- UK bond yields are the rate of interest received by those holding Government bonds.

- Governments sell bonds (also called gilts) via the Debt Management Office to fund their budget deficits. Bonds are a way for the government to borrow – a bit like the government taking out a loan.

- Government bonds are frequently traded on bond markets. Therefore, their market price may be quite different to the original price set by the government.

Example of why bond yield changes

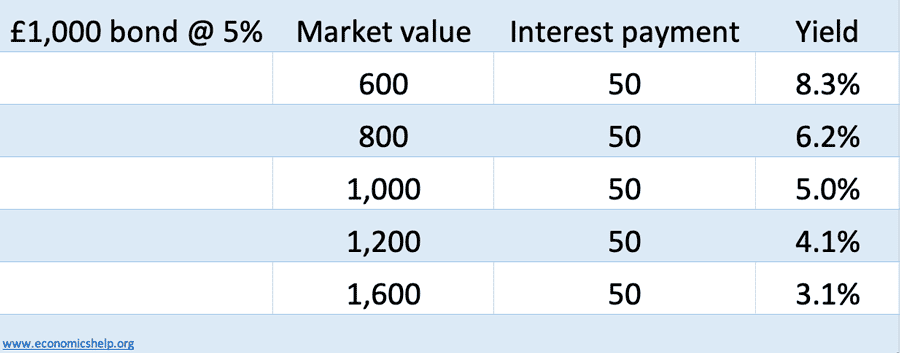

A government may sell a 10-year, £1,000 bond at 5% interest. This means every year the government will pay £50 to the holder of this bond.

- If demand for government bonds rose, this £1,000 bond would increase in price as investors pushed up the market price.

- But, the government still pay £50 a year interest until maturity. If the market price of the bond rises to say £2,000, the interest rate (yield) is now 2.5% (50/2,000)

- Therefore higher demand for bonds leads to lower bond yields.

- Conversely, if people sell bonds, this pushes up the bond yield (e.g. what happened in UK September 2022)

How a change in price of a bond changes the effective yield

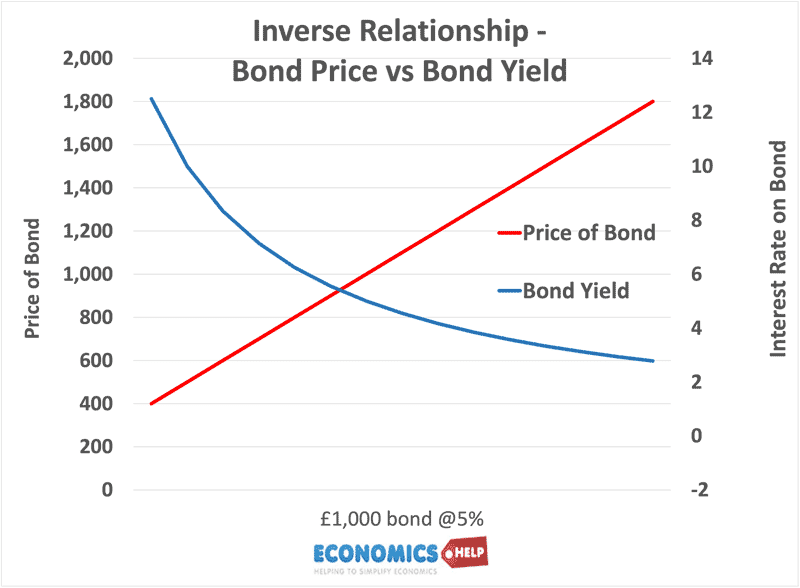

The law of the bond market

- As bond value rises, interest yield falls

- As bond value falls, interest yield rises

Video summary

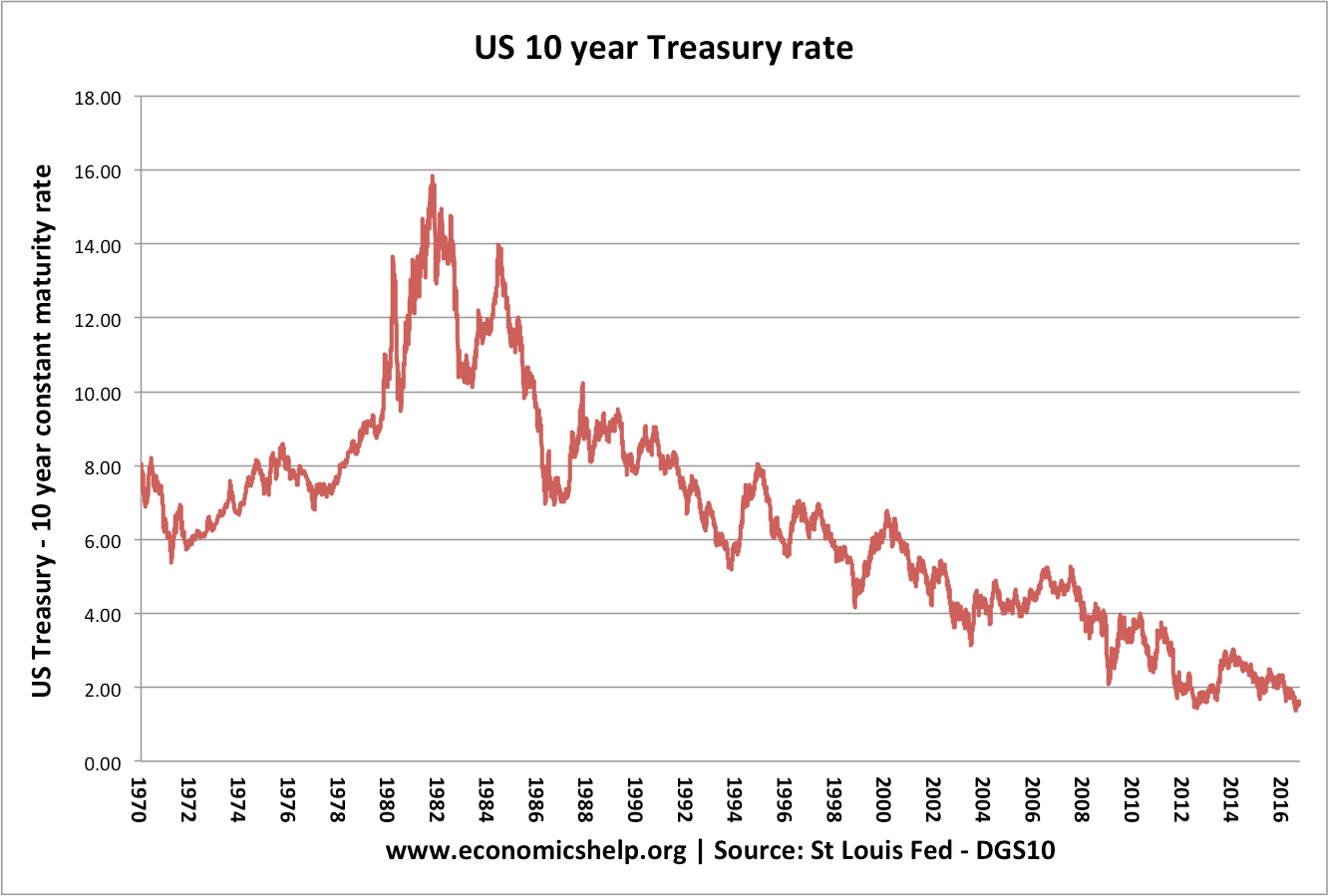

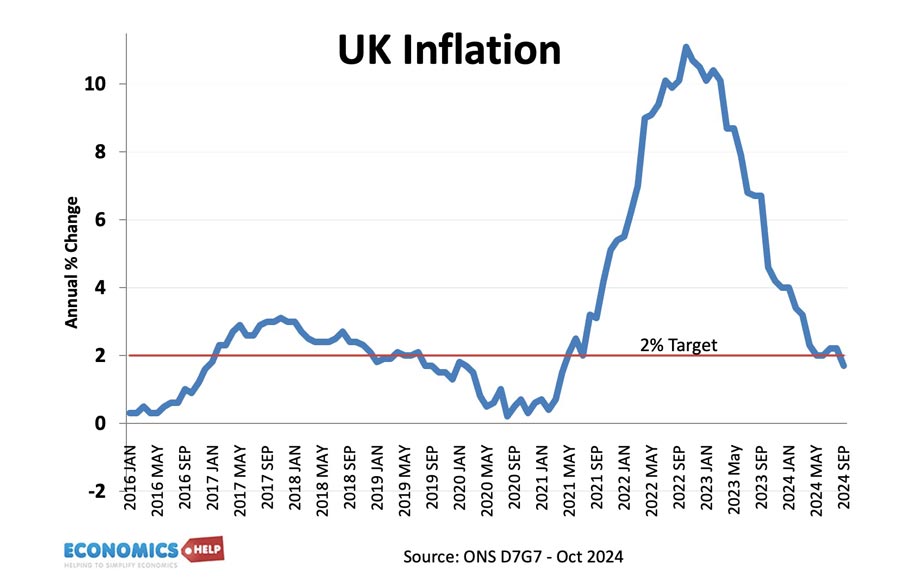

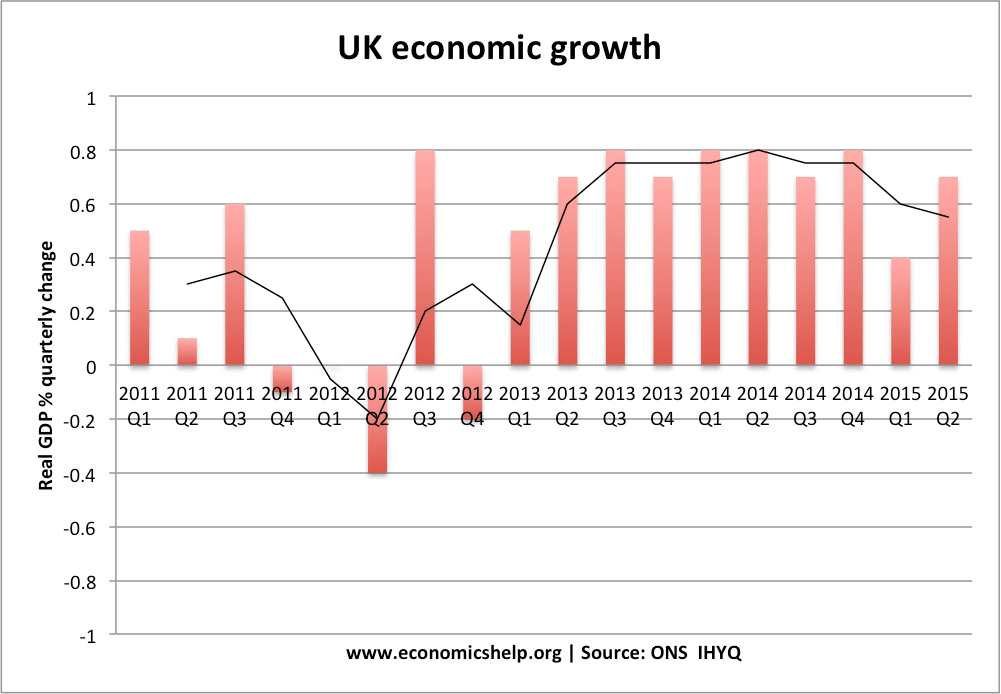

Recent UK Bond Yields

Source: Bank of England – 10-year bond yields