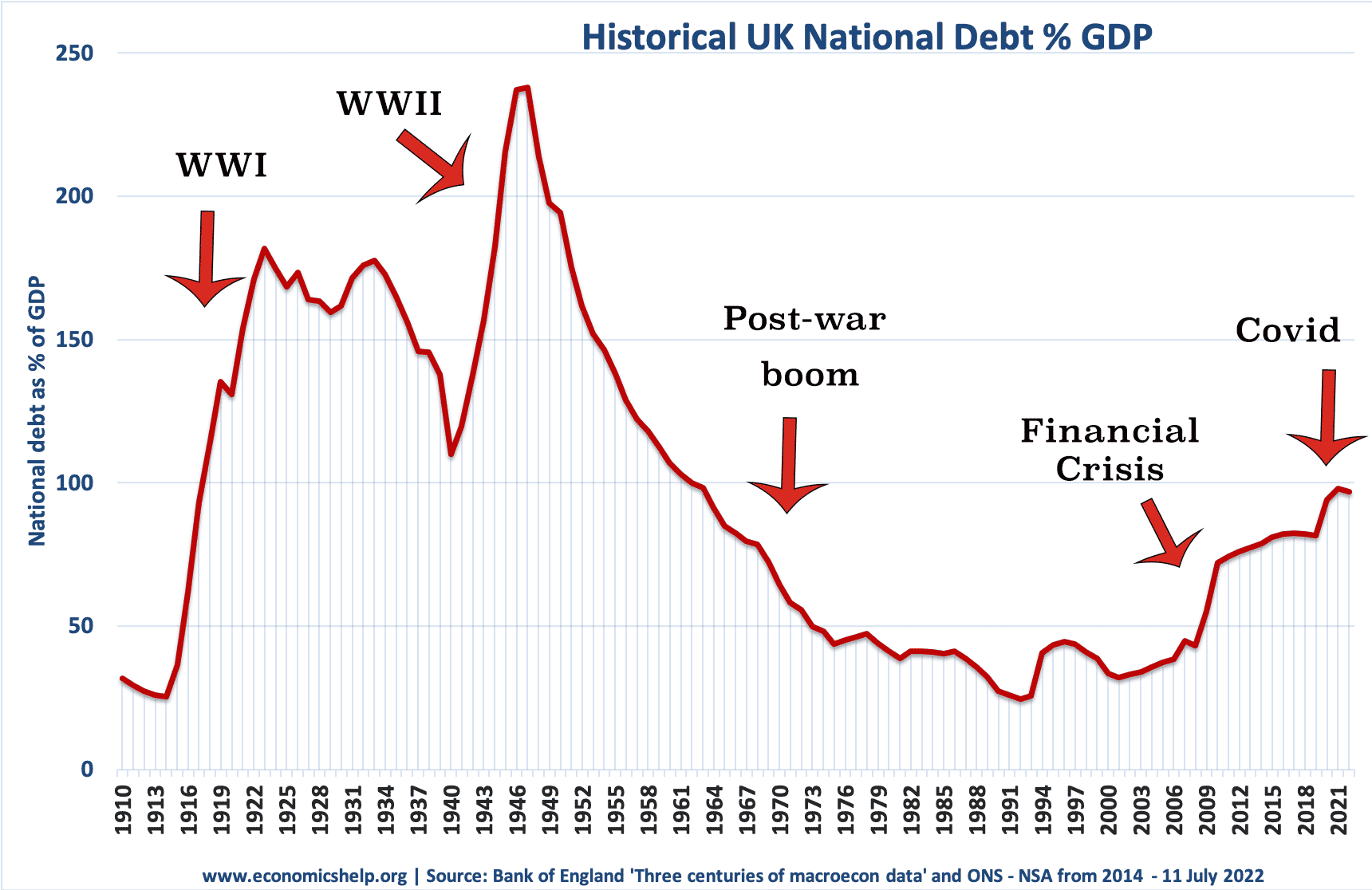

History of the national debt

Main article: History of UK national debt

UK national debt since 1900

Source: Reinhart, Camen M. and Kenneth S. Rogoff, “From Financial Crash to Debt Crisis,” NBER Working Paper 15795, March 2010. and OBR from 2010.

These graphs show that government debt as a % of GDP has been much higher in the past. Notably in the aftermath of the two world wars. This suggests that current UK debt is manageable compared to the early 1950s. (note, even with a national debt of 200% of GDP in the 1950s, UK avoided default and even managed to set up the welfare state and NHS.

Debt reduction and growth

The post-war levels of national debt suggest that high debt levels are not incompatible with rising living standards and high economic growth.

- The reduction in debt as a % of GDP 1950-1980 was primarily due to a prolonged period of economic growth. See: how the UK reduced debt in the post-war period

- This contrasts with the experience of the UK in the 1920s when in the post First World War, the UK adopted austerity policies (and high exchange rate) but failed to reduce debt to GDP. Debt in Post-First World War period.

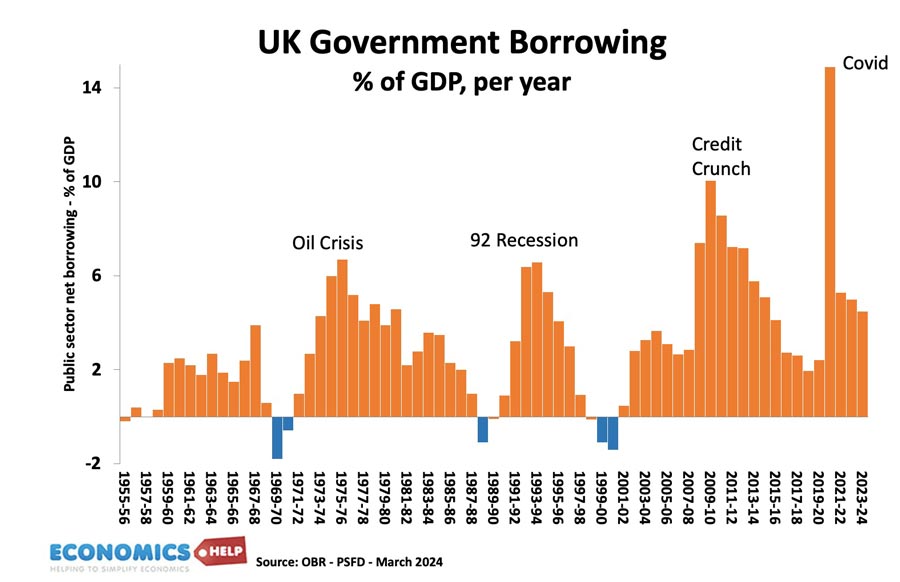

Budget deficit – annual borrowing

This is the amount the government has to borrow per year.

- Government

- borrowing in the financial year to December 2024 was £129.9

Annual borrowing since 1950. Figures for 2023-24 are forecasts (and rather optimistic!)

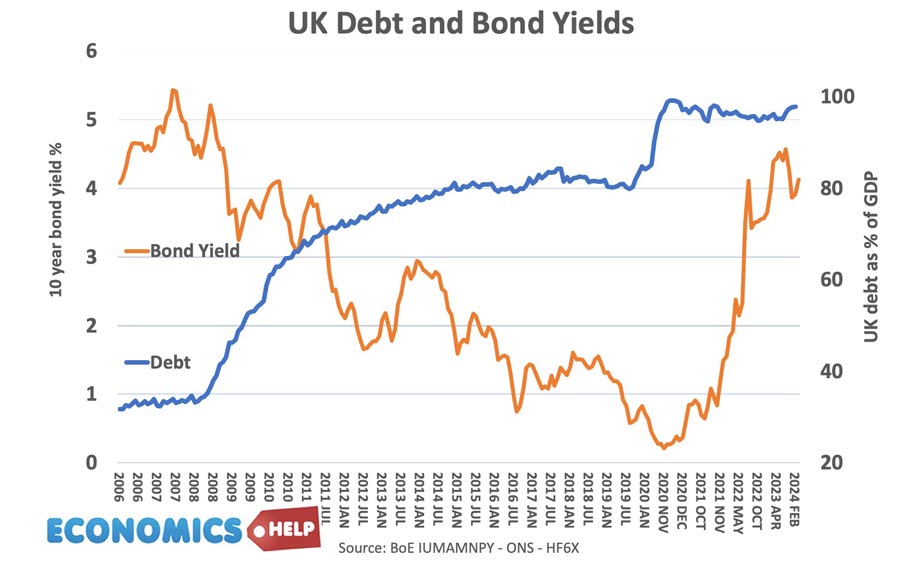

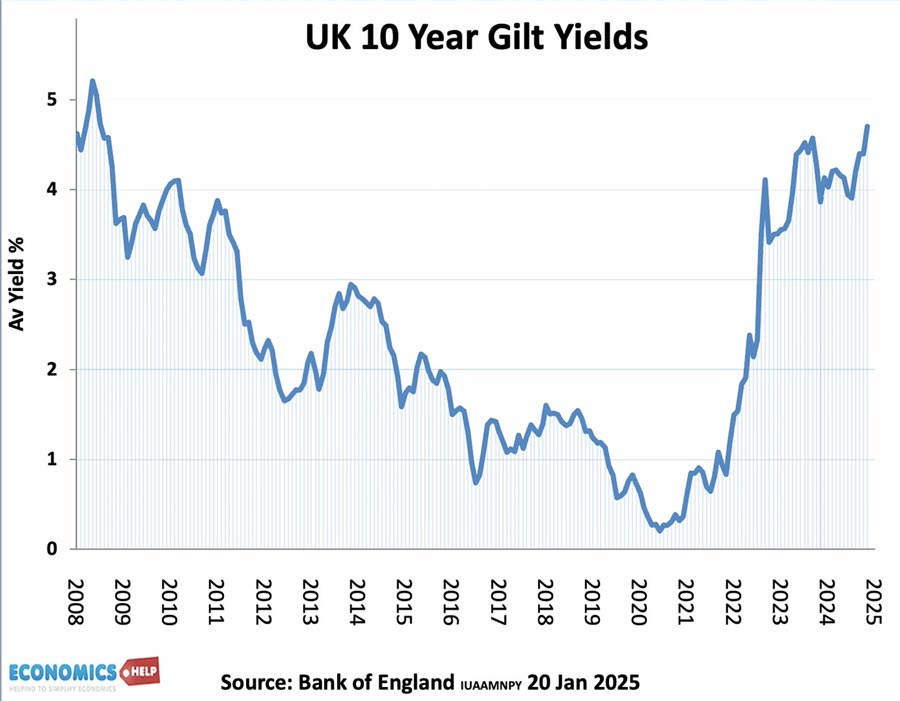

Debt and bond yields

Bond yields a the interest that the government pay bond/gilt holders. It reflects the cost of borrowing for the government. Lower bond yields reduce the cost of government borrowing.

Between 2007 and 2020, UK bond yields fell. Countries in the Eurozone with similar debt levels saw a sharp rise in bond yields putting greater pressure on their government to cut spending quickly. However, being outside the Euro with an independent Central Bank (willing to act as lender of last resort to the government) means markets don’t fear a liquidity crisis in the UK; Euro members who don’t have a Central Bank willing to buy bonds during a liquidity crisis have been more at risk to rising bond yields and fears over government debt.

See also: Bond yields on European debt | (reasons for falling UK bond yields)

Since 2021, bond yields have risen due to pick up in inflation

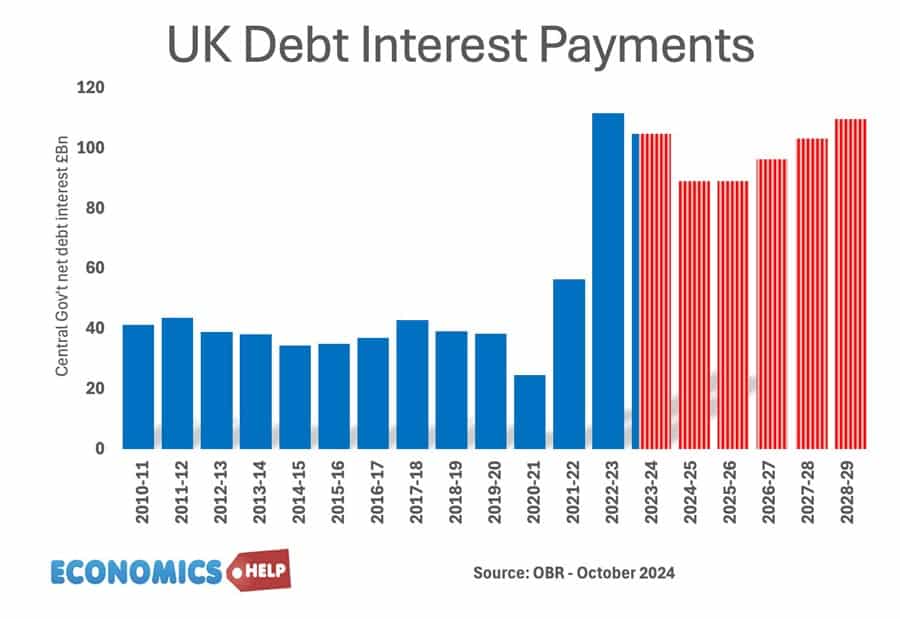

Cost of Interest Payments on National Debt

The cost of National debt is the interest the government has to pay on the bonds and gilts it sells. According to the OBR in 2023-24, debt interest payments will be £108 billion. (3.2% of GDP) or 5.2% of total spending. It is lower than in previous decades because of lower bond yields.

See also: UK Debt interest payments

The era of low interest rates post 1992 helped to reduce UK debt interest payments as a ratio of government revenue. However, with interest rates and borrowing increasing – debt interest cost have increased significantly.

Potential problems of National Debt

- Interest payments. The cost of paying interest on the government’s debt is very high. In 2011 debt interest payments will be £48 billion a year (est 3% of GDP). Public sector debt interest payments will be the 4th highest department after social security, health and education. Debt interest payments could rise close to £70bn given the forecast rise in national debt.

- Higher taxes / lower spending in the future.

- Crowding out of private sector investment/spending.

- The structural deficit will only get worse as an ageing population places greater strain on the UK’s pension liabilities. (demographic time bomb)

- Potential negative impact on the exchange rate (link)

- Potential of rising interest rates as markets become more reluctant to lend to the UK government.

However, government borrowing is not always as bad as people fear.

- Borrowing in a recession helps to offset a rise in private sector saving. Government borrowing helps maintain aggregate demand and prevents a fall in spending.

- In a liquidity trap and zero interest rates, governments can often borrow at very low rates for a long time (e.g. Japan and the UK) This is because people want to save and buy government bonds.

- Austerity measures (e.g. cutting spending and raising taxes) can lead to a decrease in economic growth and cause the deficit to remain the same % of GDP. Austerity measures and the economy | Timing of austerity

Who owns UK Debt?

The majority of UK debt used to be held by the UK private sector, in particular, UK insurance and pension funds. In recent years, the Bank of England has bought gilts taking its holding to 25% of UK public sector debt.

Source: DMO Debt Management Report 2022/23

- Overseas investors own about 28% of UK gilts (2022).

- The Asset Purchase Facility is purchases by the Bank of England as part of quantitive easing. This accounts for 26% of gilt holdings.

Total UK Debt – government + private

- Another way to examine UK debt is to look at both government debt and private debt combined.

- Total UK debt includes household sector debt, business sector debt, financial sector debt and government debt. This is over 500% of GDP. Total UK Debt

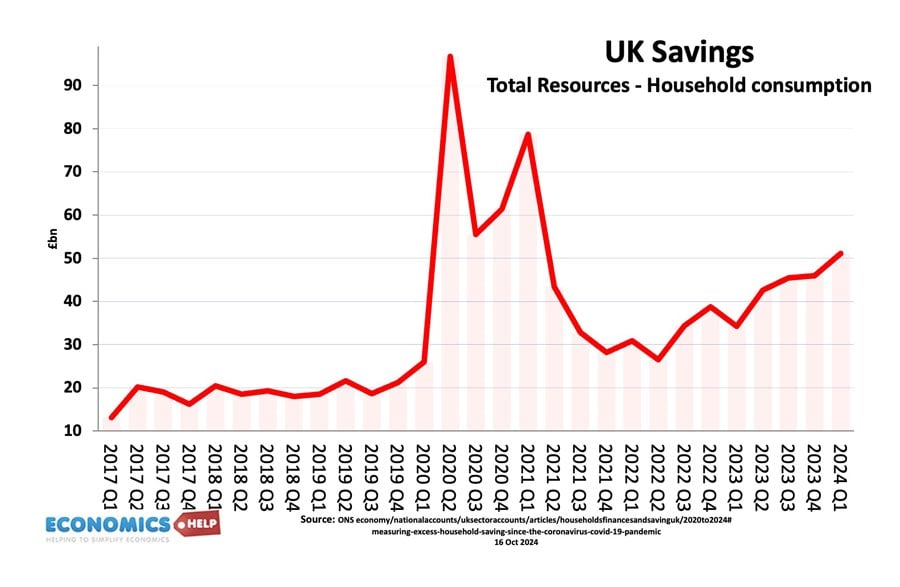

Private sector savings

When considering government borrowing, it is important to place it in context. From 2007 to 2012, we have seen a sharp rise in private sector saving (UK savings ratio). The private sector has been seeking to reduce their debt levels and increase savings (e.g. buying government bonds). This increase in savings led to a sharp fall in private sector spending and investment. The increase in government borrowing is making use of this steep increase in private sector savings and helping to offset the fall in AD. see: Private and public sector borrowing

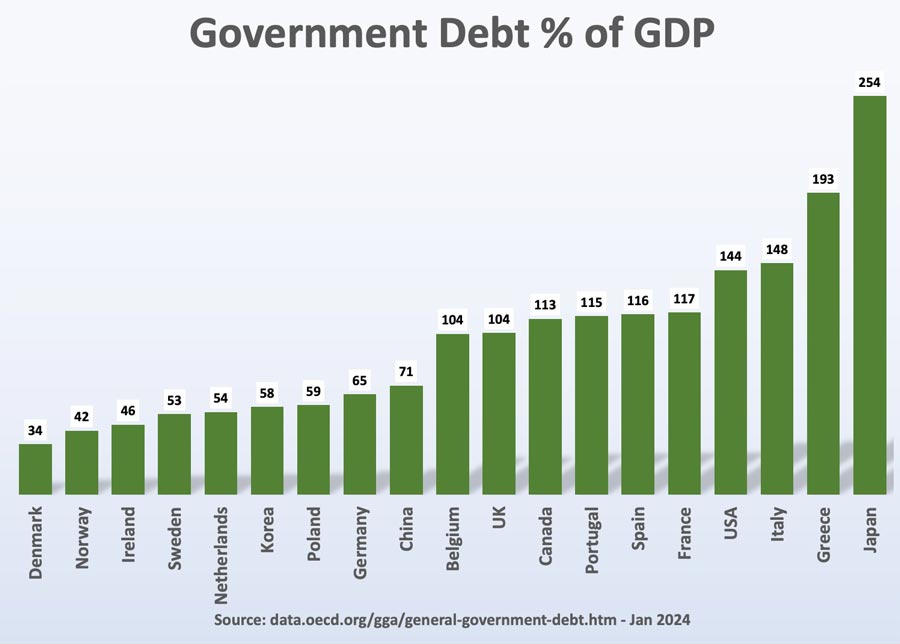

Comparison with other countries

Although 107% of GDP is high by recent UK standards, it is worth bearing in mind that other countries have a much bigger problem. Japan, for example, has a National debt of 256%, Italy is over 157%. The US national debt is over 132% of GDP. [See other countries debt].

How to reduce the debt to GDP ratio?

- Economic expansion which improves tax revenues and reduces spending on benefits like Job Seekers Allowance. The economic slowdown which has occurred since 2010 has pushed the UK into a period of slow economic growth – especially if we consider GDP per capita growth. Therefore the further squeeze on tax revenues has led to deficit-reduction targets being missed.

- Government spending cuts and tax increases (e.g. VAT) which improve public finances and deal with the structural deficit. The difficulty is the extent to which these spending cuts could reduce economic growth and hamper attempts to improve tax revenues. Some economists feel the timing of deficit consolidation is very important, and growth should come before fiscal consolidation.

- See: practical solutions to reducing debt without harming growth

Other countries debt

See also:

I believe that one of the best decisions that the goverment did was invest (buy shares) in the banks. RBS showed a profit of over 10 billion in just under 3 months “amazin” leaving the goverment with over 2 billion pounds profits in shares. thats more than they actully paid for the shares 41% of them in the first place, that should help a little towards the national debt and i believe this might be the future for most goverments to invest in the banking sector.

Just to get a little true perpsective on the debt. Can anyone tell me what the current debt is as a proportion to our total wealth as a nation?

It strikes me that many statistics are banded about to create and maintain an environment of fear so that we all then think there is not alternative to the only cuts agenda being proposed by all the main political parties and all the media. a time to remember ‘The Emporers New Clothes fable, where all but a small boy were conned into believing a lie.

I think that until people decide to stop taking out the loans,credit cards and mortgages that is offered by these banks then we will continue to have boom and bust because they offer it and we take it so the western world is stuck in a vicious circle.

That’s nuts. It’s going to take a while before the UK settles back into a healthy level of debt. The US is in even worse shape though!

Why would in government think it sensible to borrow money from private banks, owned by wealthy individuals, and then load an unbearable(and unrepayable) debt on to the country’s taxpayers.

If a government can print and sell bonds as a means of raising money, surely it is infinitely more sensible to print its own money, with no debt attached, and to release this money into the economy.

Of course, if a particular government tried to spend its way out of trouble by printing ludicrous sums of money the result would be inflation. But then we would all know that the government was solely to blame and could act accordingly, rather than have to utter impotent threats and protests at the unknown and unelected bankers.

Why is the whole issue of private banks holding a country to ransom never mentioned, let alone discussed, in the media.

You need not worry about “boom and bust” and “healthy level of debt” for very much longer. Economic experts in the U.S. are already predicting a total collapse of the world’s currencies. Money will be worthless. The billionairs will be no richer than a man with empty pockets and no wallet. After the collapse, money will not buy anything. Business will stop operating. Governments, infrastructures, schools and hospitals will shut down. Motor fuel will become unavailible. Have you ever watched an Austrialian movie staring Mel Gibson, “Road Wariors”? Watch the movie…It will give you some insight…Human nature being what it is with no means of order…Crime, terrorism and vigilanties out of control. Before it got that bad, this world’s governments will try to usher in a world order account and debit system to replace currency, making money obsolete. When this world system comes into being, AVOID IT LIKE THE PLAUGE! The book of Revelation warns about accepting that system in the last days that you can’t buy and sell without.

It is better to not have a means to buy anything for seven years than to buy yourself a ticket to Hell for eternity. On that Judgement Day, God is not going to listen to, “But I had bills to pay!” or “I needed to buy groceries!” or “Did you expect me to give up my lavish lifestyle?!” The all except lavish lifestyle Hell has to offer will not be worth it. Don’t accept any electronic chip implants either.

Where can I find a list of the organisations and people that are owed this money (the national debt) and details of interest charged.

#113 kathryn asks a vital question. Overall what % interest is the government paying on the national debt and how does that compare with what it pays to its citizens who invest in National Savings & Investments?

Why not encourage more use of NSI ?

I am not an economics student, but am struggling to increase my understanding of economics. Can you help me with an answer to a question on the UK National Debt?

I watched the recent Channel 4 (I think) programme on the National Debt. In this Programme it gave an all inclusive figure of £4.8 Trillion. How can this be squared with the very much lower figures given on your site?

Many thanks (in anticipation)

Les

I’m sure you will not be too surprised to hear that an awful lot of the government’s borrowing is borrowing they would rather we didn’t know about

(Borrowing to give to crooked banks for example)

The true figure is £6.5 trillion which I gleaned from the CIA website (Google CIA – national debts) making us the third biggest debtors in the world – behind the EU and US

(I’m sure they wouldn’t lie – would they?)

solution

64million plus change population

£10 per head a week debt tax

640000000 per week collected

33280000000 per year

This is who we owe money to….

http://www.debtbombshell.com/bond-market.htm

Can someone point me in the right direction for some true accounting for the UK government? I would like to know if the debt cited for the UK government is a “true” debt….does it include the money we have lent to other countries. Does the 459.10 billion dollars we have lent to the USA become part of our debt or our assets? Does anyone have a comprehesive list of the UK’s borrowing and lending? All I can find is what the UK owes rather than what it has lent!! Any help happily recieved!