The UK national debt is the total amount of money the British government owes to the private sector and other purchasers of UK gilts (e.g. Bank of England).

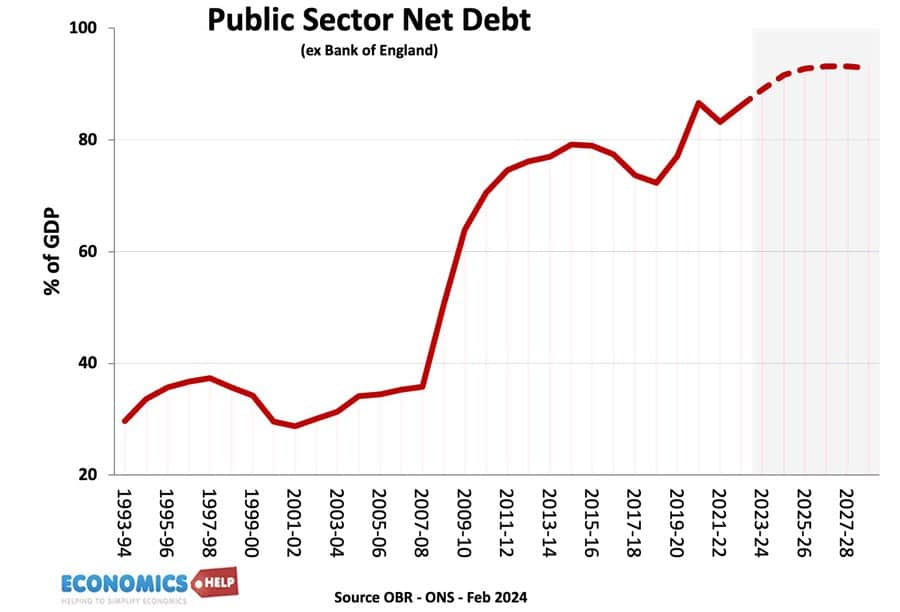

- UK public sector net debt (ex public sector banks) was £2,685.6 billion or 98.1% of GDP (20 Dec 2024).

- The OBR have forecast substantial rises in UK debt over the coming decade because of demographic factors, putting strain on UK spending.

- Source: [1. ONS public sector finances,- HF6X] (page updated 20 Jan 2024)

Source: ONS debt as % of GDP – HF6X | PUSF – public sector finances at ONS

Reasons for National debt

- Enables the government to spend more during periods of national crisis, e.g wars, pandemics, and recessions.

- In a recession, the government will automatically receive lower tax revenues (less VAT and income tax) and will have to spend more on benefits (e.g. more unemployment benefits) This causes a cyclical rise in debt.

- Extra government borrowing during a recession can help provide fiscal stimulus to promote economic recovery. By borrowing and then spending more, the government is injecting demand into the economy and this can help to reduce unemployment. This is known as fiscal policy and was advocated by J.M. Keynes.

- Strong market demand for government debt. Private investors buy gilts because they are seen as risk-free investments and there is also an annual dividend from the bond yield. Since 2009, there has been strong demand despite very low-interest rates, meaning the government can borrow very cheaply.

- Finance investment. The government could borrow to finance public investment projects that can lead to higher growth in the future.

- Political convenience. There is usually political pressure to cut taxes and increase government spending. Allowing debt to rise can be a way for the government to avoid difficult choices.

Forecast for the National debt?

Source: Fiscal risks and sustainability – OBR – Economic and Fiscal Outlook Oct 2024

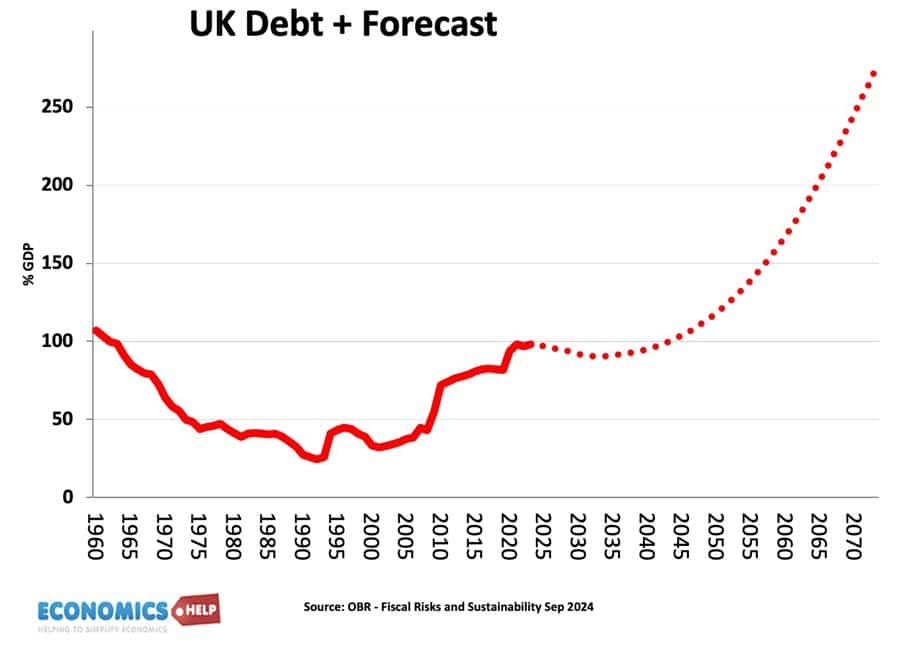

The OBR have forecast that, on our given trajectory, UK public sector debt could reach 350% of GDP within 50 years. The pessimistic outlook for national debt is made because

- An ageing population and demographic changes will put increased pressure on government spending, notably health care and pension spending.

- A smaller working population will limit UK’s productive capacity.

- Stress on finances from geopolitical events, such as frostier relations with China, Russia and the Middle East.

- Higher energy prices

- Costs of climate change.

- Declining tax revenues from petrol in a decarbonising economy.

- Low productivity growth of UK since the financial crash of 2009

- Recent boost to debt from the financial crisis and one-off cost of Coronovirus pandemic, which cut tax revenues and required government support for lockdown measures.

UK debt in context

Predicting debt for the next 50 years is difficult since we don’t know what kind of productivity improvements may come, e.g. continued gains in renewable energy may reduce the burden of higher oil and gas prices. Equally, the costs of environmental change could be worse.

History of the national debt

Main article: History of UK national debt

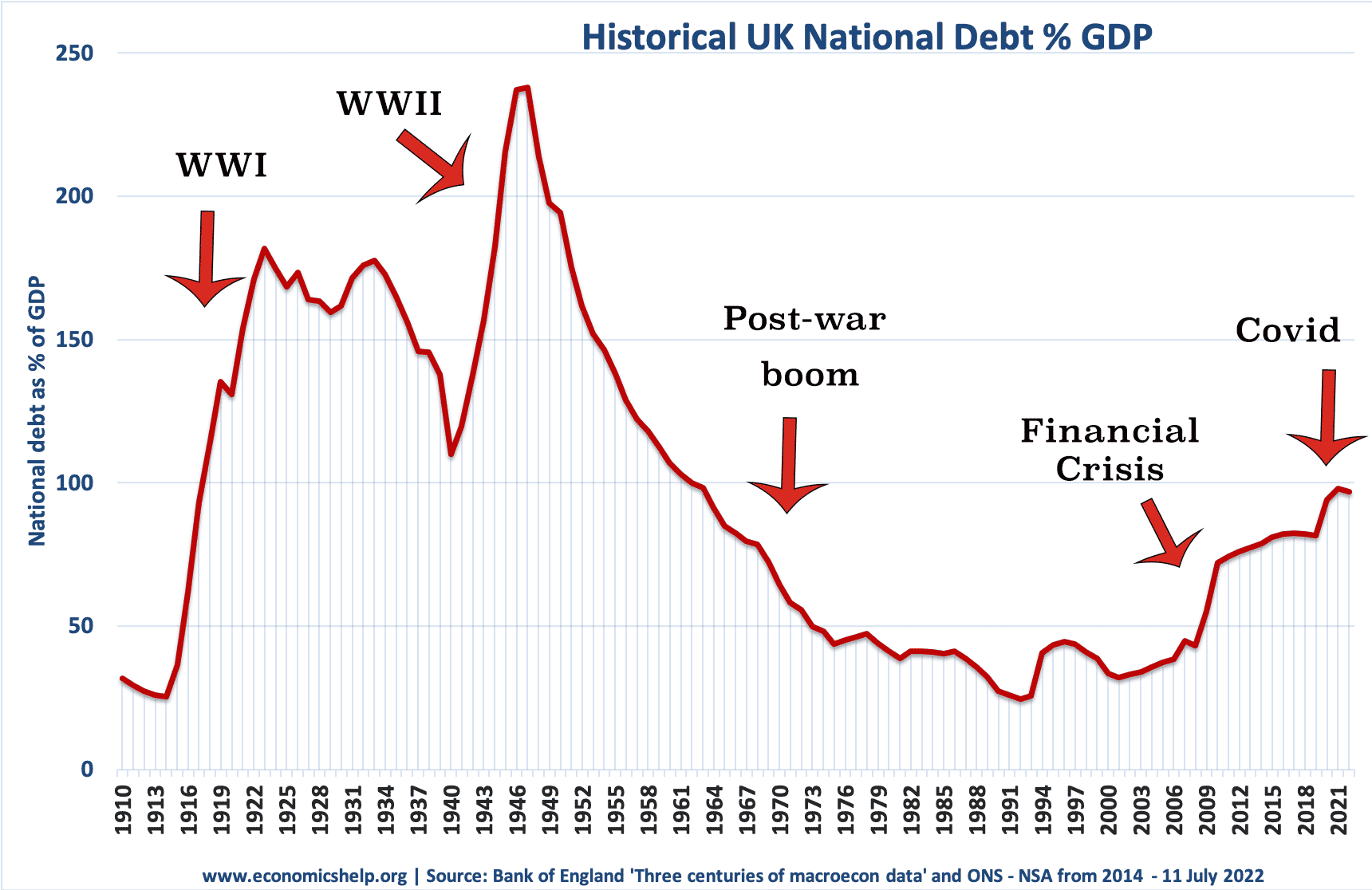

UK national debt since 1900

Source: Reinhart, Camen M. and Kenneth S. Rogoff, “From Financial Crash to Debt Crisis,” NBER Working Paper 15795, March 2010. and OBR from 2010.

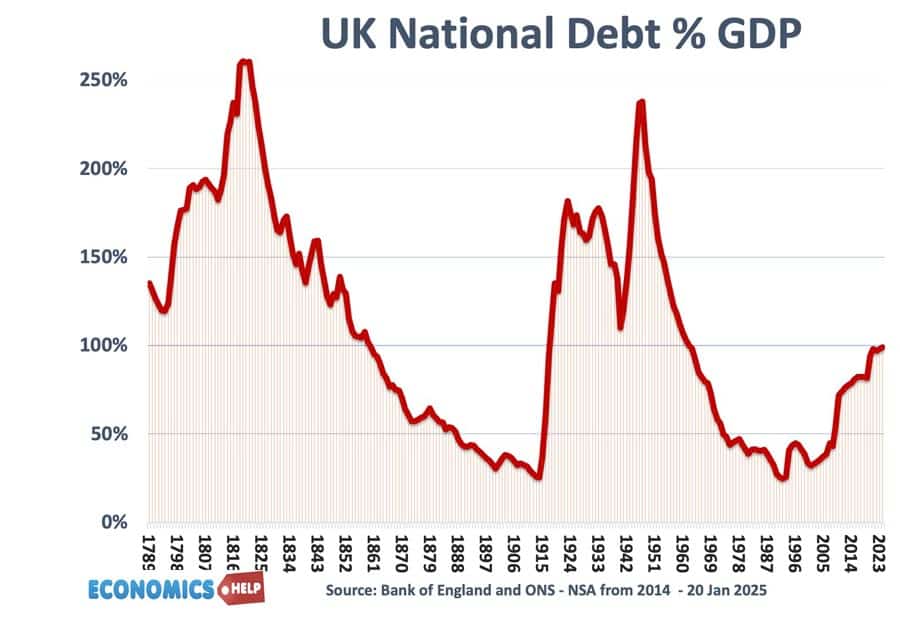

These graphs show that government debt as a % of GDP has been much higher in the past. Notably in the aftermath of the two world wars. This suggests that current UK debt is manageable compared to the early 1950s. (note, even with a national debt of 200% of GDP in the 1950s, UK avoided default and even managed to set up the welfare state and NHS.

Debt reduction and growth

The post-war levels of national debt suggest that high debt levels are not incompatible with rising living standards and high economic growth.

- The reduction in debt as a % of GDP 1950-1980 was primarily due to a prolonged period of economic growth. See: how the UK reduced debt in the post-war period

- This contrasts with the experience of the UK in the 1920s when in the post First World War, the UK adopted austerity policies (and high exchange rate) but failed to reduce debt to GDP. Debt in Post-First World War period.

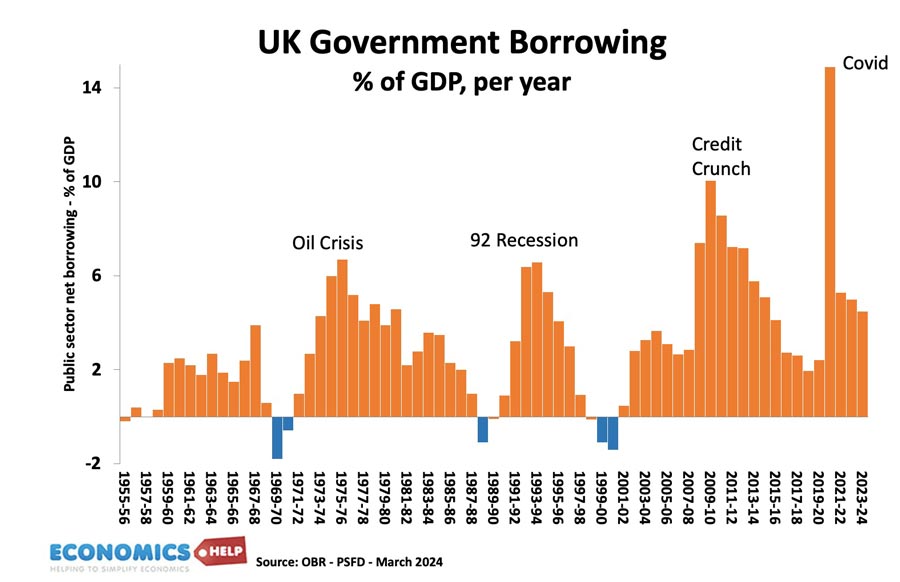

Budget deficit – annual borrowing

This is the amount the government has to borrow per year.

- Government

- borrowing in the financial year to December 2024 was £129.9

Annual borrowing since 1950. Figures for 2023-24 are forecasts (and rather optimistic!)

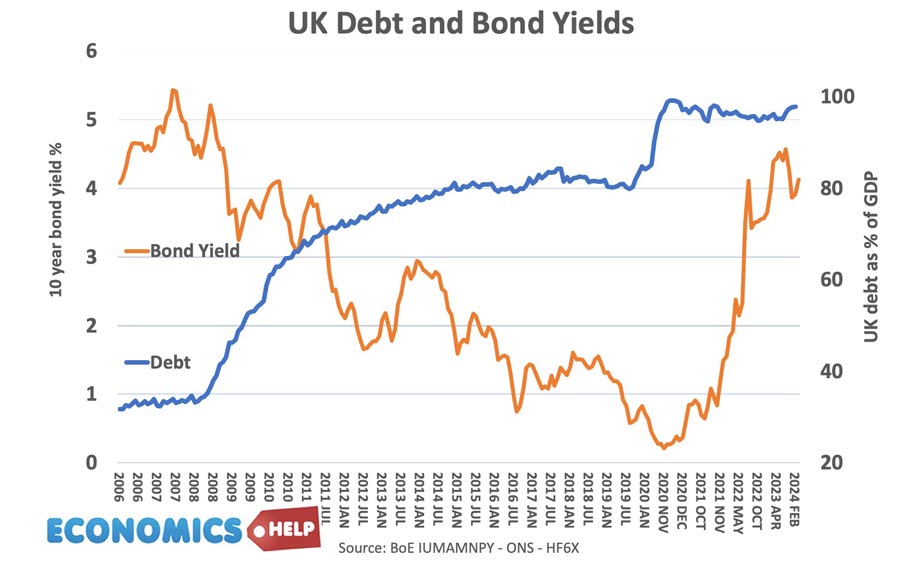

Debt and bond yields

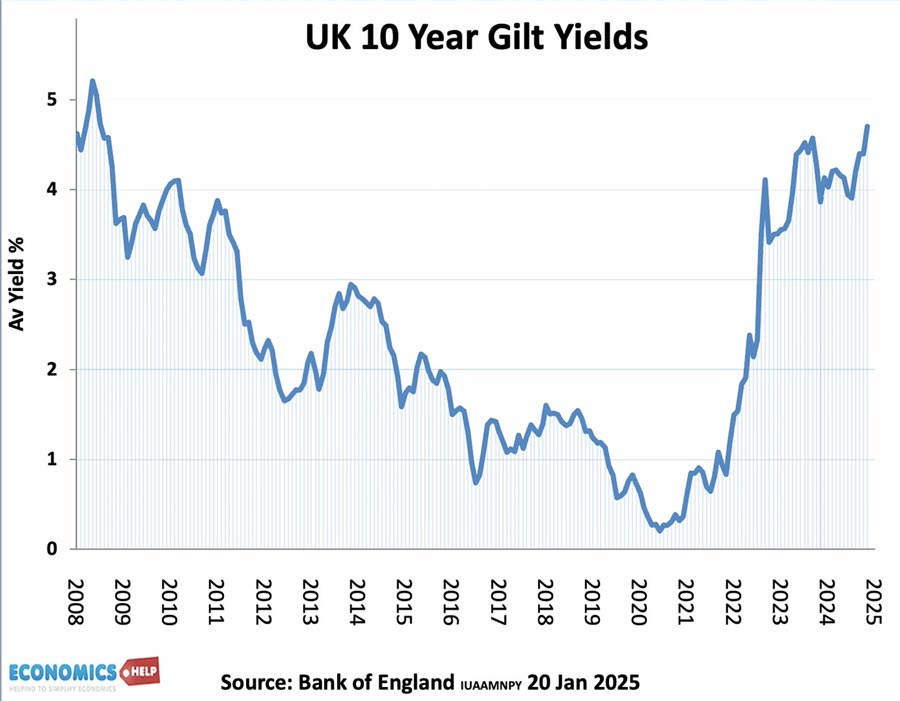

Bond yields a the interest that the government pay bond/gilt holders. It reflects the cost of borrowing for the government. Lower bond yields reduce the cost of government borrowing.

Between 2007 and 2020, UK bond yields fell. Countries in the Eurozone with similar debt levels saw a sharp rise in bond yields putting greater pressure on their government to cut spending quickly. However, being outside the Euro with an independent Central Bank (willing to act as lender of last resort to the government) means markets don’t fear a liquidity crisis in the UK; Euro members who don’t have a Central Bank willing to buy bonds during a liquidity crisis have been more at risk to rising bond yields and fears over government debt.

See also: Bond yields on European debt | (reasons for falling UK bond yields)

Since 2021, bond yields have risen due to pick up in inflation

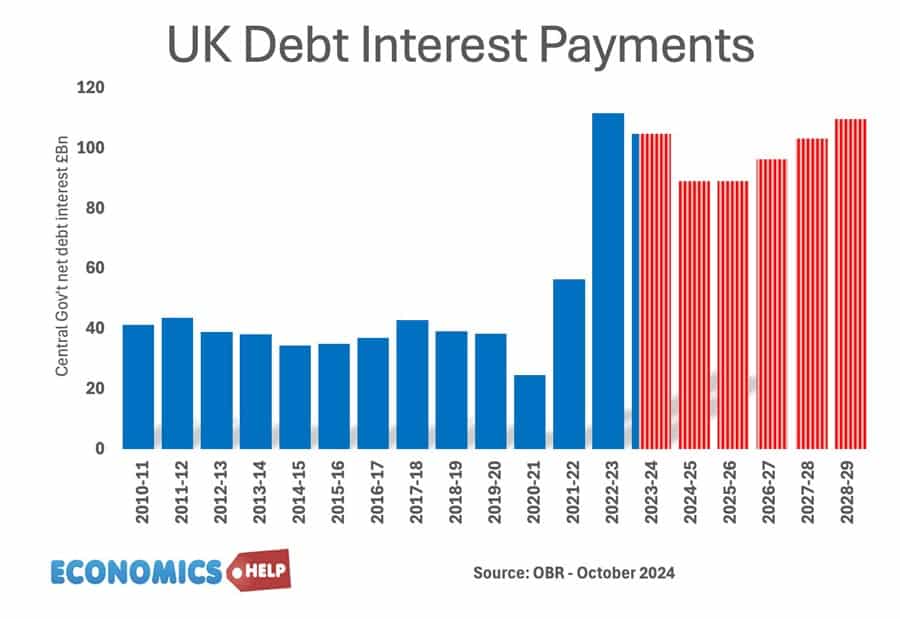

Cost of Interest Payments on National Debt

The cost of National debt is the interest the government has to pay on the bonds and gilts it sells. According to the OBR in 2023-24, debt interest payments will be £108 billion. (3.2% of GDP) or 5.2% of total spending. It is lower than in previous decades because of lower bond yields.

See also: UK Debt interest payments

The era of low interest rates post 1992 helped to reduce UK debt interest payments as a ratio of government revenue. However, with interest rates and borrowing increasing – debt interest cost have increased significantly.

Potential problems of National Debt

- Interest payments. The cost of paying interest on the government’s debt is very high. In 2011 debt interest payments will be £48 billion a year (est 3% of GDP). Public sector debt interest payments will be the 4th highest department after social security, health and education. Debt interest payments could rise close to £70bn given the forecast rise in national debt.

- Higher taxes / lower spending in the future.

- Crowding out of private sector investment/spending.

- The structural deficit will only get worse as an ageing population places greater strain on the UK’s pension liabilities. (demographic time bomb)

- Potential negative impact on the exchange rate (link)

- Potential of rising interest rates as markets become more reluctant to lend to the UK government.

However, government borrowing is not always as bad as people fear.

- Borrowing in a recession helps to offset a rise in private sector saving. Government borrowing helps maintain aggregate demand and prevents a fall in spending.

- In a liquidity trap and zero interest rates, governments can often borrow at very low rates for a long time (e.g. Japan and the UK) This is because people want to save and buy government bonds.

- Austerity measures (e.g. cutting spending and raising taxes) can lead to a decrease in economic growth and cause the deficit to remain the same % of GDP. Austerity measures and the economy | Timing of austerity

Who owns UK Debt?

The majority of UK debt used to be held by the UK private sector, in particular, UK insurance and pension funds. In recent years, the Bank of England has bought gilts taking its holding to 25% of UK public sector debt.

Source: DMO Debt Management Report 2022/23

- Overseas investors own about 28% of UK gilts (2022).

- The Asset Purchase Facility is purchases by the Bank of England as part of quantitive easing. This accounts for 26% of gilt holdings.

Total UK Debt – government + private

- Another way to examine UK debt is to look at both government debt and private debt combined.

- Total UK debt includes household sector debt, business sector debt, financial sector debt and government debt. This is over 500% of GDP. Total UK Debt

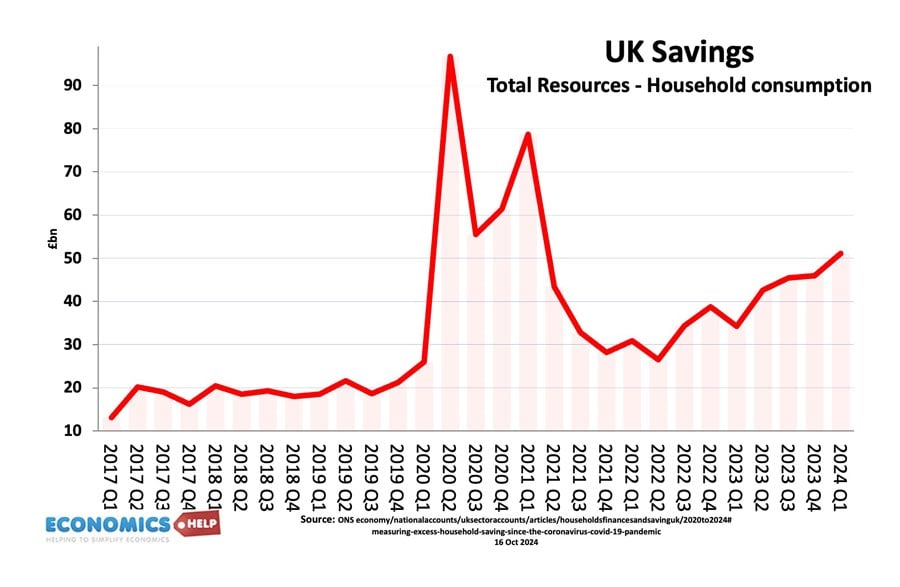

Private sector savings

When considering government borrowing, it is important to place it in context. From 2007 to 2012, we have seen a sharp rise in private sector saving (UK savings ratio). The private sector has been seeking to reduce their debt levels and increase savings (e.g. buying government bonds). This increase in savings led to a sharp fall in private sector spending and investment. The increase in government borrowing is making use of this steep increase in private sector savings and helping to offset the fall in AD. see: Private and public sector borrowing

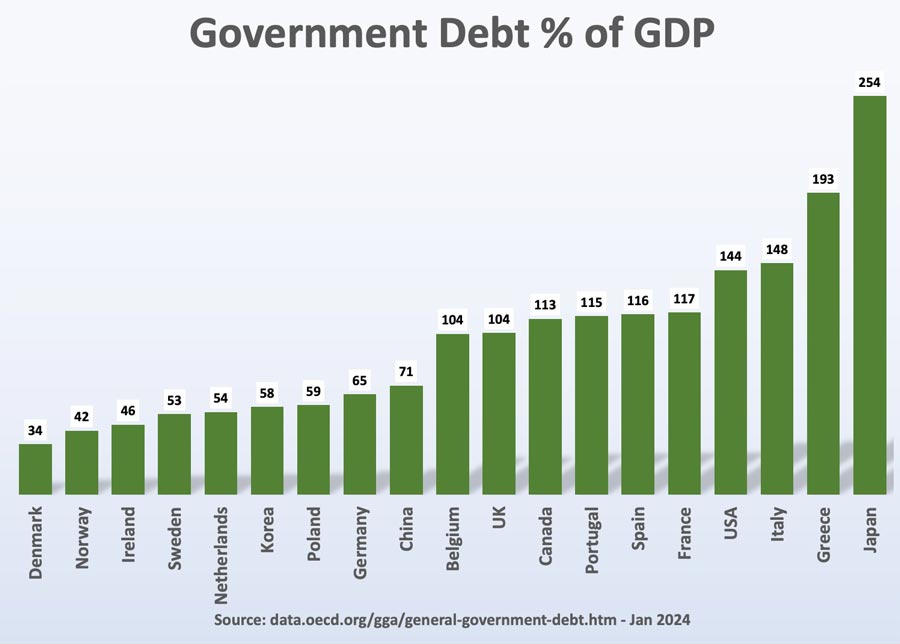

Comparison with other countries

Although 107% of GDP is high by recent UK standards, it is worth bearing in mind that other countries have a much bigger problem. Japan, for example, has a National debt of 256%, Italy is over 157%. The US national debt is over 132% of GDP. [See other countries debt].

How to reduce the debt to GDP ratio?

- Economic expansion which improves tax revenues and reduces spending on benefits like Job Seekers Allowance. The economic slowdown which has occurred since 2010 has pushed the UK into a period of slow economic growth – especially if we consider GDP per capita growth. Therefore the further squeeze on tax revenues has led to deficit-reduction targets being missed.

- Government spending cuts and tax increases (e.g. VAT) which improve public finances and deal with the structural deficit. The difficulty is the extent to which these spending cuts could reduce economic growth and hamper attempts to improve tax revenues. Some economists feel the timing of deficit consolidation is very important, and growth should come before fiscal consolidation.

- See: practical solutions to reducing debt without harming growth

Other countries debt

See also:

Sorry but the people braught this about themselves. We borrow far to much and dont pay back.

4+ trillion is an ONS estimate:

http://www.independent.co.uk/news/uk/politics/britainrsquos-debt-the-untold-story-2025979.html

Why no mention of taking steps to forbid the govenment to borrow huge sums of money from banks thus creating unbearable and unrepayable debt for the tax payer? Under the present system which allows banks to create money out of nothing (fractional reserve banking) governments are irresponsible and cowardly, and banks are greedy and parasitical.

At present there is an independent commission on banking considering ways to avoid banks destroying the country’s economy. It is due to report back in September. Let’s hope it resists the banking lobby and refuses to tinker with the banking system, and , instead, genuinely re-forms the banking system so that it serves the interests of the nation rather than continues to pusue its blinkered and ruthless pursuit of money – and to hell with the rest of us!

Dr. Debt . . . Since 1996. DrDebt.com will keep you debt free !

I run a small business in the private sector and I don’t have an economics background. But can someone please explain to me why the government is now so hell bent on making private sector pay for the mistakes made by the banks and indeed the government itself?

I’ve heard plenty of people say that the reason the banks got into trouble was because they lent too much. I’m sure if anyone reading this runs a small business they will know that the UK’s banks have not been lending in any meaningful way to businesses for years.

So as far as I can see it, the government is using the private sector to fund the ‘Old Boys’ club.

Increasing taxes including VAT is like cutting your head off to cure a headache – have these people no real understanding of the world they so aimlessly blunder through leaving a trail of destruction that wrecks the lives of people who try to make a difference.

If a business in the private sector makes a mistake, it pays for it. However if you run the country and screw things up – you make someone else pick up the cheque.

The problem is that the way in which government is going about making the private sector pick up the cheque will in effect wipe thousands of companies and tens of thousands of jobs off the map.

So when the private sector is bled dry to pay for this mistake, who will the government turn on next?

Would a much more sensible solution to the crisis not be to encourage people to spend money and stimulate the economy. I’m not a rocket scientist, but raising taxes if people can’t afford to pay them is pointless. All it does is simply make the private sector responsible a foul up that was not our responsibility.

Some more positive suggestions for bringing in cash to the Crown could include:

1. Streamlining the public sector in an effective manner and that does not mean reducing the wages of those on the bottom rung. Reduce the wages of MPs. Reduce the amount of expenses these people have access to. Reduce the number of overlapping jobs in the sector and pointless jobs. Make the public sector accountable, we all know as a business structure it’s simply not viable.

2. Look seriously at the numbers of longterm unemployed. Yes many people are truthfully unable to work, but I’m sure anyone reading this will know or have seen plenty of people who just don’t want to work. It’s sad but it is true. There is a generation that has grown up that believes the State owes them a living and in turn it’s the private sector that has to pay the State.

3. The so called investment groups in England, Scotland, Wales and Northern Ireland are such a waste of time. They waste millions every year on so called inward investment and in bringing overseas companies to the UK. I’ve seen these organisations personally waste millions of pounds on projects that have no hope of ever bringing a single job into the country.

From many of the postings I’ve read on this site from people who seem to know a great deal about economics than me, it amazes me that our so called leaders are either so naive or so corrupt that they simply view strangling businesses in the private sector as the most effective way of improving the economy.

I recently spoke with a number of other directors and everyone is saying the same thing. Britain is broke and no one is fixing it.

did you know that the nation debt is 4.5 TRILLION, yes I’ll say it again 4.5 TRILLION.

The bank bail out is drop in the ocean, In comparison to what we owe. Guy Fawkes where are you. We are proper fuc– most just don’t know it yet. when inflation rises and it will, the interest on the debt will rise to. looks like a few more wars are on the card. other wise start learning Mandarin. alternatively we could adopt the Hong Kong system.

Really you have shared very nice information in a brief along with graphical presentation. It will be useful for many students especially those have taken commercial or management studies.

To be honest, it shocks me when I read information on our economy like this – and moreover if the general public were actually aware of the mess we are potentially in then I think we’d have a riot on our hands!

I completely agree, there are some shocking statistics in these comments. How can the government possibly justify borrowing so much money and creating so much national debt. They can not preach about people learning to live within their means and not gathering debt when they can’t even do it themselves. I just don’t understand how the government is going to turn this financial situation around. People should be up in arms but I guess it’s all a little late now that the damage is done. It’s all about damage limitation and cutting services to save as much as possible.

It wont be much longer till every thing hits the fan and the world as we know it will be flipped upside down if were not paying attention so look oup

Hi, I am a novice to economics and after searching the web on the role of the Bank of Englands approach to quantitive easing wonder why the BofE don’t purchase guilts and bonds of the UK government in the same way the provide capital guarantees to Banks who do purchase UK guilts. As I understand, credit rating is the measure of your ability to pay back a debt – and is not based on on who the lender is. Why then can’t the BoE purchase a large proportion of the UK bonds issue and service the bond at the prevailing uk interest rates of 0.5% ? I understand bonds are issued face value and are sold at market rates to include a return deemed acceptable by the markets, why can’t governments sell prospective debt to the Bo E much as markets can sell debt and trade guilts ?Thanks, confused of Manchester